iXO Private Equity will support LBA in the achievement of its development plan in France and internationally

La Barrière Automatique (LBA Group) has completed an LBO alongside iXO Private Equity.

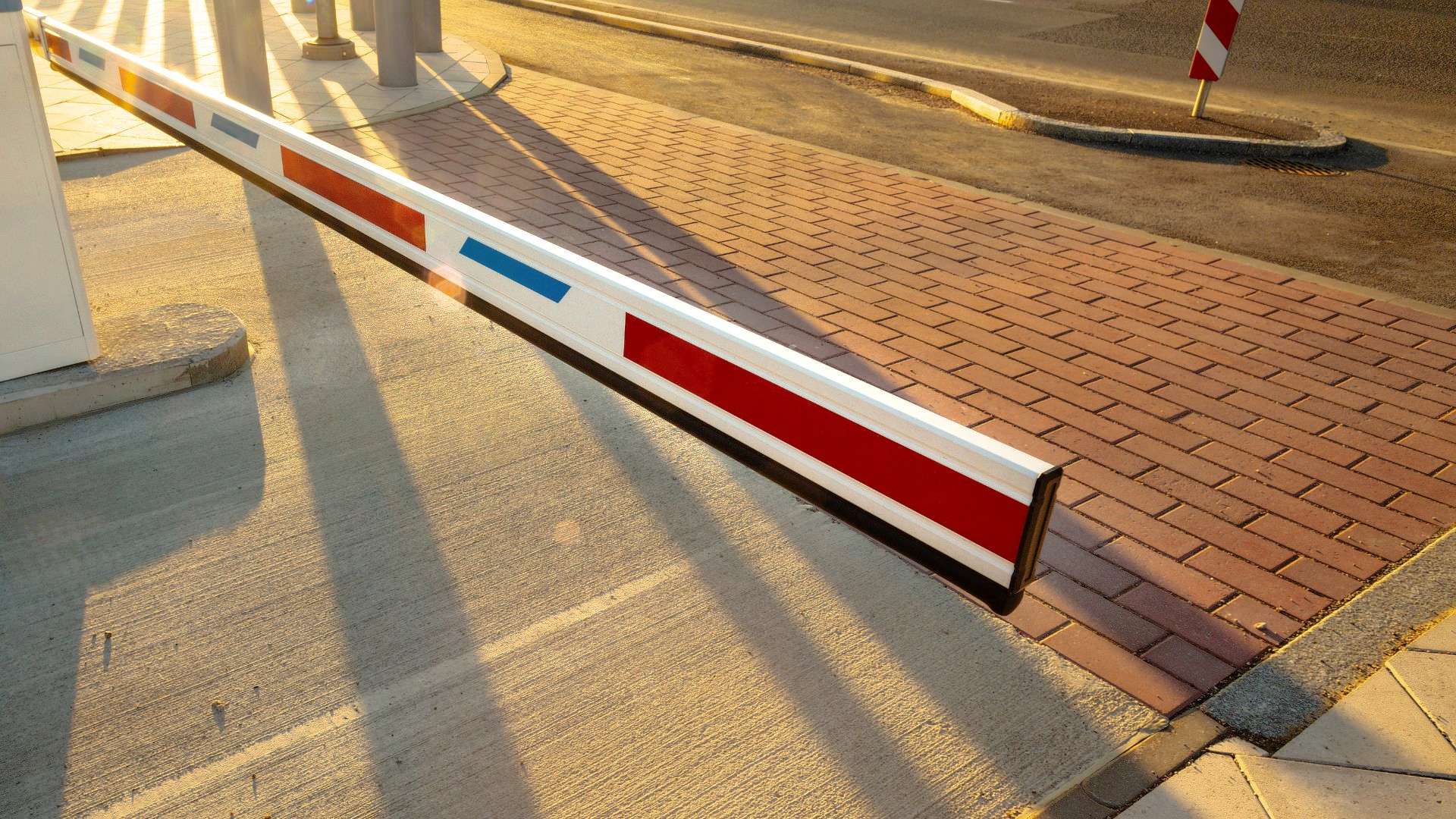

LBA Group is a security and access control specialist enabling the management of flows and the cohabitation of different mobilities. It designs, manufactures and distributes robust, high quality and reliable products, including automatic lifting barriers, pedestrian access turnstiles, retractable and security bollards, and anti-intrusion obstacles. In the last two years, the group has launched two new product ranges: hydroalcoholic gel dispenser terminals and design bollards. In 2019, LBA Group acquired AMCO Les Escamotables, specializing in retractable bollards and anti-intrusion obstacles. LBA Group operates in a market with significant growth dynamics: increasing demand for security measures deployment, and the revolution of urban land use planning, including massive pedestrianization programs. The group has generated strong organic growth (12% of CAGR 2011–2021).

Based in Toulouse, Marseille and Lyon, iXO Private Equity meets the equity needs for the best companies in southwest and southeast of France and the Rhône-Alpes region. It focuses on venture capital for high potential startup firms and small businesses, growth capital for restructuring or expanding further for ambitious small and medium-sized enterprises, and LBO/OBO/MBOs.

Oaklins’ team in France assisted LBA Group and its shareholders throughout this four-month sale process to structure the most attractive transaction.

Talk to the deal team

Related deals

Top Systems teams up with Holland Capital to create the premier Dutch battery-based solutions provider

Holland Capital, a Netherlands-based private equity firm, has acquired a stake in Top Systems, a leading provider of complete battery-based power solutions, with a unique value-added services proposition.

Learn moreSoler & Palau Ventilation has acquired subsidiaries of United Enertech Holdings

Soler & Palau Ventilation, Inc. (S&P) has acquired subsidiaries of United Enertech Holdings, LLC. (UEH). The subsidiaries included Air Conditioning Products, LLC; Air Performance, LLC; Metal Form Manufacturing, LLC; and United Enertech Corp.

Learn moreInfotreasury has been sold to Matera

Matera, a leading banking software company with world-class instant payments and core banking solutions, has acquired Infotreasury.

Learn more