Europe Snacks-Kolak has acquired Grupo Ibersnacks SL

Europe Snacks-Kolak has acquired Grupo Ibersnacks SL. Financial details have not been disclosed.

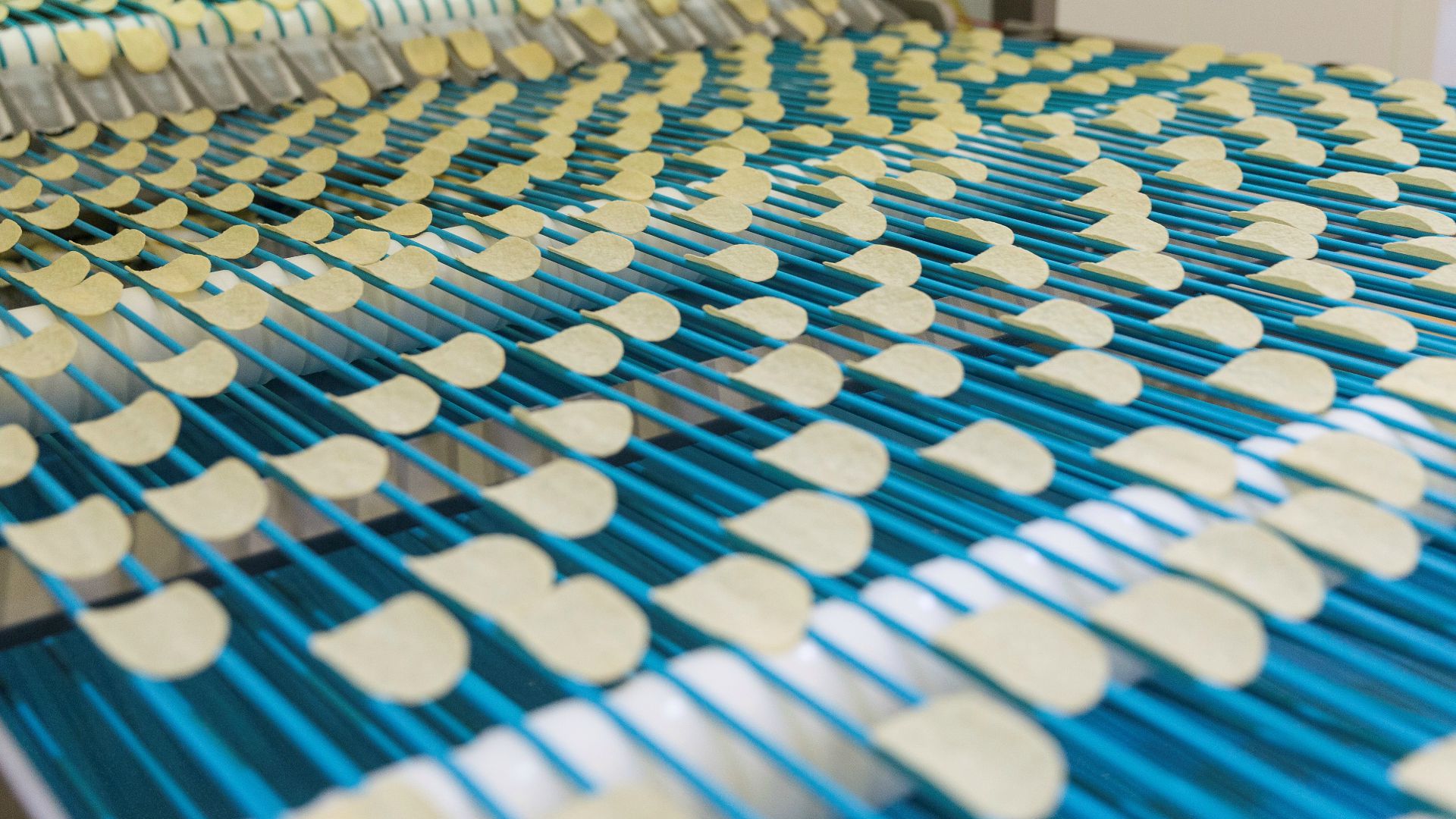

Europe Snacks-Kolak is one of Europe’s leading players specializing in the production of private label snacks, crackers and stacked chips for European distributors and manufacturers. The group generates revenues of US$320 million, employs about 1,400 people and produces over 1.4 billion packs annually from six manufacturing sites across France and the UK.

Founded in 2001, Grupo Ibersnacks is a Spanish-based crisps ans snacks manufacturer specialized in private label. The group is headquartered in Medina del Campo and operates two production sites in Spain.

Oaklins' team in France advised the buyer in this transaction.

Christophe Fenart

President and CEO, Europe Snacks Group

Talk to the deal team

Related deals

Royal Reesink has sold Motrac Industries to Anders Invest

Royal Reesink and Anders Invest have completed the sale of Motrac Industries, a specialist in hydraulic and electrical engineering.

Learn moreÑaming, SL has been acquired by DeA Capital S.p.A.

Spain’s leading producer of sandwiches, fresh and ultra-fresh products, Ñaming, has sold a majority stake to Italian fund DeA Capital.

Learn moreUniKidz has partnered with Karmijn Kapitaal

Karmijn Kapitaal has acquired a majority stake in UniKidz, a talent development organization that provides a scientifically-based developmental approach through high-quality childcare. Through the partnership with Karmijn Kapitaal, UniKidz can take the next step in bringing their unique concept to even more children.

Learn more