Mekorot Water Company has issued bonds worth US$277 million

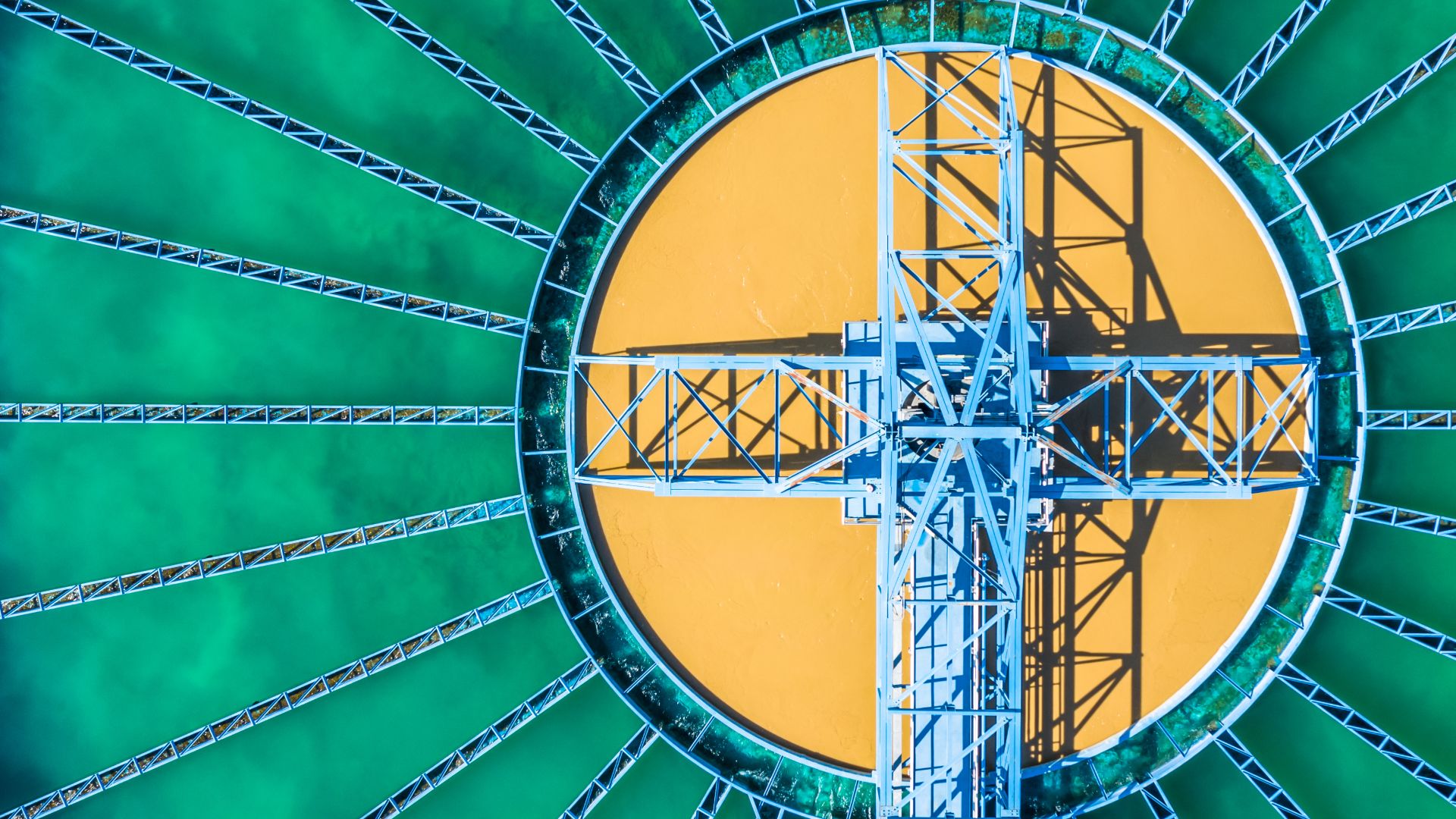

Mekorot Water Company (Mekorot) has completed a fundraising to refinance and develop the company.

Mekorot is a wholly-owned government company under the purview of the Ministry of Energy and Water and the Ministry of Finance. Mekorot was defined in the Water Law as the national water company and it is accountable to the Water Authority – the regulator that supervises Mekorot’s activities on behalf of the state. The company was founded in 1937, before the establishment of the state. Since then, it has made a profound national contribution to realizing the Zionist vision and transforming it into a sustainable reality. The infrastructure and huge water plants founded by Mekorot have essentially facilitated life in Israel and provided solutions, at all times, to all sectors – households, fields, farmers and industrial plants.

Oaklins’ team in Israel advised Mekorot Water Company and acted as a member of the distributors’ consortium.

Sprechen Sie mit dem Deal Team

Transaktionen

Amot Investments Ltd. has issued bonds

Amot Investments Ltd. has raised funds to refinance the company for further development.

Mehr erfahrenTotalEnergies and SHV Energy have sold PitPoint.LNG to ViGo Bioenergy

TotalEnergies and SHV Energy have agreed to sell PitPoint.LNG, a Netherlands-based operator of state-of-the-art LNG refueling stations, to ViGo Bioenergy, a Germany-based developer and operator of refueling stations for alternative fuels. With this strategic acquisition, ViGo Bioenergy expands its international station network for alternative fuels and strengthens its European bio-LNG position.

Mehr erfahrenOmnetic, member of EAG Group, has raised growth capital from Kartesia and CVI

EAG Group has completed a first investment round for its Omnetic platform. The company was seeking growth capital of up to US$110 million in order to consolidate the CEE markets and finance its expansion to new geographies. The transaction was closed with Kartesia, the European specialist provider of capital solutions for small- and mid-sized companies, in partnership with CVI, a private debt investor based in Warsaw, Poland.

Mehr erfahren