Aerospace, Defense & Security

In the aerospace, defense and security industry, the competition for increased control of the supply chain — from OEMs to the aftermarket — is a matter of extremely large consolidations. With deals often reaching billions of dollars, making the right investment choice is crucial. Supported by a dedicated sector research team and long-standing relations within the commercial aerospace, defense and security industries, our experienced M&A professionals can help you find and secure the most lucrative deals, providing you with M&A, growth equity and ECM, debt advisory and corporate finance services.

Contact advisor

Eterus Capital has acquired a majority stake in Virtual Reality Media

Eterus Capital, a.s. has strengthened its position as a shareholder of Virtual Reality Media via the acquisition of the additional stake and eventually becoming a majority shareholder.

Learn moreGroundcom has completed a seed investment round

Groundcom has successfully completed a fundraising round of US$1.7 million (€1.5 million), backed by a consortium of investors including Electron Capital Partners, Garage Angels and JIC Ventures. This investment reflects strong confidence in Groundcom’s vision and positions the company to advance its role in the global satellite communications ecosystem.

Learn moreColt CZ Group has raised just under US$96 million in equity through an ABB

Colt CZ Group has raised just under US$96 million (€89 million) in equity through an accelerated bookbuild (ABB) offering of 3.9 million shares, representing 6.9% of the existing capital.

Learn more

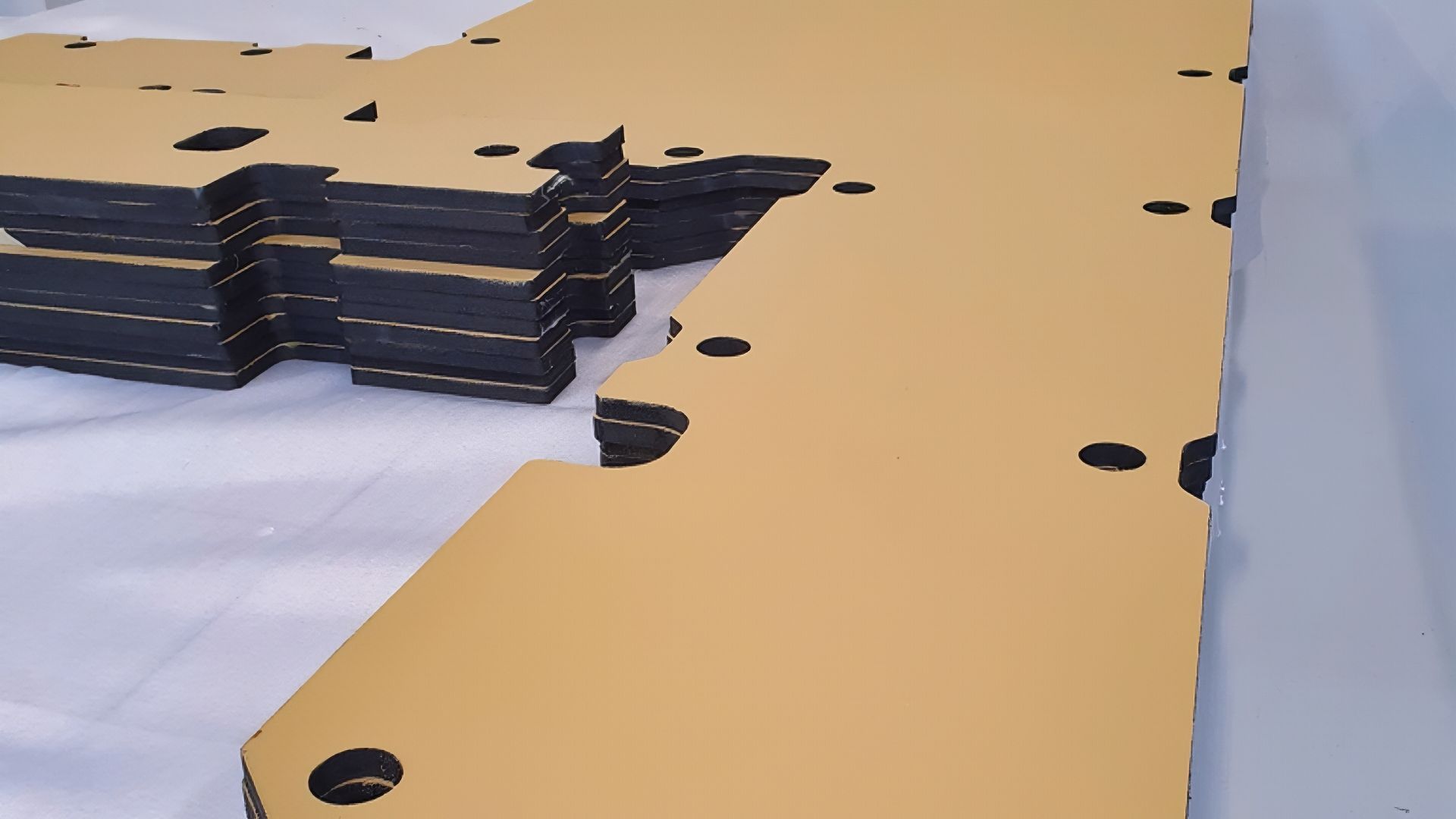

Erik Bundgaard Christensen

Founder and CEO, Scanfiber Composites

Read more

New chapters, global ambitions: mid-market M&A in Q4

QUARTERLY M&A ACTIVITY: In Q4 2025, Oaklins' clients completed 93 transactions across sectors and regions, highlighting how business leaders are using M&A to drive growth, succession and strategic change.

Learn more