Holland Capital has sold Quantib to RadNet

Quantib B.V., a portfolio company of Holland Capital, has been sold to RadNet, Inc.

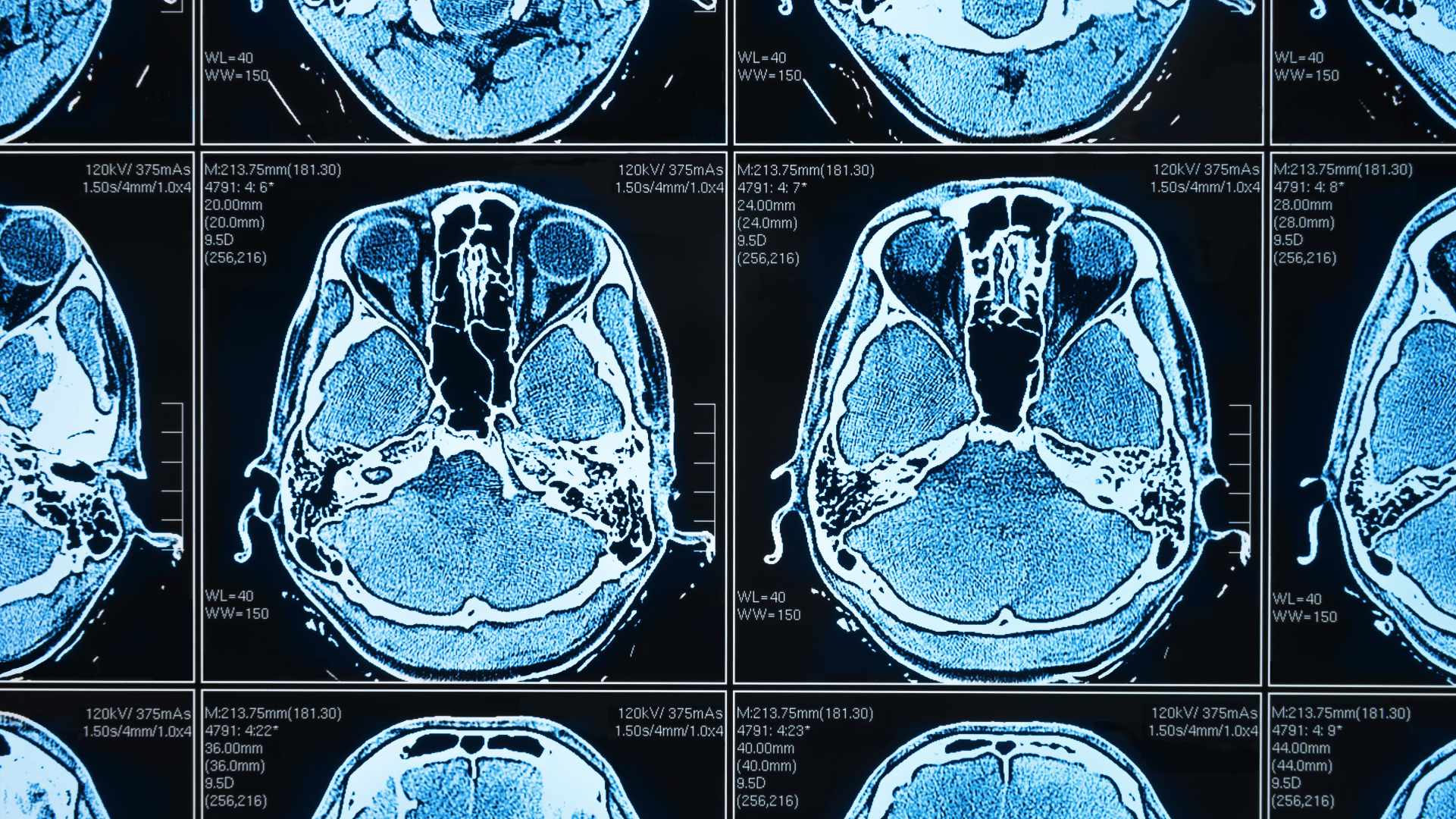

Founded in 2012 and headquartered in the Netherlands, Quantib is a leading radiology artificial intelligence and machine learning company focusing on clinical solutions for prostate cancer and neurodegeneration.

RadNet is a national leader in providing high-quality, cost-effective, fixed-site outpatient diagnostic imaging services through a network of 350 owned and operated outpatient imaging centers in the USA.

Holland Capital is one of the first independent private equity firms in the Netherlands. Since 1981, they have been successfully and responsibly investing in promising small and medium-sized Dutch businesses with growth ambitions. With a clear investment strategy, they anticipate long-term trends in attractive growth markets, focusing on the healthcare and technology sectors. Their experienced and dedicated investment team knows what entrepreneurship is.

One of Oaklins’ teams in the USA served as the exclusive financial advisor to Quantib B.V.

Talk to the deal team

James McLaren

Oaklins TM Capital

Michael S. Goldman

Oaklins TM Capital

Michael L. Bauman

Oaklins TM Capital

Harrison P. Boeschenstein

Oaklins TM Capital

Related deals

Thrive Freeze Dry has successfully sealed the acquisition deal with Paradiesfrucht GmbH

Paradiesfrucht GmbH, a gobal freeze dryer of fruits, fruit preparations, drops, powders and granulates, has been acquired by Thrive Freeze Dry (Thrive), a portfolio company of Entrepreneurial Equity Partners (e2p) and Mubadala Capital. The transaction is expected to close in 2024, subject to customary closing conditions, including antitrust approval.

Learn morePerkbox has been acquired by Great Hill Partners

Molten Ventures has sold Perkbox to Great Hill Partners.

Learn moreArculus Cyber Security has been acquired by Bridewell

The shareholders of Arculus Cyber Security (Arculus) have sold the business to Bridewell. The deal will bolster Bridewell’s growing roster of accreditations as well as strengthen its public sector footprint, enabling the expansion of its end-to-end cyber security offering for clients across the globe.

Learn more