Macquarie Infra. & Real Assets has acquired a 35% stake in RWE Grid Holding as

A consortium led by Macquarie Infrastructure and Real Assets (MIRA) has acquired approximately a 35% stake in RWE Grid Holding, a.s. (RGH), an entity which will act as the holding company for four regional gas distribution networks in the Czech Republic, for an undisclosed consideration. The consortium comprises the majority investor Macquarie European Infrastructure Fund 4 (MEIF4) and another Macquarie managed vehicle.

MIRA is a leader in alternative asset management worldwide, specializing in infrastructure, real estate, agriculture and other real asset classes via public and private funds, co-investments, partnerships and separately managed accounts. Edward Beckley, European Head of MIRA, said: “This is a unique opportunity to create a high-quality, consolidated gas distribution business in one of Eastern Europe’s strongest economies. RGH is an excellent match for the long-term investment objectives of our investors."

This is the second acquisition for MEIF4, following its investment in the German gas transmission system operator, Open Grid Europe GmbH in July 2012.

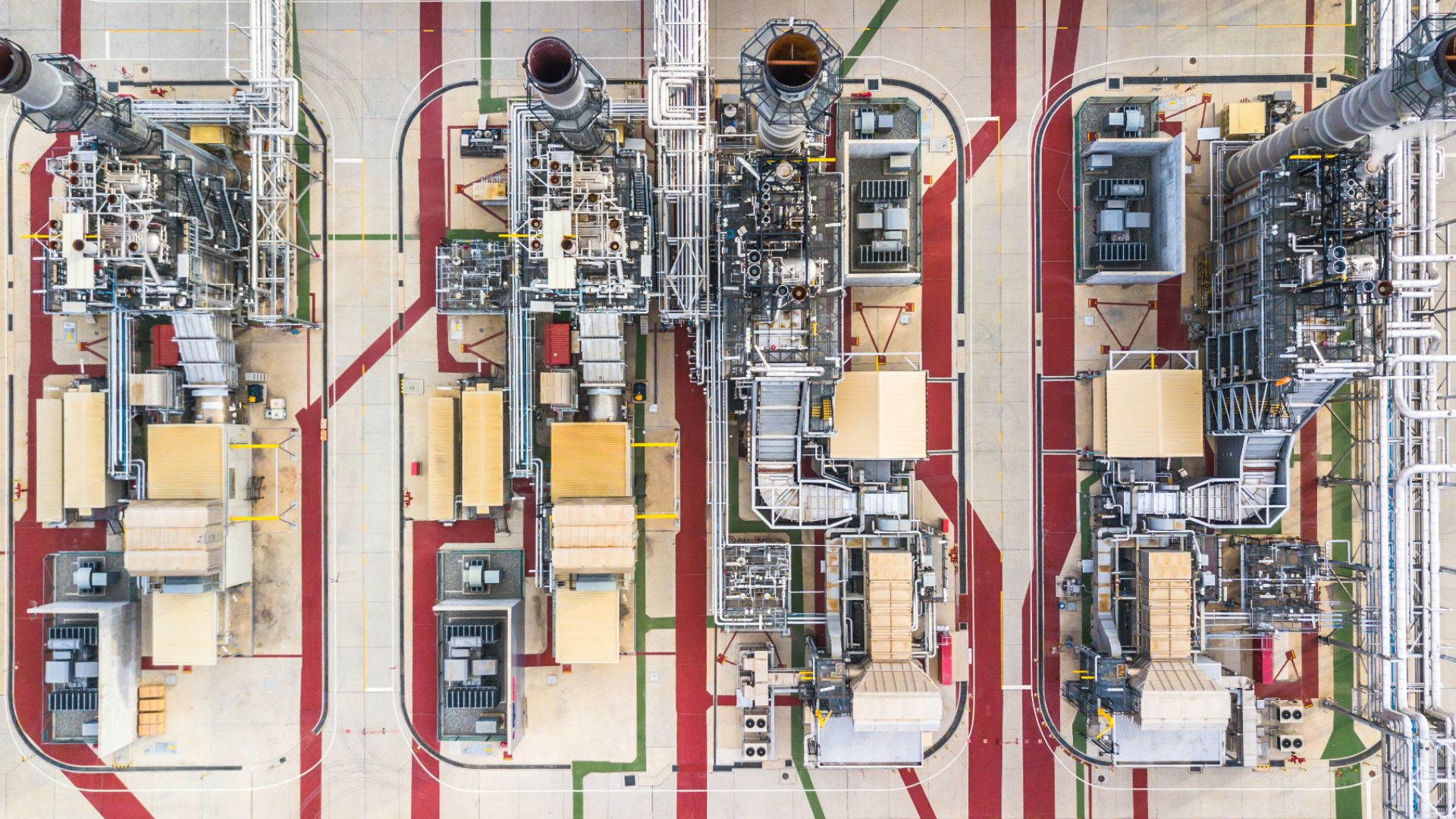

RGH will own and operate approximately 80% of the Czech Republic’s gas distribution network. The consortium will acquire minority interests in three regional gas networks from SPP, E.ON and GdF. These minority interests will be consolidated into RGH, alongside the existing Czech gas distribution interests of RWE.

Oaklins' team in the Czech Republic acted as financial advisor in the transaction and Patria Finance as financial advisor in the acquisition of minority interests from E.ON. Societe Generale Corporate and Investment Banking acted as debt advisor in the transaction. Allen & Overy (Prague) acted as legal advisor.

Talk to the deal team

Related deals

Presight Solutions has been acquired by Banyan Software

Banyan Software, a leading acquiror and operator of mission-critical software businesses, has entered Norway with the acquisition of Presight Solutions AS, a SaaS company delivering advanced software for safety, operational integrity and regulatory compliance in high-risk industries. The transaction marks a new chapter for Presight, strengthening its ability to scale while preserving the product focus, sector expertise and customer trust built since its founding in 2003.

Learn moreStrawberry Equities has sold Ecohz to Caely Renewables

Ecohz, a global renewable energy company, has been acquired by environmental commodity trading house Caely Renewables from Strawberry Equities. The transaction marks an important new chapter for Ecohz and brings together two organizations with complementary strengths, aligned in their commitment to accelerating the global energy transition.

Learn moreSwiss Solar Group has acquired OmniWatt and taken a significant minority stake in enshift

Swiss Solar Group AG has acquired OmniWatt AG and taken a significant minority stake in enshift AG. With these transactions, Swiss Solar Group advances its strategic growth initiative and pursues its objective of positioning itself as a leading integrated provider of sustainable energy transition solutions in Switzerland. The transactions support the group’s strategy to expand its presence across the entire energy value chain and to achieve profitable growth in the renewable energy sector.

Learn more