Diversified Gas & Oil Plc has raised funds to acquire EQT entities

Diversified Gas & Oil Plc (DGO) has raised US$250 million through an equity share placing to help fund the acquisition of EQT entities holding certain gas and oil assets for US$575 million.

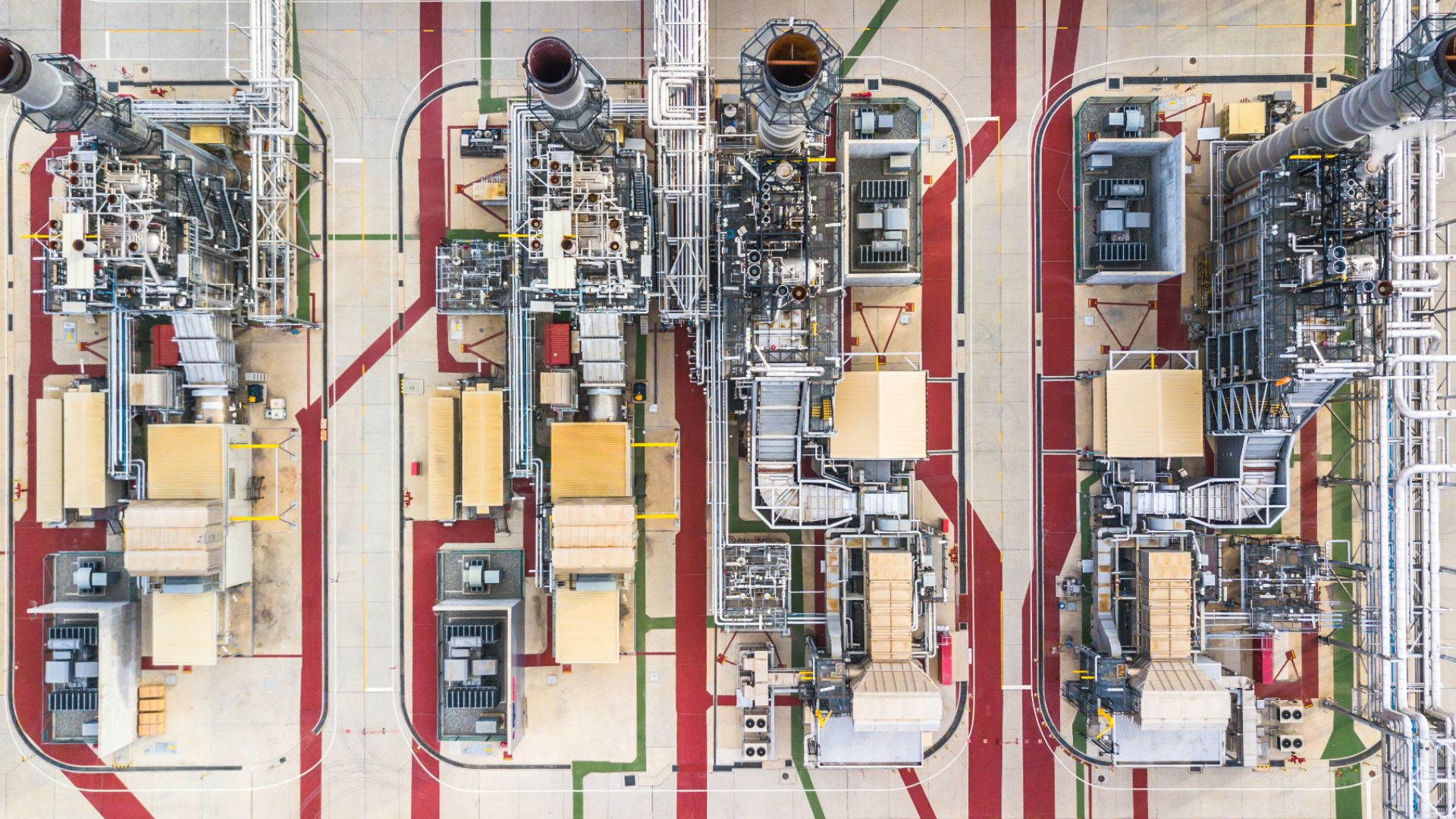

Diversified Gas & Oil is an independent gas and oil producer in the Appalachian Basin in the US.

Oaklins Smith & Williamson, based in the UK, acted as Nominated Advisor (Nomad) to DGO on the acquisitions and the share placing.

Talk to the deal team

Brian Livingston

Oaklins Evelyn Partners

Related deals

Top Systems teams up with Holland Capital to create the premier Dutch battery-based solutions provider

Holland Capital, a Netherlands-based private equity firm, has acquired a stake in Top Systems, a leading provider of complete battery-based power solutions, with a unique value-added services proposition.

Learn moreXeros Technology Group has completed a placing, subscription and retail offer

Xeros Technology Group plc has raised funds to drive forward its commercialization strategy.

Learn moreEVIO has raised funds from Lince Capital for its international expansion

EVIO has secured a second fundraising round lead by Lince Capital, a Portuguese private equity firm, in order to fund its international expansion and reinforce its commercial activity.

Learn more