Cerea Partners has acquired AB Process Ingénierie

Cerea Partners has acquired AB Process Ingénierie from Trajan Capital.

Cerea Partners is a sector-focused investor driven by one particular ambition: better nutrition, better production, better living. Cerea Partners supports companies and entrepreneurs in their growth, transformation and succession projects. With its unique thematic focus and diversified offer of financing solutions, Cerea Partners provides managers with its know-how and expertise of companies operating across the food and beverage universe. With more than US$1.2 billion in assets under management and thanks to its recognized know-how, Cerea Partners is the main investor for food and beverage companies, having completed more than 160 investments since 2004.

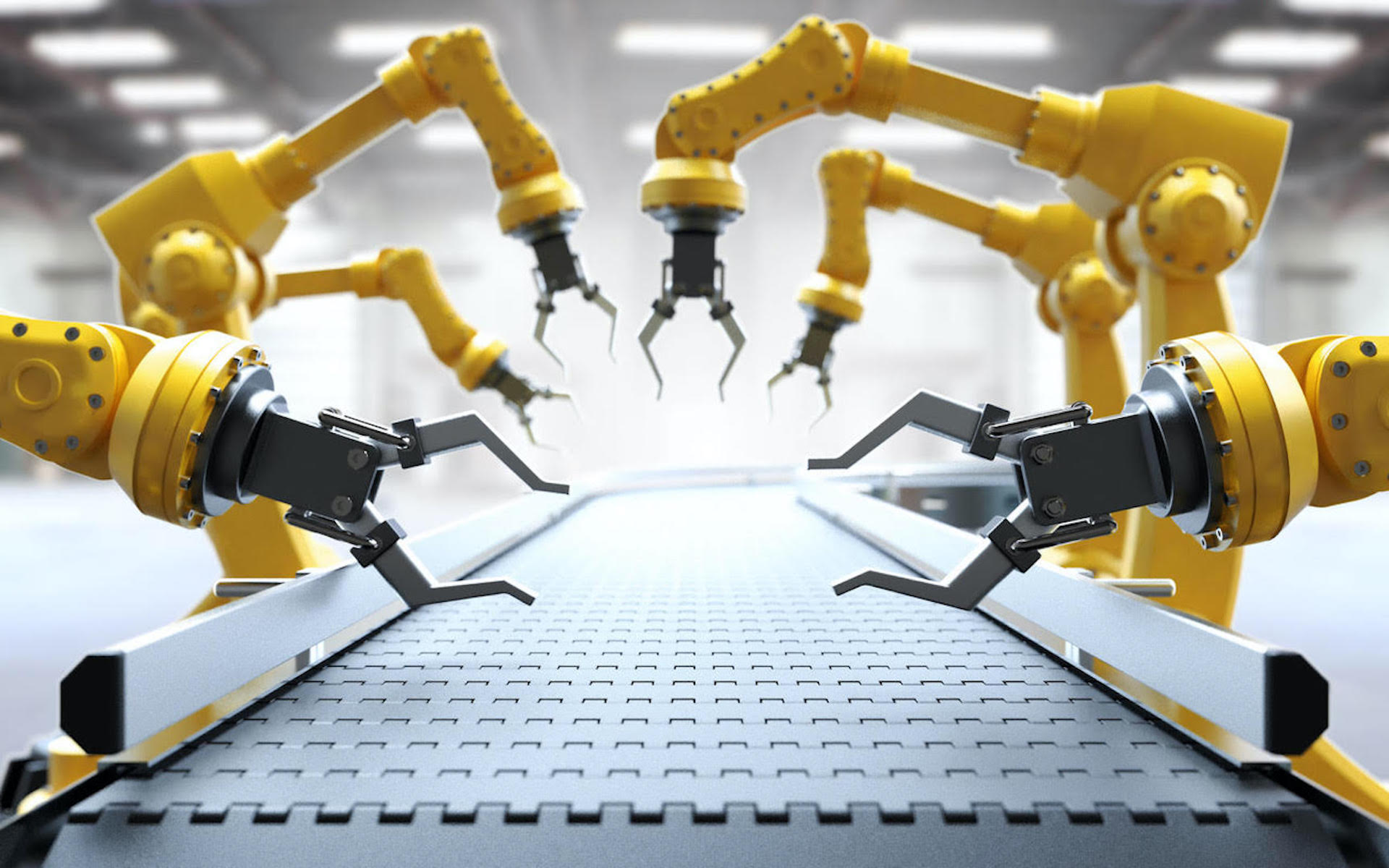

As an integrator of automation and industrial robotics, AB Process designs, manufactures and installs high-performance, tailor-made, turnkey automation solutions for production lines. As a long-term partner, the company supports its clients at every stage of their project, from defining customers’ needs to commissioning and maintaining their installation.

Trajan Capital is a generalist investment team with no sector exclusivity, founded by two former Andera investment directors. Its first investment was completed in March 2020. Trajan invests in French companies (or those in neighboring countries) with sales of at least US$10 million and EBITDA of at least US$2 million, and a proven business model. Its aim is to develop these companies over the long term, drawing on the entrepreneurial energy of the buyer. Trajan is specialized and referenced as the leader of the MBI operations in France.

Oaklins’ team in France acted as the exclusive buy-side advisor of Cerea Partners in this transaction.

Talk to the deal team

Related deals

Dolmans Landscaping Group has welcomed Foreman Capital as a new shareholder to support further growth

Dolmans Landscaping Group, a leading full-service provider of landscaping services, has welcomed Foreman Capital as a new shareholder. By partnering with Foreman Capital, which has extensive experience in building stronger companies in the maintenance of public spaces, Dolmans can accelerate its growth trajectory across core verticals and further professionalize the business.

Learn moreBackspin has completed a mandatory public tender offer for the shares of Spindox

Backspin S.p.A. has completed a mandatory public tender offer for Spindox S.p.A.

Learn moreValmiermuižas Alus has been acquired by Cēsu Alus

Valmiermuižas Alus has been acquired by Cēsu Alus AS through the purchase of 100% of its shares. The transaction enabled the founder’s exit and strengthened the company’s platform for continued growth within a consolidating Baltic beverage market.

Learn more