Macquarie Infra. & Real Assets has acquired a 35% stake in RWE Grid Holding as

A consortium led by Macquarie Infrastructure and Real Assets (MIRA) has acquired approximately a 35% stake in RWE Grid Holding, a.s. (RGH), an entity which will act as the holding company for four regional gas distribution networks in the Czech Republic, for an undisclosed consideration. The consortium comprises the majority investor Macquarie European Infrastructure Fund 4 (MEIF4) and another Macquarie managed vehicle.

MIRA is a leader in alternative asset management worldwide, specializing in infrastructure, real estate, agriculture and other real asset classes via public and private funds, co-investments, partnerships and separately managed accounts. Edward Beckley, European Head of MIRA, said: “This is a unique opportunity to create a high-quality, consolidated gas distribution business in one of Eastern Europe’s strongest economies. RGH is an excellent match for the long-term investment objectives of our investors."

This is the second acquisition for MEIF4, following its investment in the German gas transmission system operator, Open Grid Europe GmbH in July 2012.

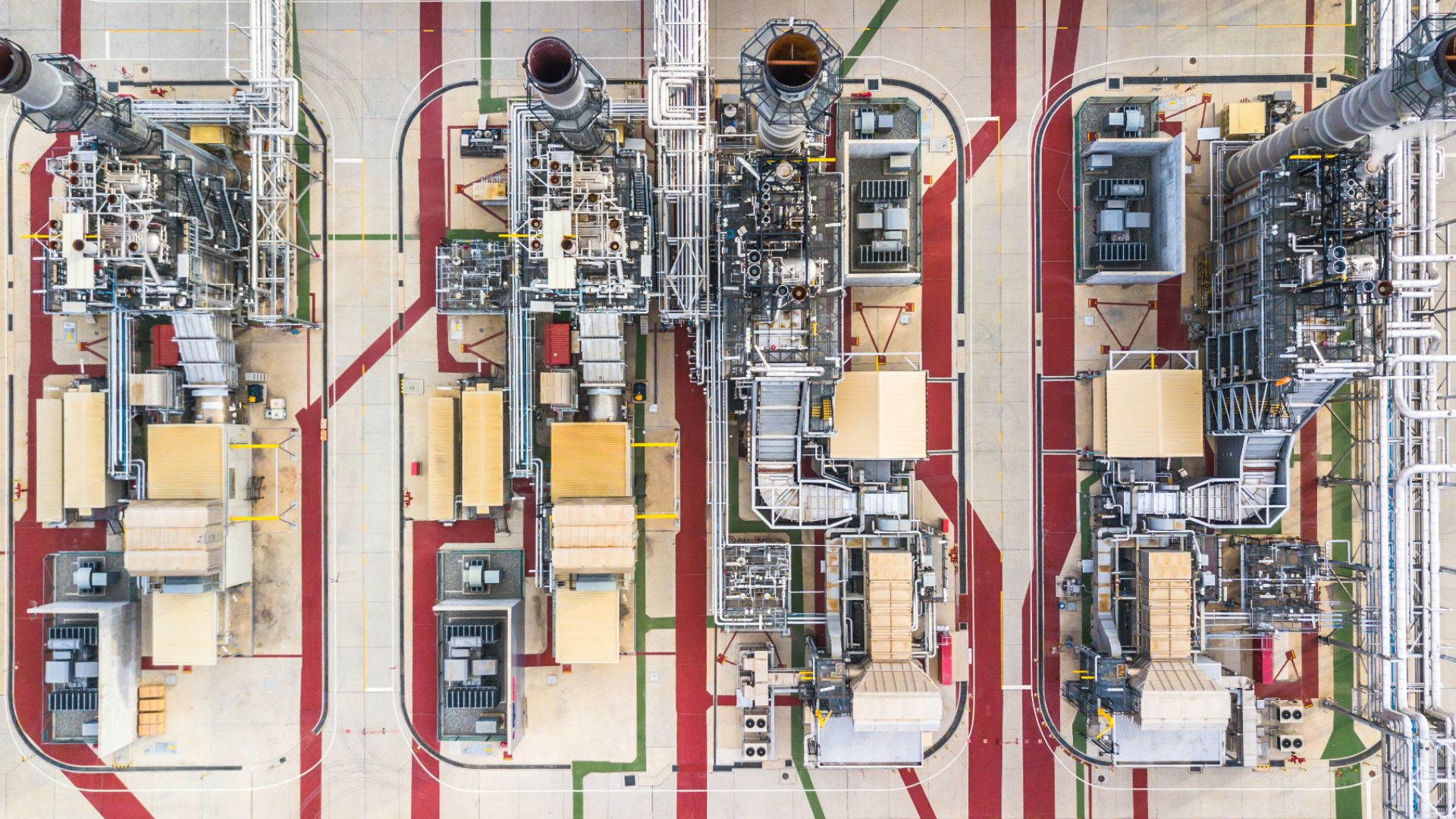

RGH will own and operate approximately 80% of the Czech Republic’s gas distribution network. The consortium will acquire minority interests in three regional gas networks from SPP, E.ON and GdF. These minority interests will be consolidated into RGH, alongside the existing Czech gas distribution interests of RWE.

Oaklins' team in the Czech Republic acted as financial advisor in the transaction and Patria Finance as financial advisor in the acquisition of minority interests from E.ON. Societe Generale Corporate and Investment Banking acted as debt advisor in the transaction. Allen & Overy (Prague) acted as legal advisor.

Talk to the deal team

Related deals

Bolster Investment Partners has acquired a majority stake in Eternal Sun

Bolster Investment Partners, a Netherlands-based investment firm, has acquired a majority stake in Eternal Sun, a global technology leader in advanced solar panel testing equipment, from ABN AMRO Sustainable Impact Fund, a private impact fund based in the Netherlands, and Vermec, a Belgium-based investment firm.

Learn moreiwell raises US$31 million to deploy its leading European smart battery storage solutions into new markets

iwell, a developer of smart energy management (EMS) and battery storage systems (BESS), has successfully closed a US$31 million (€27 million) funding round. The round was led by Meridiam, with Invest-NL and Rabobank participating, alongside existing investors.

Learn moreEcosun Expert has been acquired by TSG Group

The successful acquisition of Ecosun Expert by TSG Group has been completed.

Learn more