Listan, a leading provider of high-performance computer components, has been acquired by Afinum

The three founders of Listan GmbH have sold a majority stake in the company to Afinum.

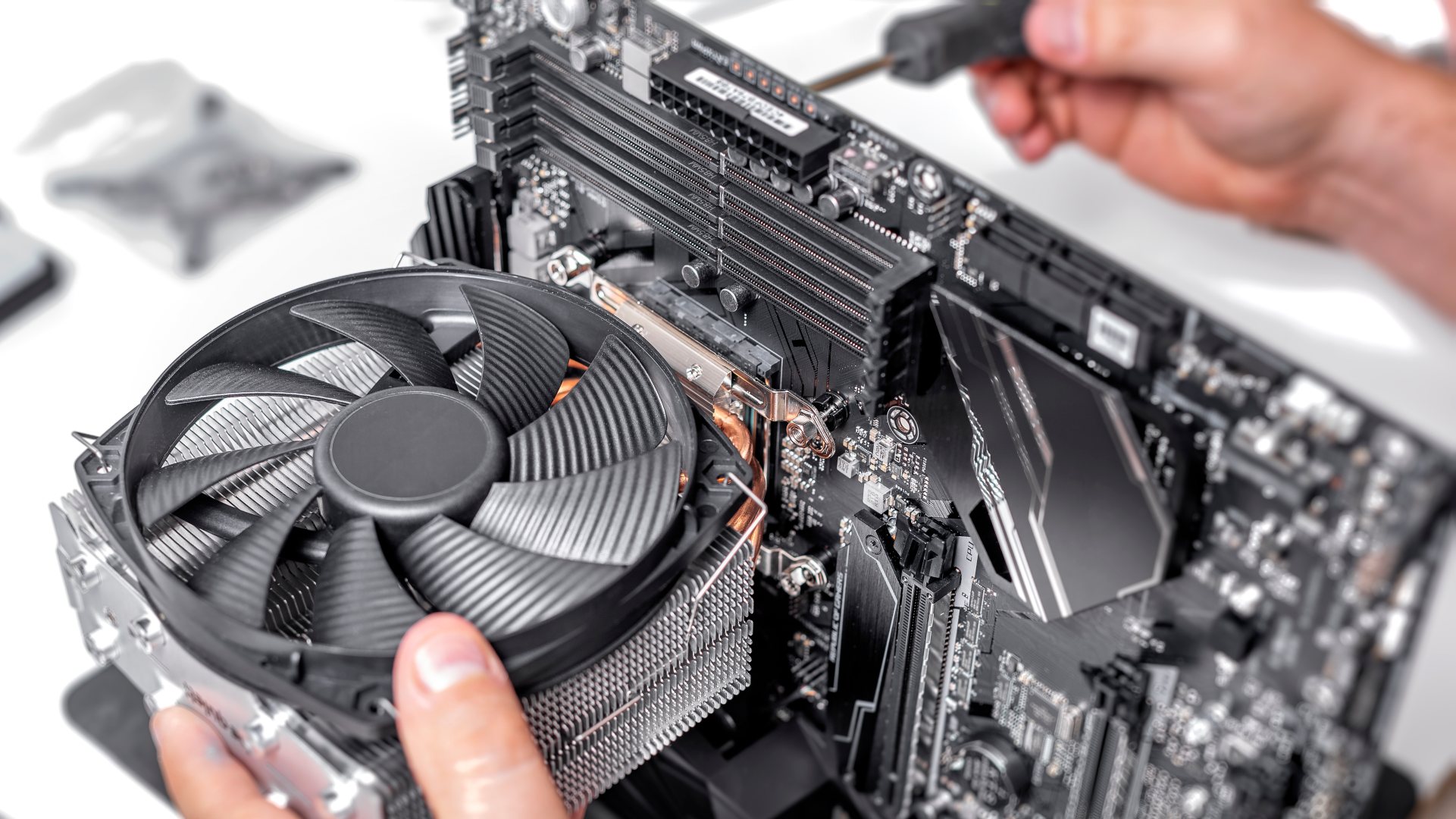

Listan, through its brands “be quiet!” and “Xilence”, provides high-performance PC components targeted at performance gamers and computer enthusiasts. Based on products with superior features such as extremely low noise and heat emission levels, industry-leading product quality and award-winning design, the company has gained trust and brand awareness among its relevant distribution channels and its end customers. Since its foundation in 2000, Listan has become one of the market leaders in the DACH region and has successfully initiated its geographical expansion in Europe and globally.

Afinum is an independent investment firm owned by its management team, with offices in Munich, Zurich and Hong Kong, specializing in the acquisition of shareholdings in financially sound and successful mid-market companies in the German speaking region as well as in neighboring countries in Europe.

Throughout the whole process, Oaklins’ team in Germany acted as the lead advisor to the three founders of Listan. Oaklins advised in the preparation of the sale process and due diligence as well as the approach and parallel negotiations with potential financial investors until closing.

Talk to the deal team

Related deals

Top Systems teams up with Holland Capital to create the premier Dutch battery-based solutions provider

Holland Capital, a Netherlands-based private equity firm, has acquired a stake in Top Systems, a leading provider of complete battery-based power solutions, with a unique value-added services proposition.

Learn moreSoler & Palau Ventilation has acquired subsidiaries of United Enertech Holdings

Soler & Palau Ventilation, Inc. (S&P) has acquired subsidiaries of United Enertech Holdings, LLC. (UEH). The subsidiaries included Air Conditioning Products, LLC; Air Performance, LLC; Metal Form Manufacturing, LLC; and United Enertech Corp.

Learn moreInfotreasury has been sold to Matera

Matera, a leading banking software company with world-class instant payments and core banking solutions, has acquired Infotreasury.

Learn more