Hydraulex has been acquired by BBB Industries

The private shareholders of Hydraulex have sold the company to BBB Industries, a portfolio company of Clearlake Capital Group.

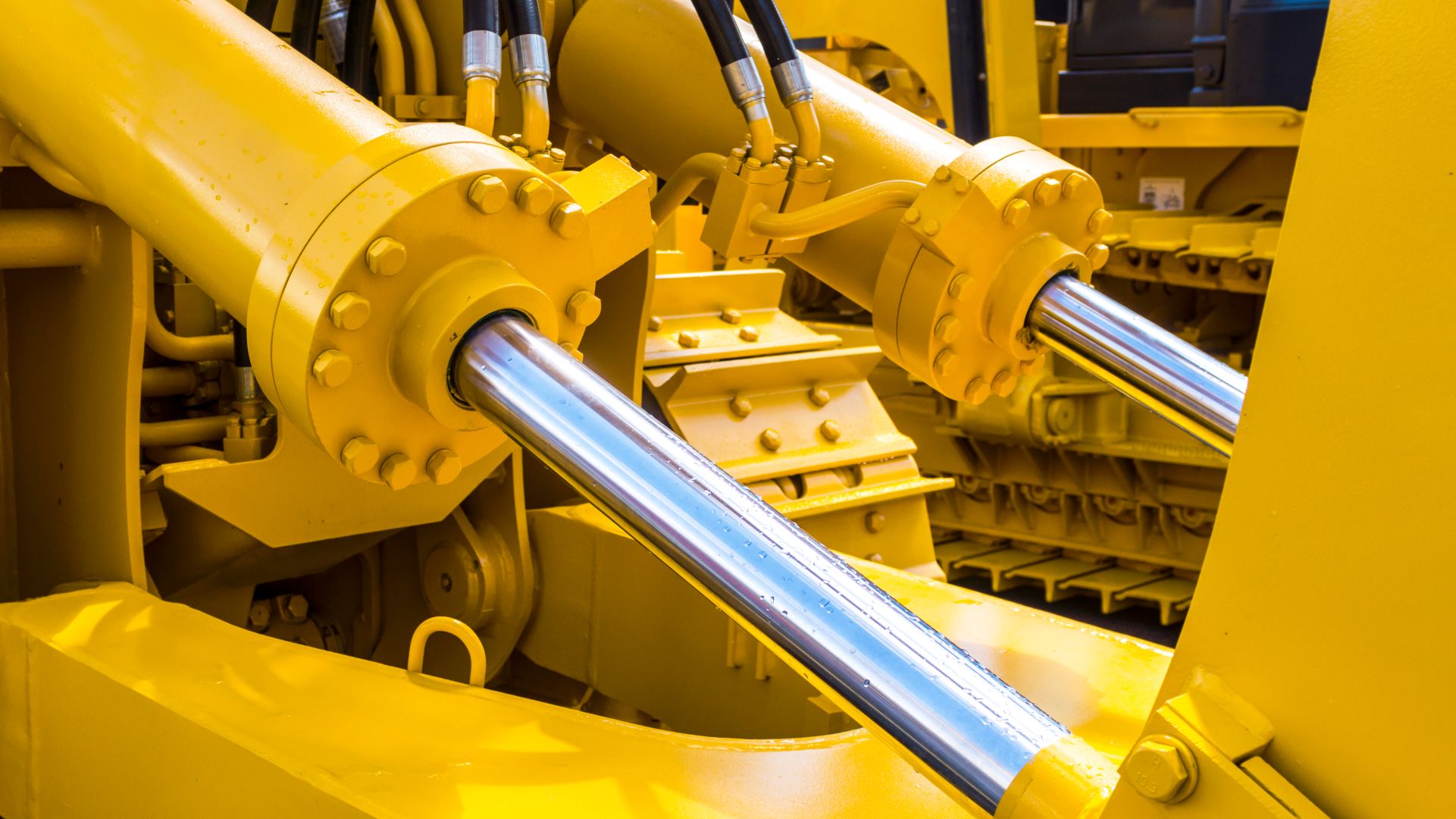

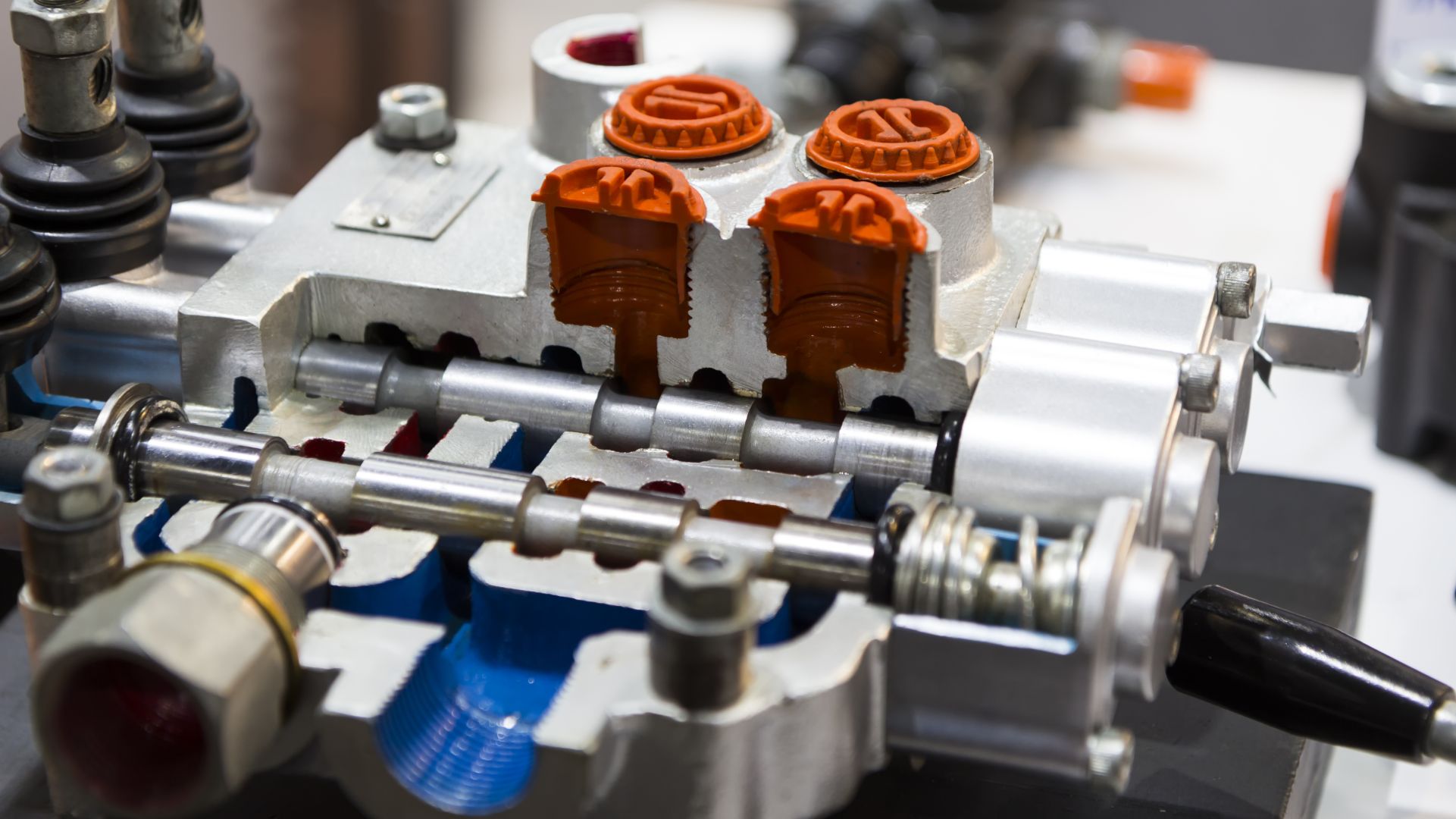

Hydraulex is a one-stop-shop provider of mission-critical aftermarket remanufactured, repair and new replacement hydraulic solutions. Headquartered in Chesterfield, Michigan, with additional facilities in Memphis and the greater Seattle area, Hydraulex provides need-it-now products, including pumps, motors, cylinders, valves and other parts to OEMs, distributors, repair shops and end users.

Founded in 1987, BBB Industries is a leading sustainable manufacturer of aftermarket parts for the automotive, industrial, energy storage and solar markets. BBB conducts business in over 90 countries, with facilities located throughout North America and Europe. Headquartered in Santa Monica, California, Clearlake Capital Group is a private equity firm with over US$70 billion of assets under management.

Oaklins TM Capital in the US served as the exclusive financial advisor to Hydraulex in this transaction.

Brian Tinney

CEO, Hydraulex

Talk to the deal team

Paul Smolevitz

Oaklins TM Capital

Matt Rosenthal

Oaklins TM Capital

Related deals

Tecnosafra has been acquired by Tranorte

Tecnosafra Sistemas Mecanizados Ltda. has been acquired by Tranorte reinforcing their commitment to delivering agricultural equipment and high-quality service to producers across their regions. The integration expands geographic coverage, strengthens after-sales capabilities and enhances access to agriculture technologies, parts availability and field support teams.

Learn moreGCT GmbH has been acquired by CTC India and JoReiCo GmbH

GCT GmbH has been acquired by CTC India Pvt. Ltd. and JoReiCo GmbH from Extramet AG, gaining access to a broader network of expertise, enhanced resources and a global sales network. With its extensive experience in diamond coating and its broad client base in the printed circuit board (PCB) tool market, GCT brought new momentum and specialist knowledge to its buyers.

Learn moreClearfield, Inc. has divested Nestor Cables Oy

Clearfield, Inc. has divested its subsidiary Nestor Cables Oy.

Learn more