Keystone Fund has issued bonds

Keystone Fund has raised funds to develop and refinance the company.

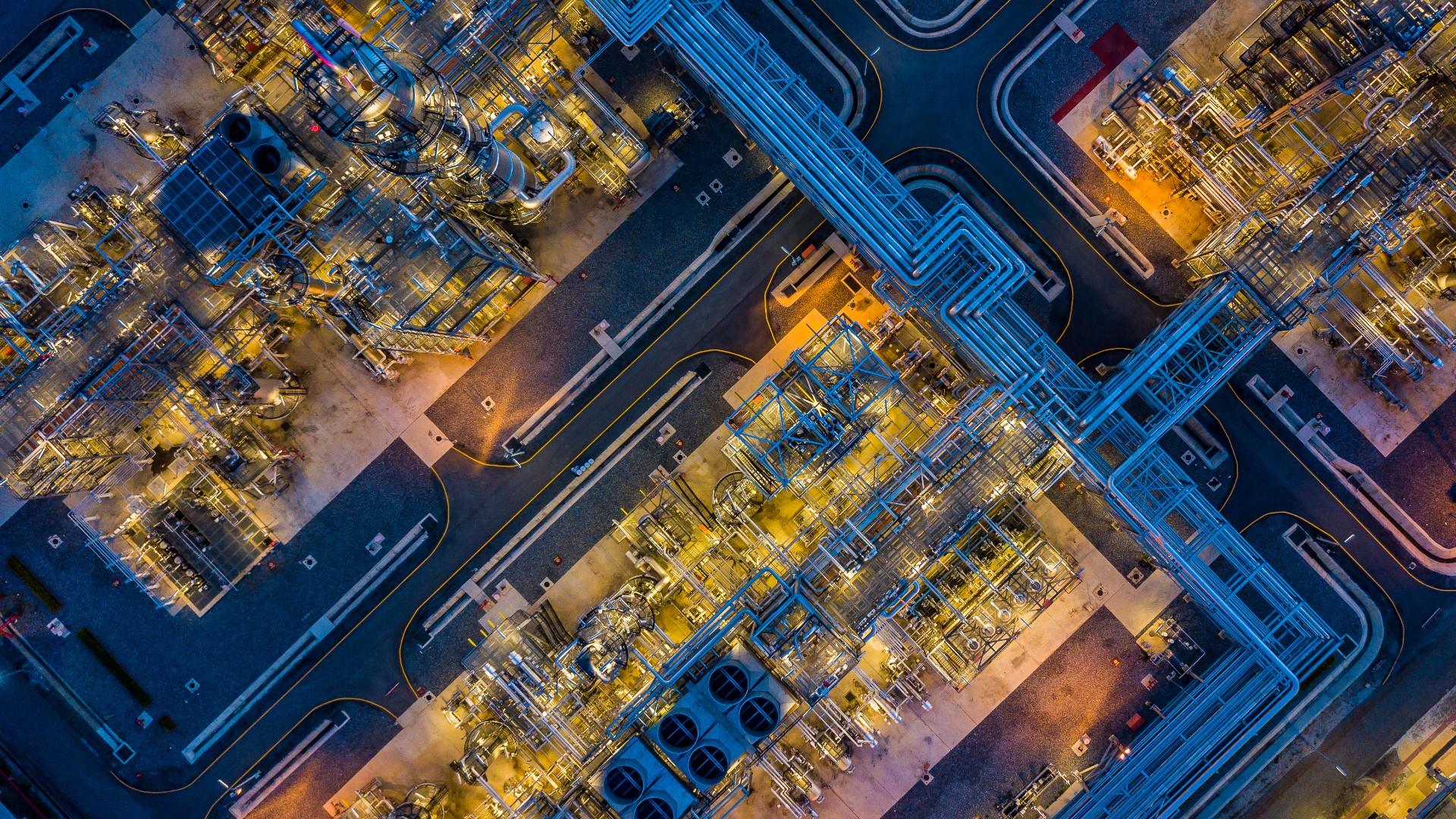

Keystone Fund is an Israeli infrastructure investment fund established in 2019 as part of the government’s policy to promote and encourage investments in infrastructure, including water desalination, wastewater and waste projects, energy infrastructure, transportation and communication projects. Keystone’s goal is to form and establish a balanced and diverse investment portfolio that will offer its investors a long-term return, with as little risk and fluctuation as possible.

Oaklins’ team in Israel advised the company and acted as a member of the distributors’ consortium.

Talk to the deal team

Related deals

Amot Investments Ltd. has issued bonds

Amot Investments Ltd. has raised funds to refinance the company for further development.

Learn moreTotalEnergies and SHV Energy have sold PitPoint.LNG to ViGo Bioenergy

TotalEnergies and SHV Energy have agreed to sell PitPoint.LNG, a Netherlands-based operator of state-of-the-art LNG refueling stations, to ViGo Bioenergy, a Germany-based developer and operator of refueling stations for alternative fuels. With this strategic acquisition, ViGo Bioenergy expands its international station network for alternative fuels and strengthens its European bio-LNG position.

Learn moreOmnetic, member of EAG Group, has raised growth capital from Kartesia and CVI

EAG Group has completed a first investment round for its Omnetic platform. The company was seeking growth capital of up to US$110 million in order to consolidate the CEE markets and finance its expansion to new geographies. The transaction was closed with Kartesia, the European specialist provider of capital solutions for small- and mid-sized companies, in partnership with CVI, a private debt investor based in Warsaw, Poland.

Learn more