Ethos Engineering Limited has been acquired by Exponent

The shareholders of data center designer Ethos Engineering have sold a majority stake to Exponent.

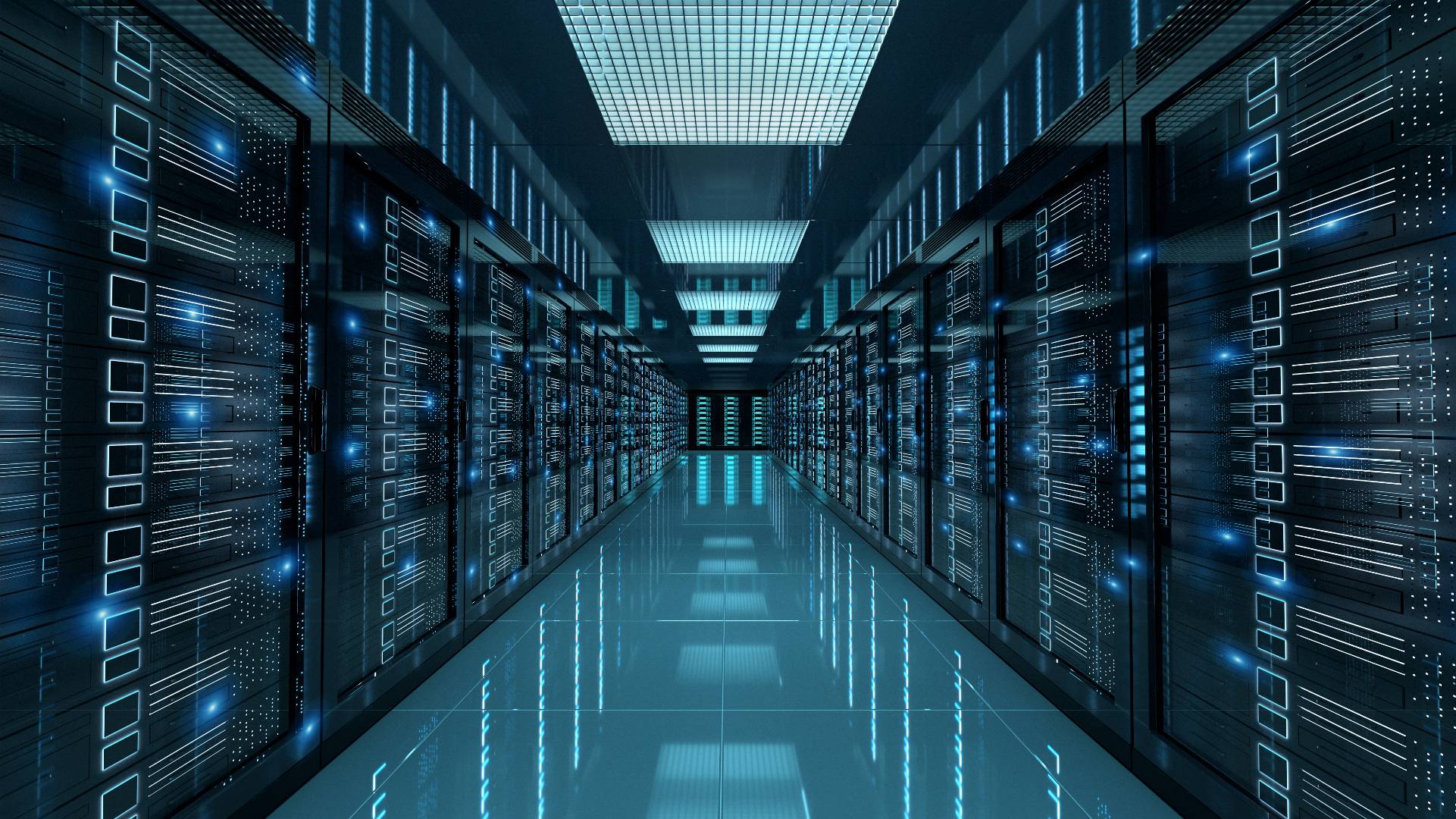

Ethos Engineering is a leading Irish-headquartered, pan-European engineering design consultancy with over 220 employees. It provides mechanical and electrical engineering solutions to a range of blue-chip companies, with a focus on sustainable data center design for some of the world’s leading technology firms. Ethos has worked on more than 90 data centers across 19 countries in EMEA, representing over 2 GW of capacity, as well as being an established market leader in its home market, Ireland. Over the past five years, the company has continued to grow internationally with their blue-chip base, and as of FY23 approximately 80% of its group revenue comes from outside Ireland.

Founded in 2004, Exponent is a prominent European private equity firm that invests in mid-market companies based in the UK, Ireland, Benelux and the Nordics. It has raised more than €3 billion (US$3.8 billion) to date and has offices in London, Dublin and Amsterdam.

Oaklins’ team in Ireland acted as the exclusive sell-side financial advisor to the shareholders of Ethos Engineering in this transaction.

Talk to the deal team

Related deals

Dolmans Landscaping Group has welcomed Foreman Capital as a new shareholder to support further growth

Dolmans Landscaping Group, a leading full-service provider of landscaping services, has welcomed Foreman Capital as a new shareholder. By partnering with Foreman Capital, which has extensive experience in building stronger companies in the maintenance of public spaces, Dolmans can accelerate its growth trajectory across core verticals and further professionalize the business.

Learn moreGuard has strengthened its Danish platform with the acquisition of Holtec

Guard Automation AS, a leading Nordic provider of automation services, insight and process optimization, has acquired Holtec AS, a Danish engineering and automation company. The acquisition strengthens Guard’s presence in Denmark and supports its strategy of combining strong local expertise with digital platforms. Together with X Automation, Holtec will form a strong Danish automation platform, enabling knowledge sharing, best-practice transfer and enhanced capabilities across the Nordics.

Learn moreBackspin has completed a mandatory public tender offer for the shares of Spindox

Backspin S.p.A. has completed a mandatory public tender offer for Spindox S.p.A.

Learn more