The former shareholders of Energie have divested the company to Horizon Equity Partners

The former shareholders of Energie have successfully divested their stake in the company to Horizon Equity Partners. The investment will support Energie in its next phase of strategic growth, focused on capturing market opportunities driven by the accelerating shift toward sustainable energy solutions, strengthening product development and R&D capabilities and consolidating the company’s expansion across Iberia and key European markets.

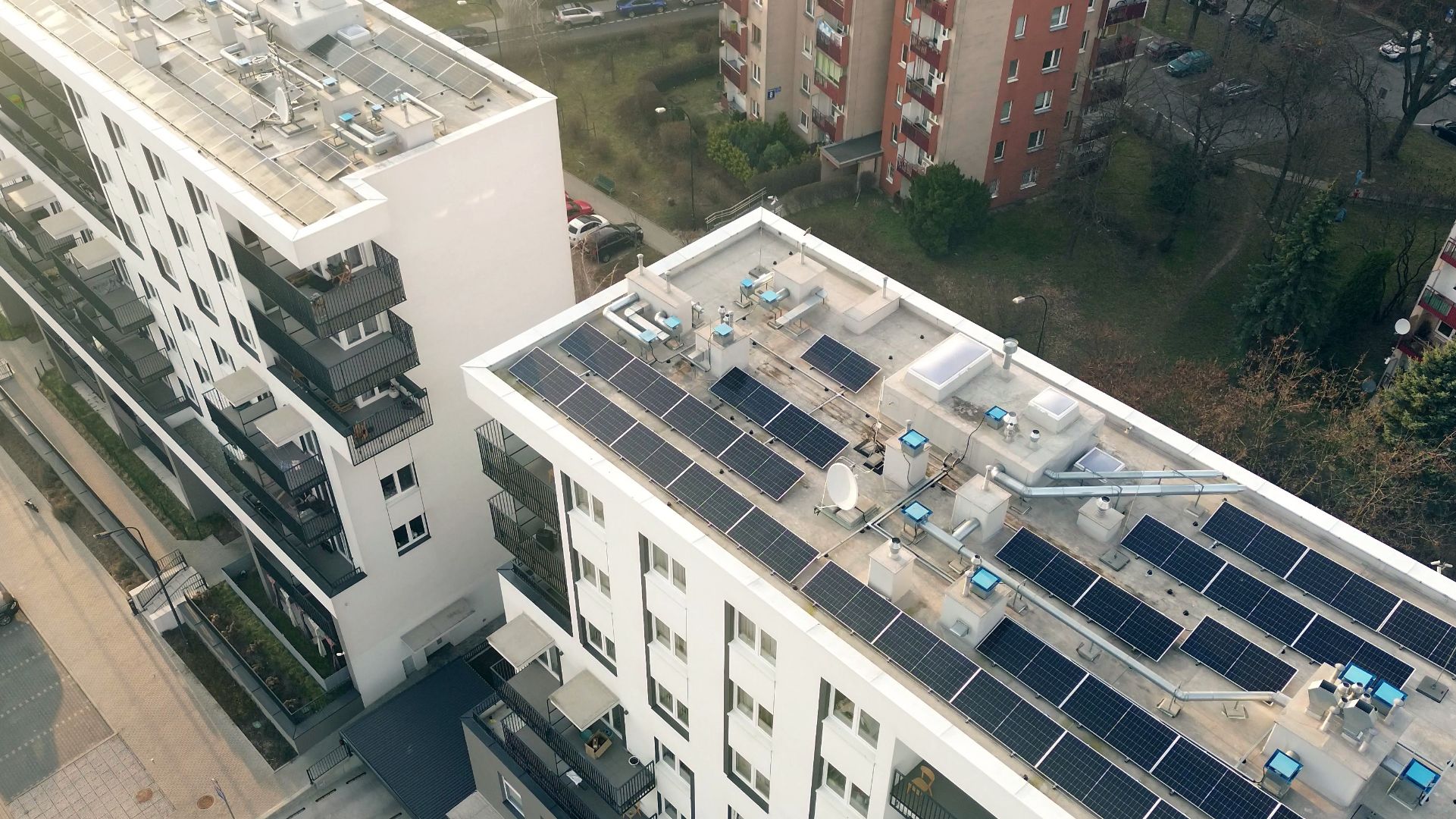

Incorporated in 1981, Energie is a leading Portuguese company specializing in heating solutions, including heat pumps for domestic and industrial hot water. Over the years, the company has consistently maintained a strong focus on R&D, resulting in the development of highly advanced technological products. Its product portfolio includes aerothermal heat pumps for domestic hot water, industrial applications, climatization and swimming pool heating; thermodynamic solar technology designed for domestic and industrial hot water; and geothermal heat pumps marketed to the original equipment manufacturer (OEM) channel in Iberia, with heating, cooling and hot water capabilities. Energie combines a flexible production setup with robust R&D and innovation capabilities, supported by a skilled team of engineers dedicated to continuously enhancing its product range.

Horizon Equity Partners is an independent Portuguese private equity firm.

Oaklins’ team in Portugal acted as co-advisor, together with Banco Finantia, to Energie’s shareholders on the divestment of the company.

Talk to the deal team

Related deals

Dolmans Landscaping Group has welcomed Foreman Capital as a new shareholder to support further growth

Dolmans Landscaping Group, a leading full-service provider of landscaping services, has welcomed Foreman Capital as a new shareholder. By partnering with Foreman Capital, which has extensive experience in building stronger companies in the maintenance of public spaces, Dolmans can accelerate its growth trajectory across core verticals and further professionalize the business.

Learn moreGuard has strengthened its Danish platform with the acquisition of Holtec

Guard Automation AS, a leading Nordic provider of automation services, insight and process optimization, has acquired Holtec AS, a Danish engineering and automation company. The acquisition strengthens Guard’s presence in Denmark and supports its strategy of combining strong local expertise with digital platforms. Together with X Automation, Holtec will form a strong Danish automation platform, enabling knowledge sharing, best-practice transfer and enhanced capabilities across the Nordics.

Learn morePresight Solutions has been acquired by Banyan Software

Banyan Software, a leading acquiror and operator of mission-critical software businesses, has entered Norway with the acquisition of Presight Solutions AS, a SaaS company delivering advanced software for safety, operational integrity and regulatory compliance in high-risk industries. The transaction marks a new chapter for Presight, strengthening its ability to scale while preserving the product focus, sector expertise and customer trust built since its founding in 2003.

Learn more