Sandvik has acquired Portugal-based Frezite

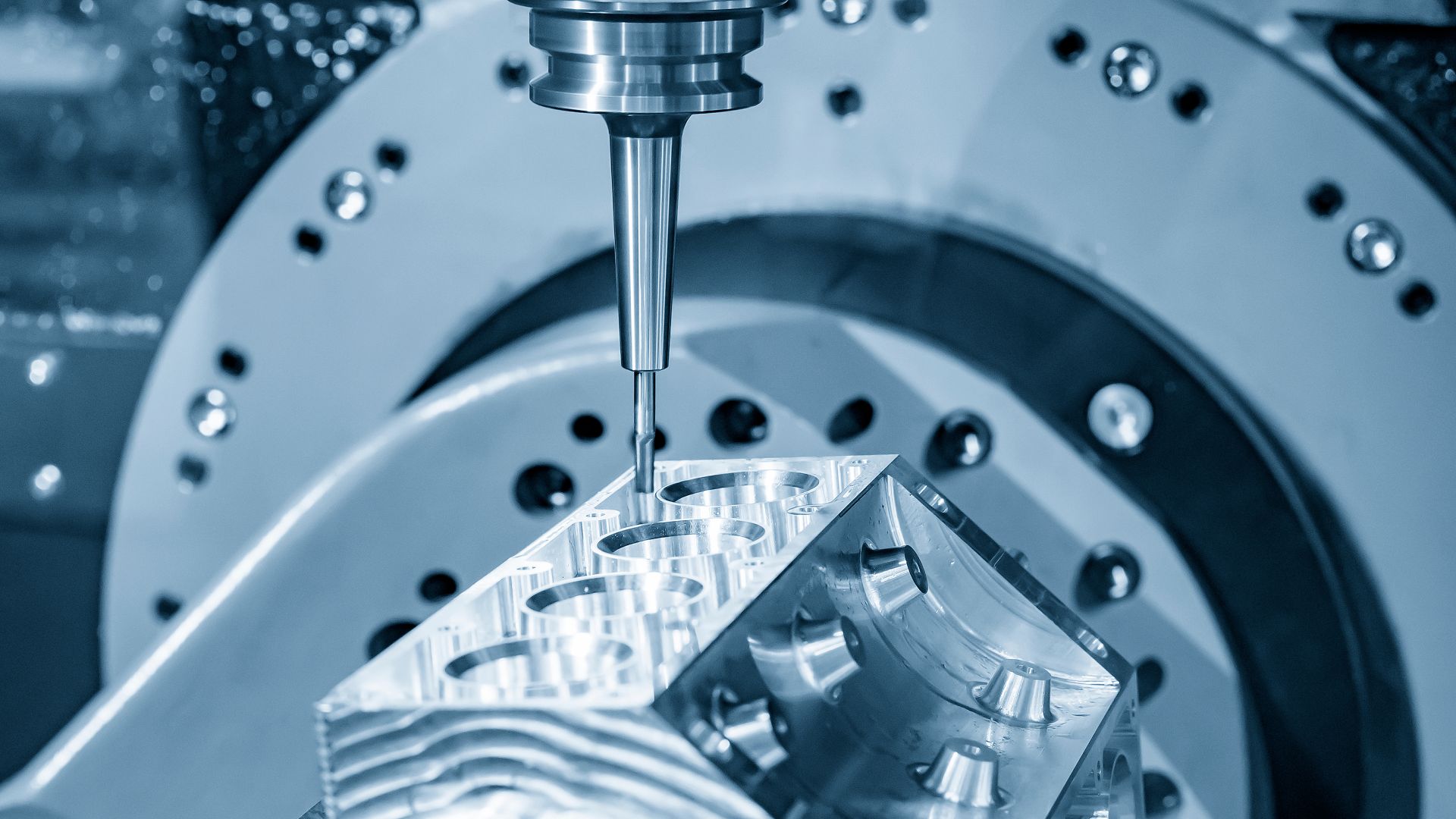

Walter, a division of Sandvik Manufacturing and Machining Solutions, has acquired Portugal-based Frezite, a family-owned polycrystalline diamond (PCD) tool manufacturer.

Sandvik is a global high-tech engineering group offering solutions that enhance customer productivity, profitability and sustainability for the manufacturing, mining and infrastructure industries. Sandvik is at the forefront of digitalization with a focus on optimizing customers’ processes, as well as having a world-leading offering, including equipment, tools, services and digital solutions for machining, mining, rock excavation, rock processing and advanced materials. In 2021, the group had approximately 44,000 employees and revenues of over US$9 billion in about 150 countries.

Founded in 1978, Frezite primarily offers made-to-order PCD tools for metal and wood applications, predominantly serving customers in the automotive, general engineering and aerospace segments. The company is headquartered in Trofa, Portugal, and is present in Europe, Mexico and Brazil. Frezite has approximately 450 employees and generated revenues of approximately US$45.5 million in 2021.

Oaklins’ Swedish and Portuguese teams acted as financial advisors to Sandvik and Walter throughout the acquisition process.

Nadine Crauwels

President, Sandvik Machining Solutions

Talk to the deal team

Related deals

The assets of IMG have been acquired by SLV Mecklenburg-Vorpommern

The assets of Ingenieurtechnik und Maschinenbau GmbH (IMG) have been acquired by SLV Mecklenburg-Vorpommern GmbH (SLV-MV) through an asset deal as part of IMG’s insolvency proceedings.

Learn moreLauak Group has sold a majority stake to Wipro Infrastructure Engineering

After careful strategic reflection to secure the group’s future, Lauak Group’s shareholders have chosen an industrial partnership, in line with the ongoing consolidation trend in the market. Attracted by opportunities for innovation and international expansion, the Charritton family, founders and long-term shareholders, regard Wipro Infrastructure Engineering as a trusted industrial partner. The historical shareholders remain minority stakeholders, and the current CEO continues to lead Lauak.

Learn moreEbidco has completed a voluntary public tender offer for the warrants of Eles Semiconductor Equipment

Ebidco S.r.l. has completed a voluntary public tender offer for the warrants of Eles Semiconductor Equipment S.p.A.

Learn more