Doosan Skoda Power has been listed on the Prague Stock Exchange with a US$104 million initial public offering

Doosan Skoda Power and its parent company, Doosan Power Systems, have placed just over US$114 million (€100 million) of the company’s shares, of which US$31.4 million (€27.6 million) supported a 10% capital increase and US$72.4 million (€63.7 million), representing 23% of the pre-transaction share capital, was returned to the selling shareholder. This amount includes US$10.5 million (€9.2 million) in greenshoe shares, equivalent to 10% of the base deal.

Following the IPO, the free float stood at 33%, with no stabilization measures implemented. The proceeds from the capital increase will enhance the company’s overall capabilities and competitiveness through medium-term investments in new machinery, facilities, digitalization and IT.

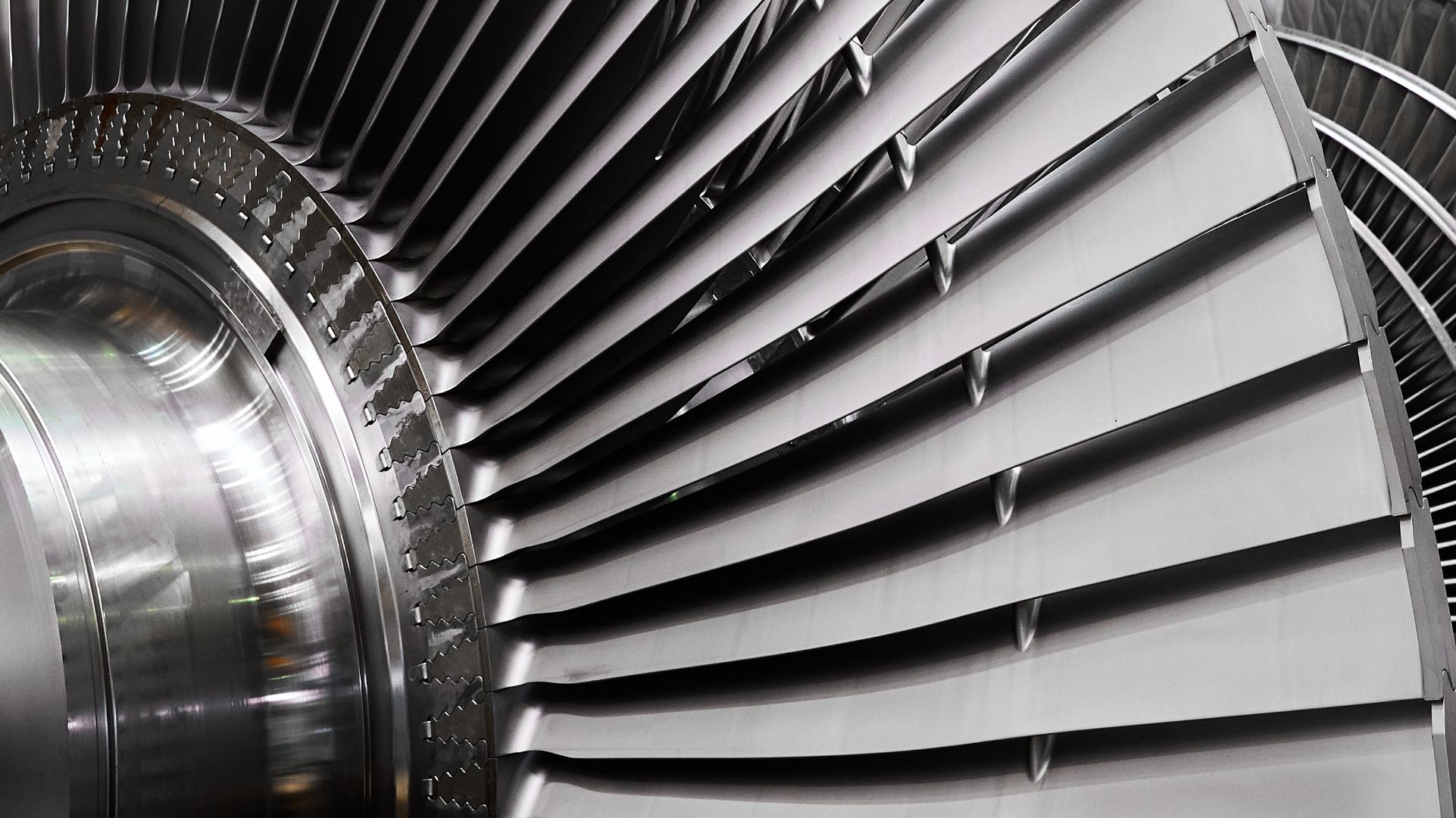

Headquarted in Pilsen, Czech Republic, Doosan Skoda Power is a leading steam turbine manufacturer. Its immediate parent company is Doosan Power Systems, the selling shareholder and part of Doosan Enerbility, which acquired the company in 2009. Doosan Skoda Power provides products and services to customers across several sectors, including waste-to-energy, utilities, pulp and paper, mining and refining.

Oaklins’ team in the Czech Republic acted as the joint global coordinator on this transaction, which targeted Czech and European institutional investors, Czech family offices and high-net-worth individuals (HNWI). Leading the syndicate, the team secured orders from 44 investors, with over 90% of the demand at the offer price coming from Czech-based investors. This highlights the strong appetite and capacity of local investors to provide substantial demand, even for large transactions on the Prague Stock Exchange. The team also engaged leading Czech brokers as selling agents to tap into the new, non-institutional sector. The books were covered within the price range of US$10-11.8 (CZK220-260) on the fourth day of the bookbuilding period, and throughout the price range on the following day. On the final day of bookbuilding, the syndicate guided investors towards a revised price range of US$10.9-11.8 (CZK240-260). The books closed on 5 February 2025 with a significant oversubscription and a strong investor structure at the deal price of US$10.9 (CZK240). The shares debuted on the Prague Stock Exchange on 6 February, opening at US$11.8 (CZK260), representing an 8.3% increase, and closing the day at US$12.9 (CZK284), a premium of 18.3% over the IPO price.

Talk to the deal team

Related deals

Backspin has completed a mandatory public tender offer for the shares of Spindox

Backspin S.p.A. has completed a mandatory public tender offer for Spindox S.p.A.

Learn moreLauak Group has sold a majority stake to Wipro Infrastructure Engineering

After careful strategic reflection to secure the group’s future, Lauak Group’s shareholders have chosen an industrial partnership, in line with the ongoing consolidation trend in the market. Attracted by opportunities for innovation and international expansion, the Charritton family, founders and long-term shareholders, regard Wipro Infrastructure Engineering as a trusted industrial partner. The historical shareholders remain minority stakeholders, and the current CEO continues to lead Lauak.

Learn moreThe assets of IMG have been acquired by SLV Mecklenburg-Vorpommern

The assets of Ingenieurtechnik und Maschinenbau GmbH (IMG) have been acquired by SLV Mecklenburg-Vorpommern GmbH (SLV-MV) through an asset deal as part of IMG’s insolvency proceedings.

Learn more