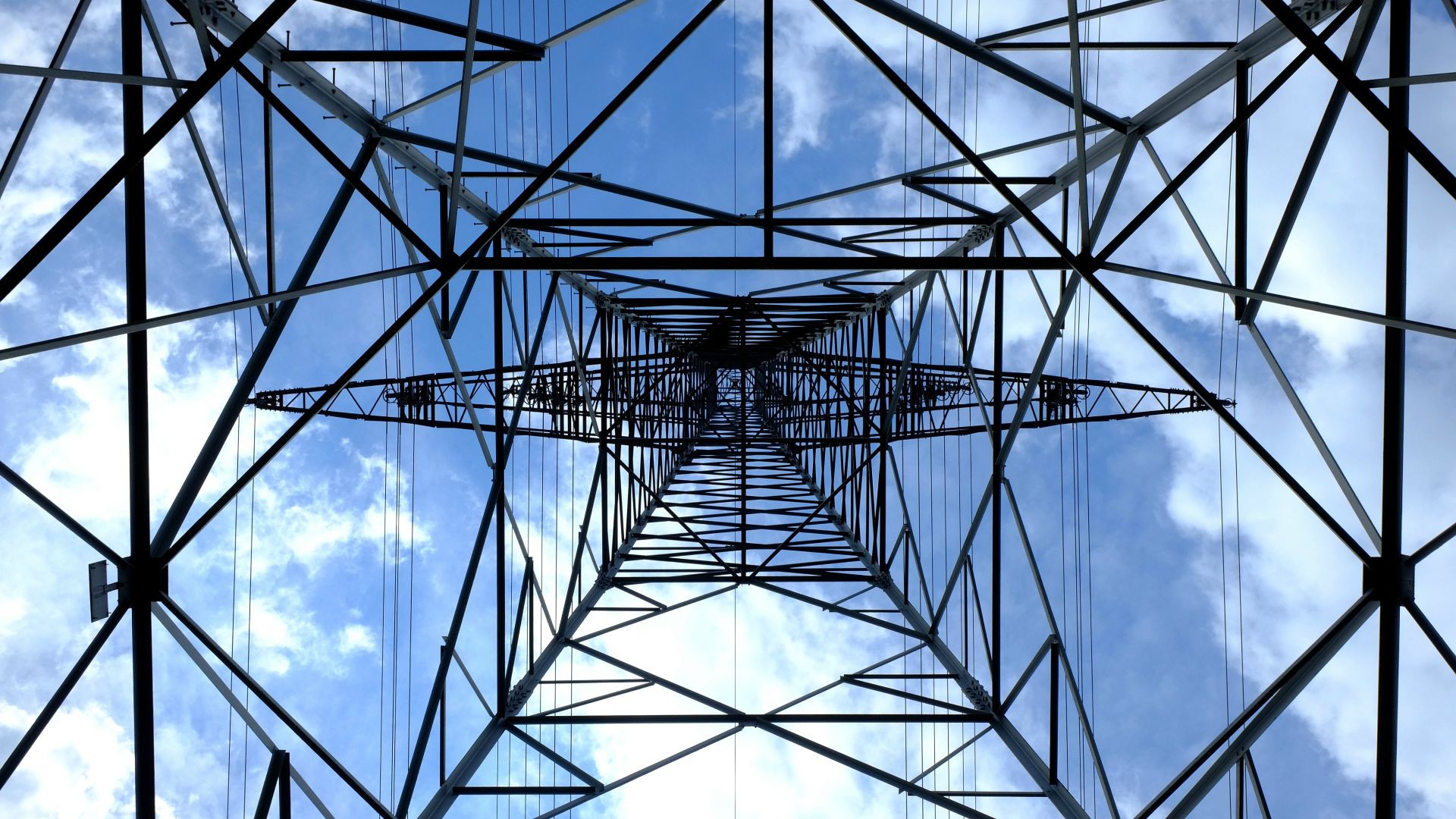

Les Industries JPB has raised both equity and debt to build a cogeneration power plant

Les Industries JPB has raised both equity and debt to build a new power plant.

Founded in 2000, Les Industries JPB specializes in the reclamation and transformation of treated timber discarded by power distribution, telephone, highway transportation and railway companies. The firm processes this wood into quality lumber and non-standard poles, among other things, and converts the production waste into wood chips or biomass for subsequent use as an energy source by cement factories and paper mills.

Oaklins' team in Canada advised Les Industries JPB on the minority sale of the equity as well as on the debt financing plan.

Talk to the deal team

Related deals

Presight Solutions has been acquired by Banyan Software

Banyan Software, a leading acquiror and operator of mission-critical software businesses, has entered Norway with the acquisition of Presight Solutions AS, a SaaS company delivering advanced software for safety, operational integrity and regulatory compliance in high-risk industries. The transaction marks a new chapter for Presight, strengthening its ability to scale while preserving the product focus, sector expertise and customer trust built since its founding in 2003.

Learn moreStrawberry Equities has sold Ecohz to Caely Renewables

Ecohz, a global renewable energy company, has been acquired by environmental commodity trading house Caely Renewables from Strawberry Equities. The transaction marks an important new chapter for Ecohz and brings together two organizations with complementary strengths, aligned in their commitment to accelerating the global energy transition.

Learn moreSwiss Solar Group has acquired OmniWatt and taken a significant minority stake in enshift

Swiss Solar Group AG has acquired OmniWatt AG and taken a significant minority stake in enshift AG. With these transactions, Swiss Solar Group advances its strategic growth initiative and pursues its objective of positioning itself as a leading integrated provider of sustainable energy transition solutions in Switzerland. The transactions support the group’s strategy to expand its presence across the entire energy value chain and to achieve profitable growth in the renewable energy sector.

Learn more