Plocher Möbelelemente GmbH has been acquired by ME Capital Advisory & Consulting

The private shareholders of Plocher Möbelelemente GmbH, the families Plocher and Bätzner, have sold the company to ME Capital Advisory & Consulting GmbH, a German family investment company, for an undisclosed consideration.

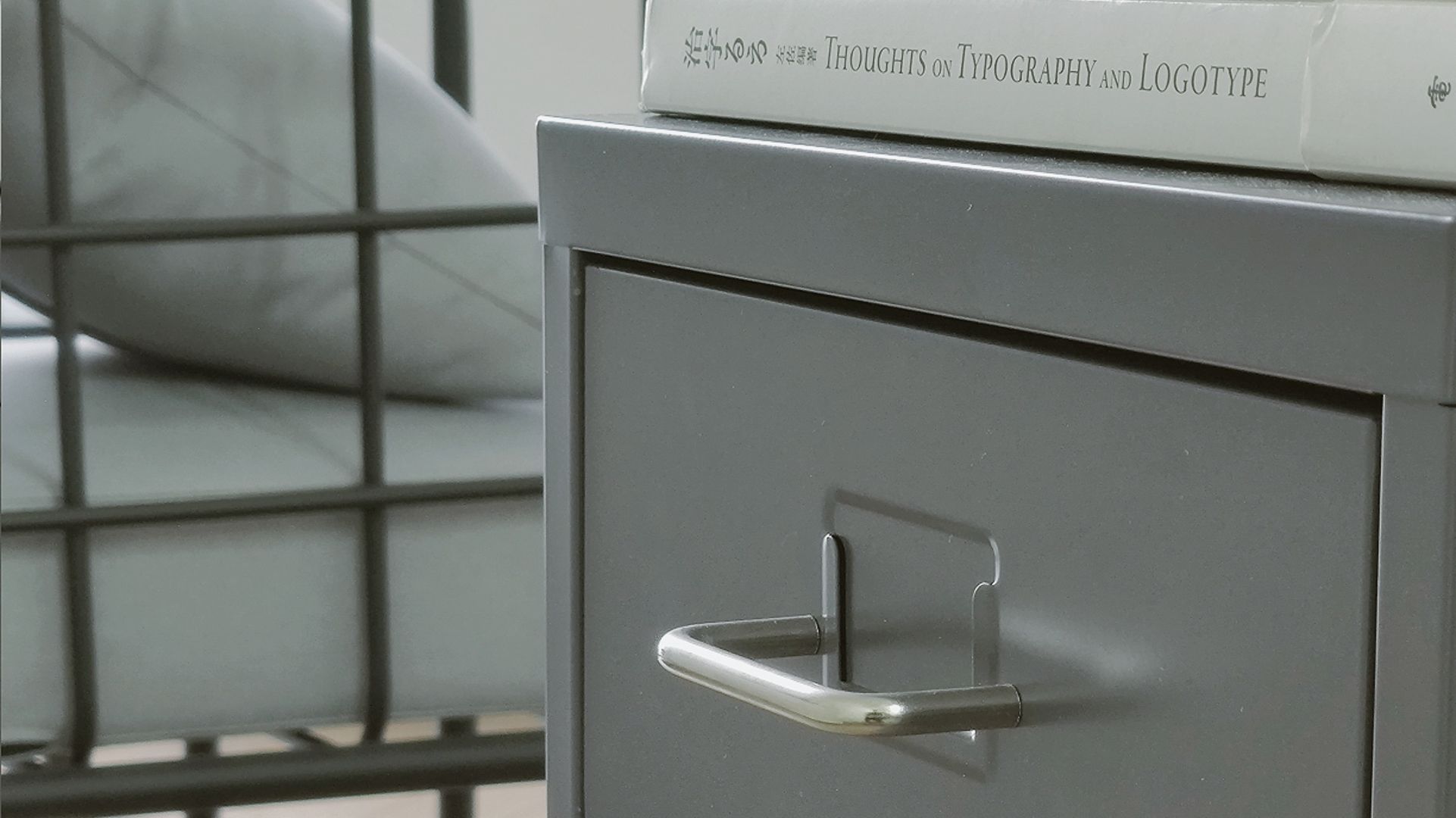

With more than 60 years' experience, Plocher Möbelelemente is a leading supplier to the furniture industry, offering individual solutions for drawers, traverses, sockets, profiles and complete furniture systems.

ME Capital is a family investment company with long experience in the management of mid-market companies in the automotive, aerospace, machinery, construction, electrics and electronics industries. Every engagement is actively managed through the involvement of experienced market and industry experts or the establishment of an advisory board. The primary objective is to establish a successful long- term continuation of the company while retaining its independence.

Oaklins' team in Germany exclusively advised the seller in this transaction.

Talk to the deal team

Related deals

iwell raises US$31 million to deploy its leading European smart battery storage solutions into new markets

iwell, a developer of smart energy management (EMS) and battery storage systems (BESS), has successfully closed a US$31 million (€27 million) funding round. The round was led by Meridiam, with Invest-NL and Rabobank participating, alongside existing investors.

Learn moreTerra Holding S.r.l. has launched a voluntary public tender offer for Gibus S.p.A.

Terra Holding S.r.l. has initiated a voluntary public tender offer for the shares of Gibus S.p.A.

Learn moreLe Cercle has successfully completed its primary LBO in partnership with FrenchFood Capital and Bpifrance

Le Cercle, a pioneer in reusable meal trays and a leading catering company in the Île-de-France region, is entering a new phase of development with an investment from FrenchFood Capital and the support of Bpifrance. This transaction also marks the appointment of Nathalie Grand-Morin, currently managing director, as the new CEO of the company.

Learn more