Bolster Investment Partners has acquired a majority stake in Eternal Sun

Bolster Investment Partners, a Netherlands-based investment firm, has acquired a majority stake in Eternal Sun, a global technology leader in advanced solar panel testing equipment, from ABN AMRO Sustainable Impact Fund, a private impact fund based in the Netherlands, and Vermec, a Belgium-based investment firm.

This partnership marks the next phase of growth for Eternal Sun. With its long-term support and growth expertise, Bolster is the ideal partner to help Eternal Sun drive its buy-and-build strategy, accelerate international expansion and support the continued professionalization of the organization.

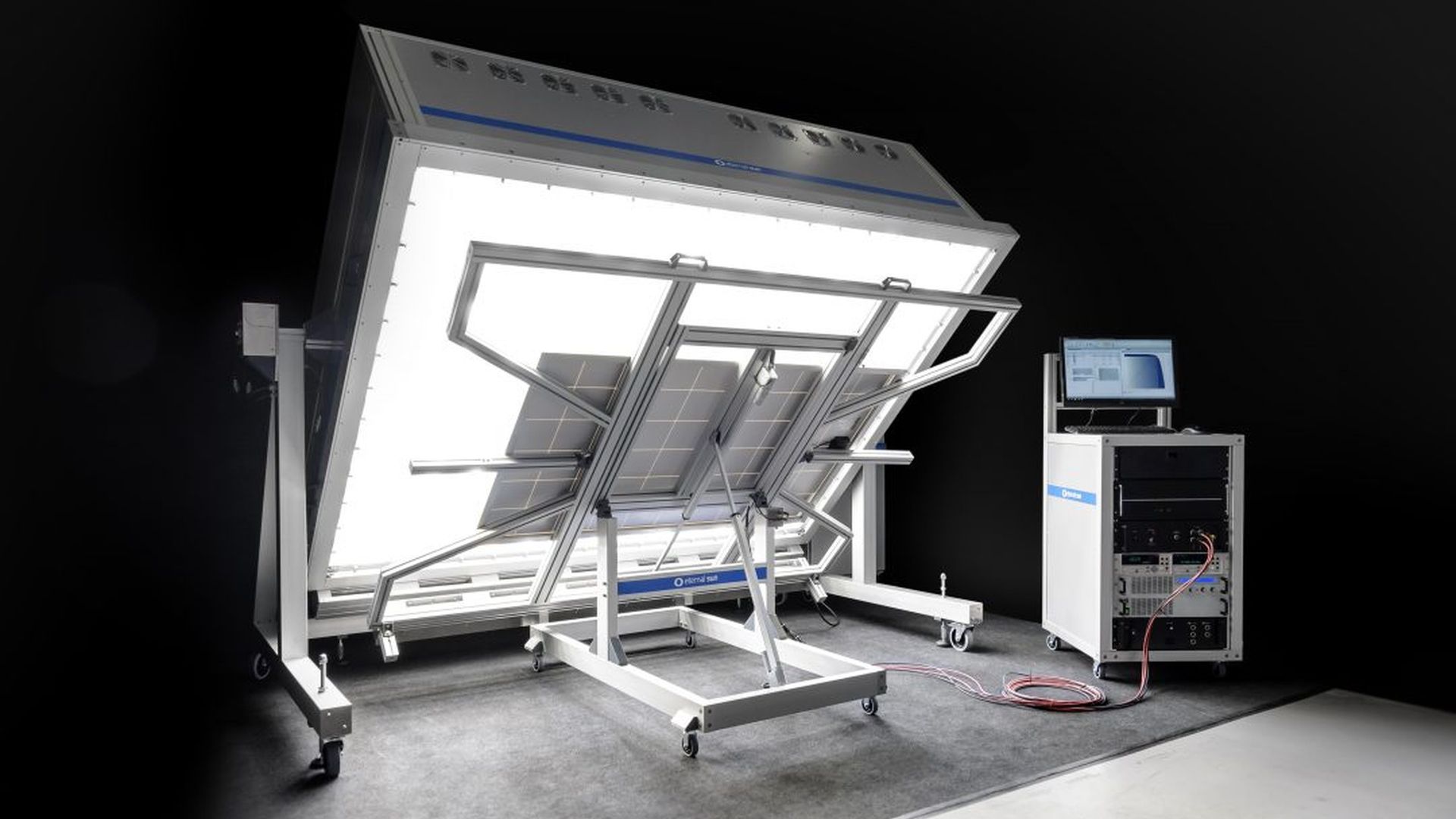

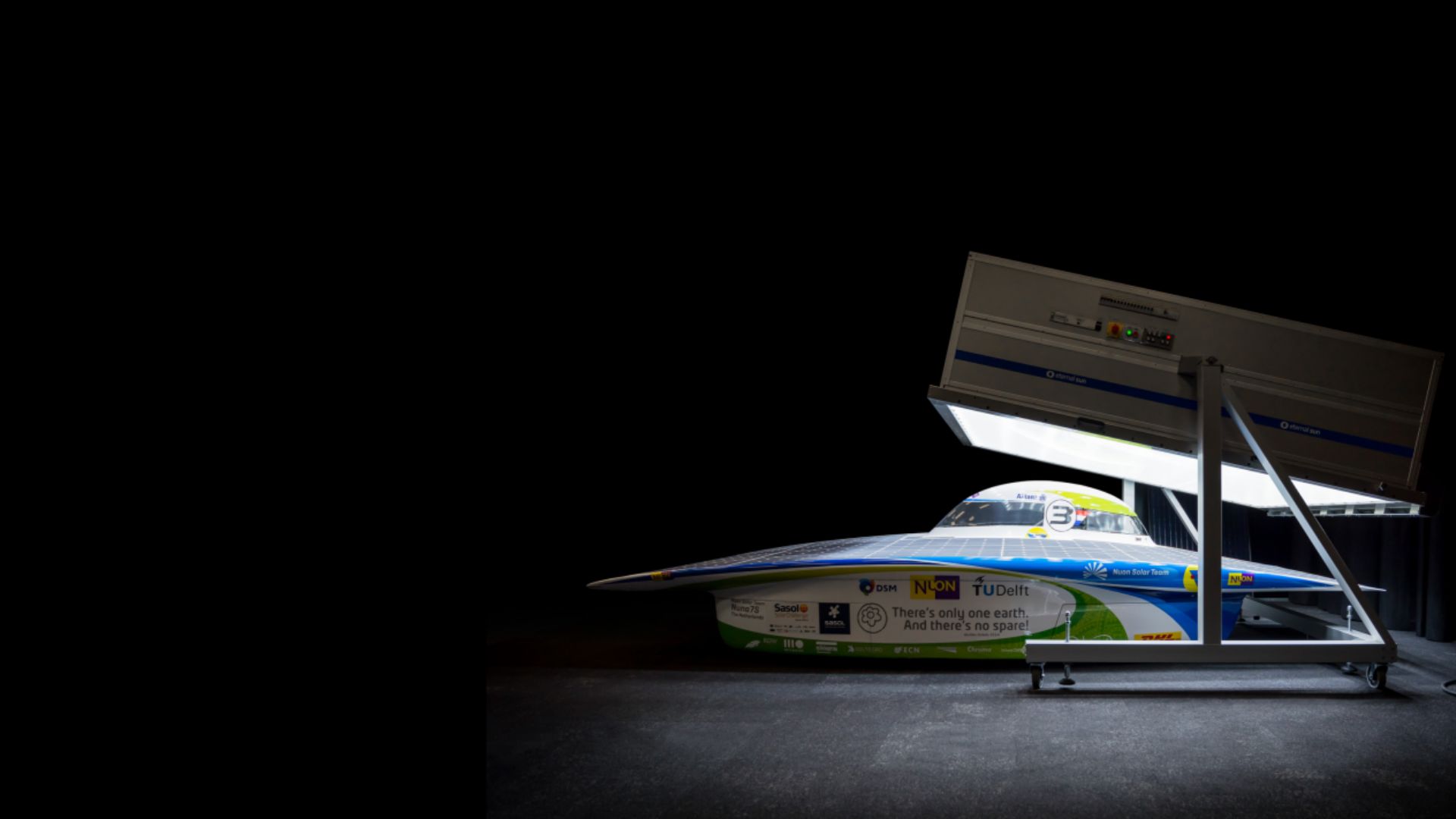

Founded in 2011 by Stefan Roest, Eternal Sun develops, manufactures and installs advanced testing equipment for solar panels. With a focus on innovative flash and steady-state simulators, the company helps customers around the world assess the performance and reliability of solar panels. Leveraging deep technical expertise and innovative strength, Eternal Sun has established itself as the global market leader in steady-state simulators, essential tools for accurate, long-term testing of solar panels. The company serves leading solar panel manufacturers and independent laboratories across 60 countries, operating from six locations in four countries. Its high-precision testing equipment plays a vital role in quality control, pricing and R&D. In addition, Eternal Sun provides import testing and factory inspection services to major importers and developers of solar energy projects. Following earlier strategic acquisitions, such as Spire Solar in the USA and SunChine in China, the company is well positioned to benefit from continued market growth and technological advancements.

Bolster Investment Partners is a long-term investment firm focused on partnering with founder-led and family-owned businesses through both minority and majority stakes. The firm’s long-term approach and experience align well with sustainable and technology-driven businesses such as Eternal Sun.

Oaklins’ team in the Netherlands acted as the exclusive sell-side advisor to the shareholders of Eternal Sun on this transaction. The team in Germany provided support in the early stages of the transaction. The deal highlights Oaklins’ extensive expertise in the energy and sustainability sector, advising both management and private equity investors on value maximization strategies for industry-leading businesses.

Stefan Roest

Founder and CTO, Eternal Sun

Talk to the deal team

Rainier Smeink

Oaklins Netherlands

Related deals

Dolmans Landscaping Group has welcomed Foreman Capital as a new shareholder to support further growth

Dolmans Landscaping Group, a leading full-service provider of landscaping services, has welcomed Foreman Capital as a new shareholder. By partnering with Foreman Capital, which has extensive experience in building stronger companies in the maintenance of public spaces, Dolmans can accelerate its growth trajectory across core verticals and further professionalize the business.

Learn morePresight Solutions has been acquired by Banyan Software

Banyan Software, a leading acquiror and operator of mission-critical software businesses, has entered Norway with the acquisition of Presight Solutions AS, a SaaS company delivering advanced software for safety, operational integrity and regulatory compliance in high-risk industries. The transaction marks a new chapter for Presight, strengthening its ability to scale while preserving the product focus, sector expertise and customer trust built since its founding in 2003.

Learn moreBackspin has completed a mandatory public tender offer for the shares of Spindox

Backspin S.p.A. has completed a mandatory public tender offer for Spindox S.p.A.

Learn more