USK Karl Utz GmbH has been sold to Aumann AG

The private shareholders of USK Karl Utz Sondermaschinen GmbH (USK) have sold the company to Aumann AG. Financial details have not been disclosed.

USK is a renowned specialist in automation solutions. In 2016, the company achieved sales of almost US$80 million. With more than 300 employees, USK has decades of experience in manufacturing automation solutions for leading automotive OEM and tier 1 suppliers. The company also offers sophisticated special machines and production lines in the fields of electronics, renewable energies and medical technology.

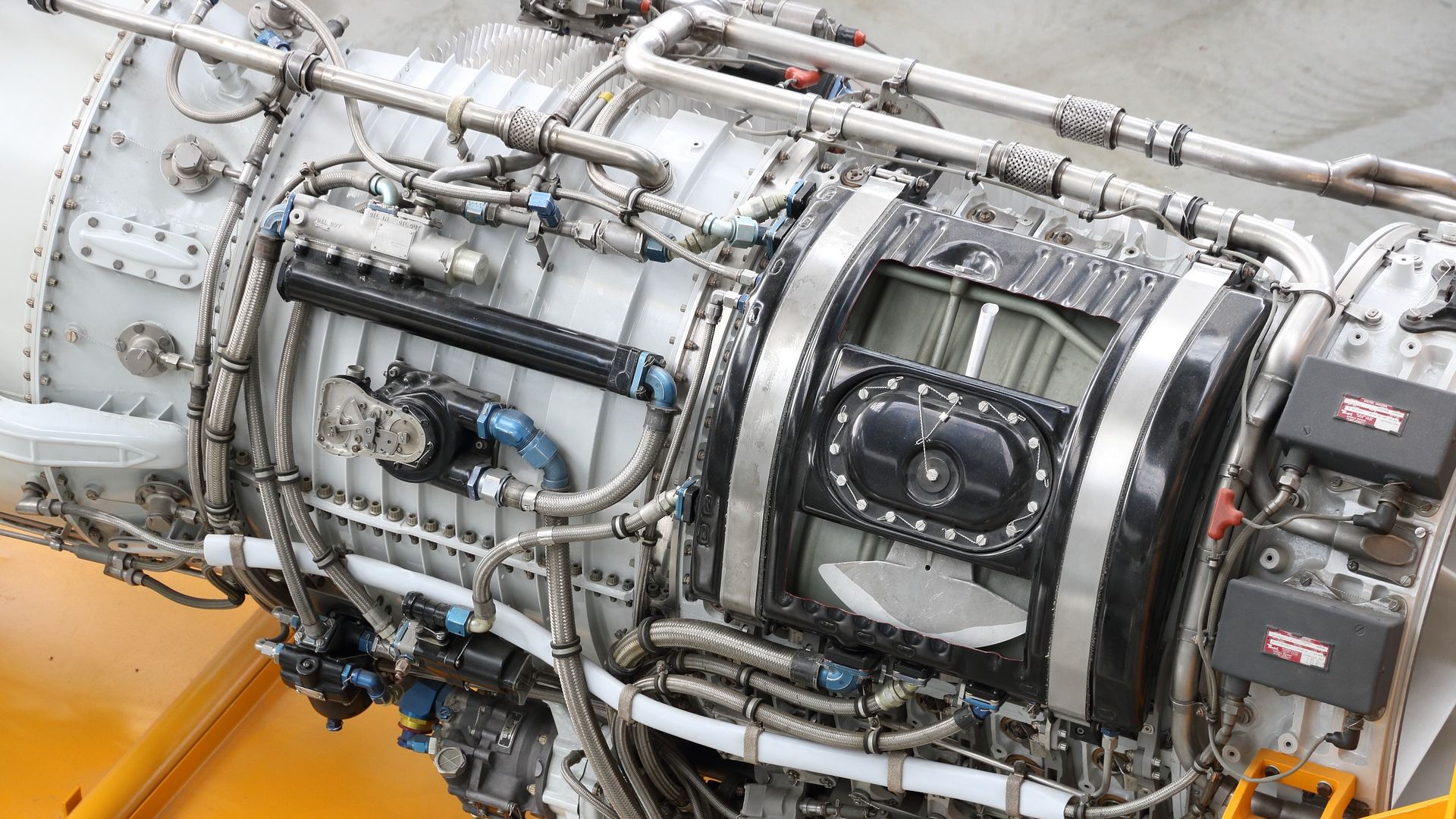

Aumann is a world leading manufacturer of innovative special machines and automated production lines with a focus on e-mobility. The company combines unique winding technology for the highly efficient production of electric motors with decades of automation experience, especially in the automotive industry. Aumann provides solutions for serial production of purely electrical and hybrid vehicle drives. Together with USK's development, construction and assembly capacities, as well as its expertise in future technologies such as fuel cell production, Aumann expects a substantial growth boost in the e-mobility sector.

Oaklins' team in Germany acted as the exclusive advisor to the seller in this transaction.

Sprechen Sie mit dem Deal Team

Dr. Florian von Alten

Oaklins Germany

Transaktionen

Lauak Group has sold a majority stake to Wipro Infrastructure Engineering

After careful strategic reflection to secure the group’s future, Lauak Group’s shareholders have chosen an industrial partnership, in line with the ongoing consolidation trend in the market. Attracted by opportunities for innovation and international expansion, the Charritton family, founders and long-term shareholders, regard Wipro Infrastructure Engineering as a trusted industrial partner. The historical shareholders remain minority stakeholders, and the current CEO continues to lead Lauak.

Mehr erfahrenThe assets of IMG have been acquired by SLV Mecklenburg-Vorpommern

The assets of Ingenieurtechnik und Maschinenbau GmbH (IMG) have been acquired by SLV Mecklenburg-Vorpommern GmbH (SLV-MV) through an asset deal as part of IMG’s insolvency proceedings.

Mehr erfahrenTecnosafra has been acquired by Tranorte

Tecnosafra Sistemas Mecanizados Ltda. has been acquired by Tranorte reinforcing their commitment to delivering agricultural equipment and high-quality service to producers across their regions. The integration expands geographic coverage, strengthens after-sales capabilities and enhances access to agriculture technologies, parts availability and field support teams.

Mehr erfahren