Argosy Private Equity has acquired Vac2Go

Argosy Private Equity has acquired Vac2Go.

Argosy is a private equity firm that invests in lower middle-market niche manufacturing and business-to-business services companies. The acquisition of Vac2Go represents Argosy’s seventh platform investment from its US$422 million sixth private equity fund.

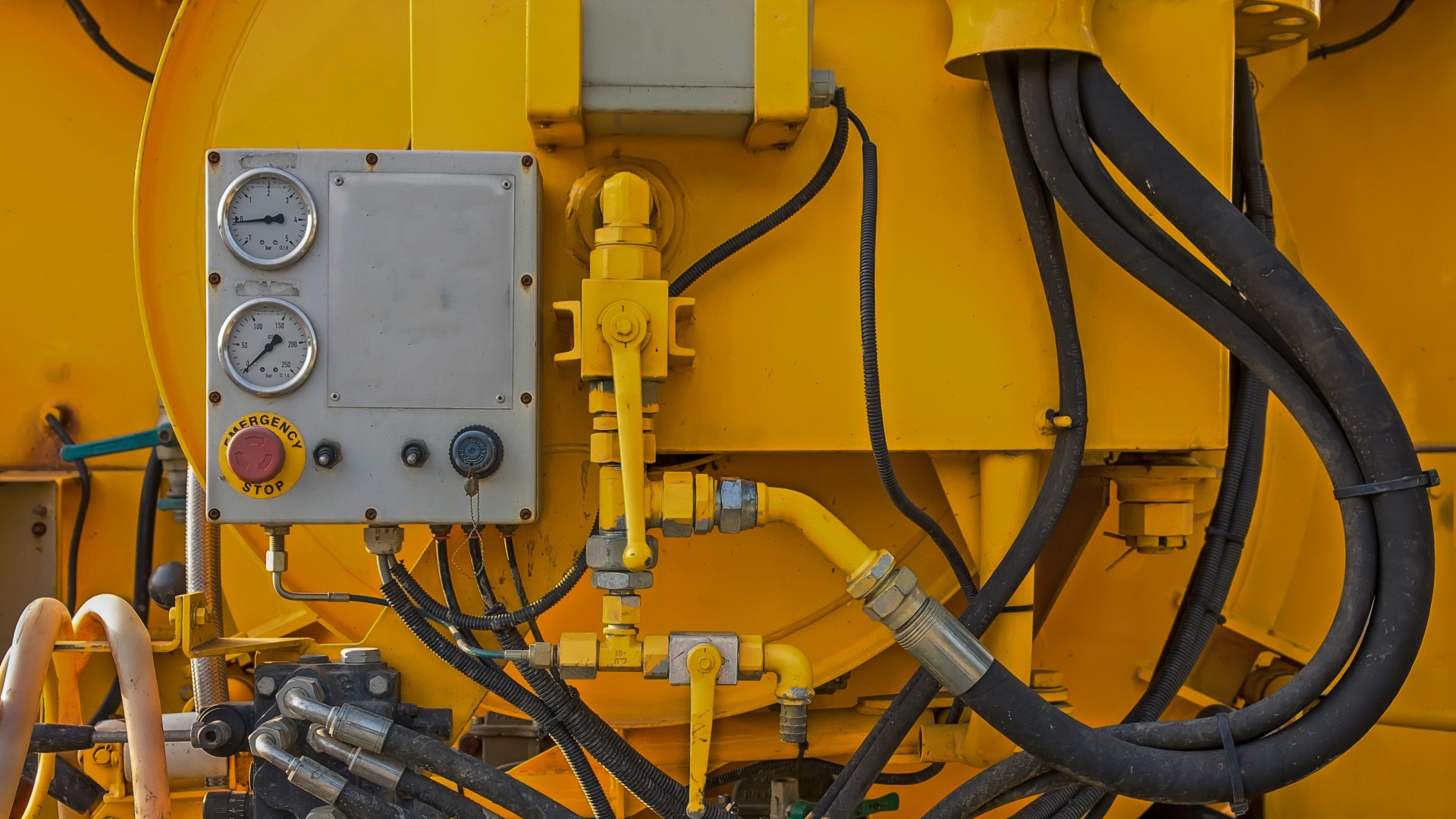

Vac2Go has become a leader in the vacuum truck rental industry, serving industrial, utility and municipal customers from seven offices across the Midwest, Southeast and Southwest of the US.

Oaklins TM Capital in the US served as the exclusive financial advisor to Argosy Private Equity in connection with its acquisition of Vac2Go. Oaklins TM Capital is a market leader in the equipment rental and dealer sectors, having completed multiple recent transactions involving both financial and strategic buyers/partners while publishing authoritative industry research.

Talk to the deal team

David M. Felts

Oaklins TM Capital

Related deals

Top Systems teams up with Holland Capital to create the premier Dutch battery-based solutions provider

Holland Capital, a Netherlands-based private equity firm, has acquired a stake in Top Systems, a leading provider of complete battery-based power solutions, with a unique value-added services proposition.

Learn moreInfotreasury has been sold to Matera

Matera, a leading banking software company with world-class instant payments and core banking solutions, has acquired Infotreasury.

Learn moreThrive Freeze Dry has successfully sealed the acquisition deal with Paradiesfrucht GmbH

Paradiesfrucht GmbH, a gobal freeze dryer of fruits, fruit preparations, drops, powders and granulates, has been acquired by Thrive Freeze Dry (Thrive), a portfolio company of Entrepreneurial Equity Partners (e2p) and Mubadala Capital. The transaction is expected to close in 2024, subject to customary closing conditions, including antitrust approval.

Learn more