Labcraft Holdings has been acquired by Safe Fleet Holdings

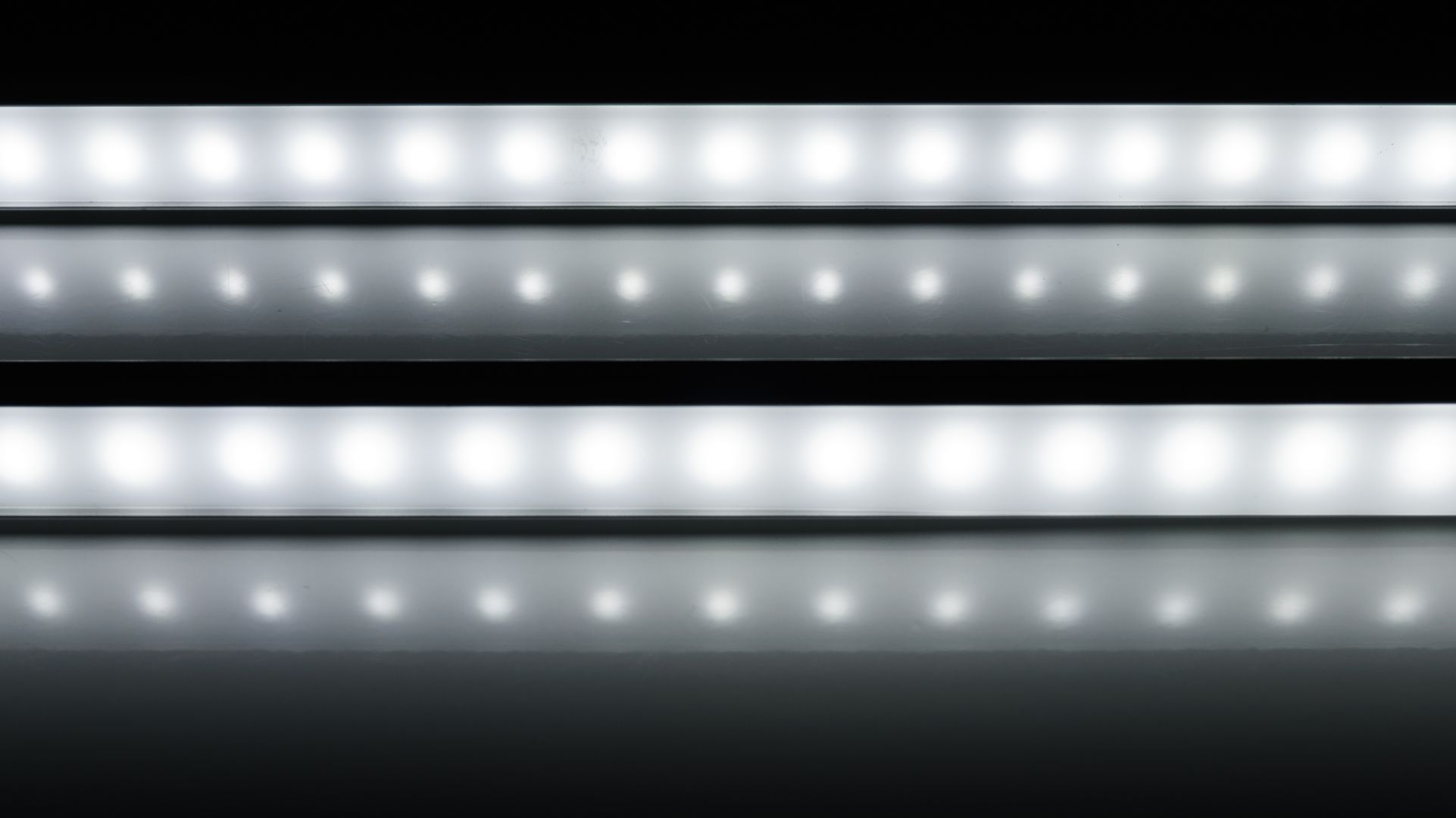

The shareholders of Labcraft Holdings Limited, the UK’s leading manufacturer of high performance and energy-efficient LED lighting for the commercial vehicle and emergency services sectors, have sold the business to Safe Fleet Holdings, a leading supplier of safety solutions for fleet vehicles, enhancing Labcraft’s presence in the US.

Labcraft designs and manufactures LED lighting for the commercial and emergency vehicle sectors, selling to 32 countries around the world. These low voltage products have diversified into many other applications, such as commercial, marine and leisure. Established in 1956, Labcraft has a developed a strong reputation for innovative high-quality lighting solutions with distinctive design features. Labcraft, with its strong brand heritage, will continue to operate as a stand-alone entity within the Safe Fleet group.

Headquartered in Missouri, USA, Safe Fleet is a leading supplier of safety solutions for fleet vehicles. It provides a platform that combines deep fleet market know-how, ground-breaking technology and engineering, a commitment to safety and a 100-year history of innovation. Safe Fleet has unified an unrivaled portfolio of best-of-breed smart solutions into an integrated safety platform for fleets of every type – school bus, transit bus, law enforcement, fire, EMS, work truck, truck and trailer, waste and recycling, construction, agriculture, industrial and military. This acquisition bolsters Safe Fleet’s offering, with the addition of premium safety lighting solutions to its unified brand portfolio and extending its product portfolio.

Oaklins Cavendish, based in the UK, acted as advisor to the seller in this transaction.

Nick Luscombe

CEO, Labcraft Holdings Limited

Talk to the deal team

Related deals

Lauak Group has sold a majority stake to Wipro Infrastructure Engineering

After careful strategic reflection to secure the group’s future, Lauak Group’s shareholders have chosen an industrial partnership, in line with the ongoing consolidation trend in the market. Attracted by opportunities for innovation and international expansion, the Charritton family, founders and long-term shareholders, regard Wipro Infrastructure Engineering as a trusted industrial partner. The historical shareholders remain minority stakeholders, and the current CEO continues to lead Lauak.

Learn moreThe assets of IMG have been acquired by SLV Mecklenburg-Vorpommern

The assets of Ingenieurtechnik und Maschinenbau GmbH (IMG) have been acquired by SLV Mecklenburg-Vorpommern GmbH (SLV-MV) through an asset deal as part of IMG’s insolvency proceedings.

Learn moreQuantum Base has completed a fundraise

Quantum Base Holdings plc (AIM: QUBE) has successfully completed a US$5.7 million fundraise.

Learn more