IHC Vremac Cylinders has been acquired by VAPO

Royal IHC, a supplier of equipment, vessels and services for the offshore, dredging and wet mining markets, has sold IHC Vremac Cylinders to VAPO.

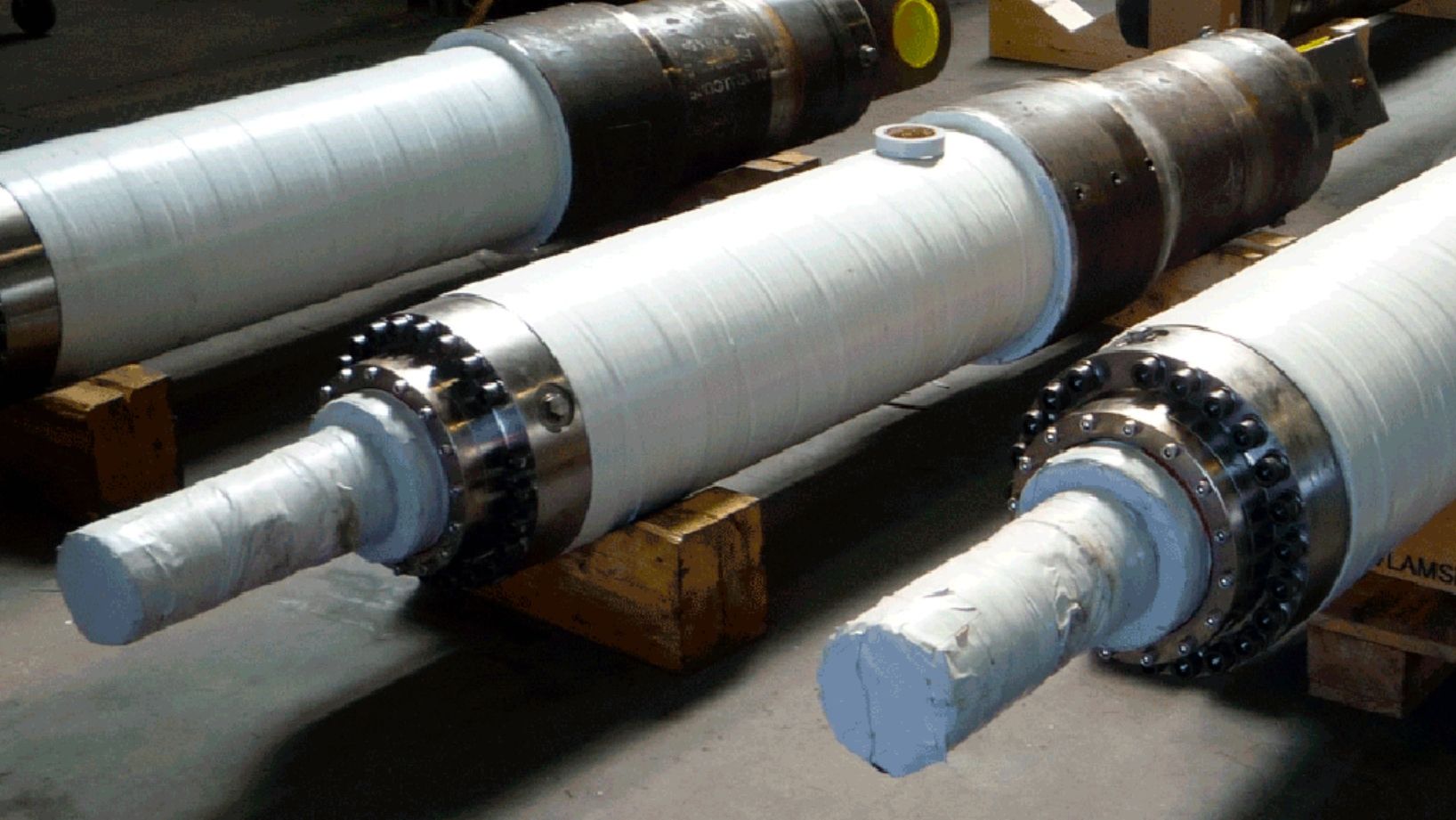

IHC Vremac Cylinders (Vremac) is a designer and manufacturer of top quality customized and project-engineered hydraulic cylinders, accumulators and swivels for all applications in the dredging and offshore, civil engineering, transport and loading, and heavy-duty machinery industries. Vremac has a strong global client base in multiple end markets. Renowned customers include Caterpillar, Mammoet, SPIE, Huisman and Boskalis. Vremac operates from a custom-build facility in Apeldoorn that was opened in 2017 and employs 90 full-time employees.

VAPO is a Belgian designer and manufacturer of hydraulic cylinders, hydraulic systems and components. VAPO is backed by Belgian private equity firm Vybros, a hands-on firm focused on small- and medium-sized companies.

Oaklins' teams in the Netherlands and Belgium advised the sellers in this transaction.

Dave Vander Heyde

CEO, Royal IHC

Talk to the deal team

Related deals

Royal Reesink has sold Motrac Industries to Anders Invest

Royal Reesink and Anders Invest have completed the sale of Motrac Industries, a specialist in hydraulic and electrical engineering.

Learn moreÑaming, SL has been acquired by DeA Capital S.p.A.

Spain’s leading producer of sandwiches, fresh and ultra-fresh products, Ñaming, has sold a majority stake to Italian fund DeA Capital.

Learn moreUniKidz has partnered with Karmijn Kapitaal

Karmijn Kapitaal has acquired a majority stake in UniKidz, a talent development organization that provides a scientifically-based developmental approach through high-quality childcare. Through the partnership with Karmijn Kapitaal, UniKidz can take the next step in bringing their unique concept to even more children.

Learn more