Contiweb has been acquired by H2 Equity Partners

American Industrial Partners (AIP) has sold Contiweb to H2 Equity Partners.

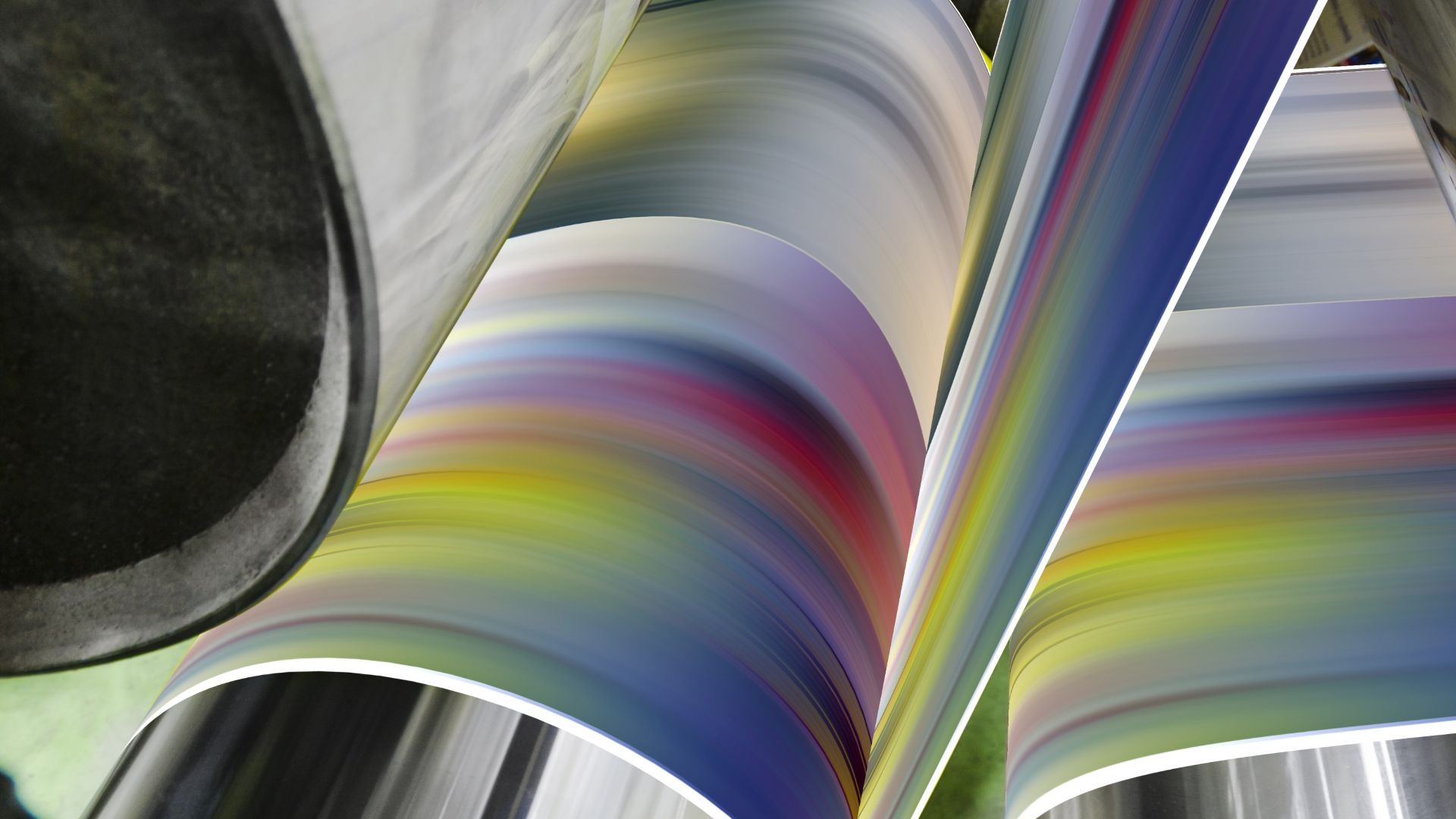

Contiweb designs, manufactures and markets equipment used for a variety of print processes, together with a comprehensive suite of aftermarket services to commercial and packaging printers. Contiweb is a leading producer of auxiliary equipment for digital and heatset web offset presses used by commercial printers. The company also produces full offset printing presses (Thallo Press) used by packaging printers. Contiweb provides aftermarket services, parts and enhancements to its US$1.3 billion global installed base of over 3,000 equipment installations.

Founded in 1991 and headquartered in Amsterdam, the Netherlands, H2 Equity Partners is an independent private equity firm with a focus on investing in mid-sized companies that are uniquely positioned and provide significant growth potential. The company acts as an active shareholder and aims to play a key role in building their investments into stronger companies.

AIP is a New York-based operationally-oriented middle-market private equity firm that is distinctively focused on buying and improving industrial businesses. The AIP team has deep roots in the industrial economy and has been active in private equity since 1989.

Oaklins’ team in the Netherlands and one of Oaklins’ teams in the USA acted as the exclusive sell-side M&A advisors to American Industrial Partners in this transaction.

Rick Hoffman

Partner, American Industrial Partners

Talk to the deal team

W. Gregory Robertson

Oaklins TM Capital

Bradford A. Adams

Oaklins TM Capital

Jonathan I. Mishkin

Oaklins TM Capital

Related deals

Top Systems teams up with Holland Capital to create the premier Dutch battery-based solutions provider

Holland Capital, a Netherlands-based private equity firm, has acquired a stake in Top Systems, a leading provider of complete battery-based power solutions, with a unique value-added services proposition.

Learn moreXeros Technology Group has completed a placing, subscription and retail offer

Xeros Technology Group plc has raised funds to drive forward its commercialization strategy.

Learn moreSoler & Palau Ventilation has acquired subsidiaries of United Enertech Holdings

Soler & Palau Ventilation, Inc. (S&P) has acquired subsidiaries of United Enertech Holdings, LLC. (UEH). The subsidiaries included Air Conditioning Products, LLC; Air Performance, LLC; Metal Form Manufacturing, LLC; and United Enertech Corp.

Learn more