Fameco Group has been acquired by Keller & Kalmbach

Fameco Holding AB has sold Fameco Group AB to Keller & Kalmbach GmbH (K&K).

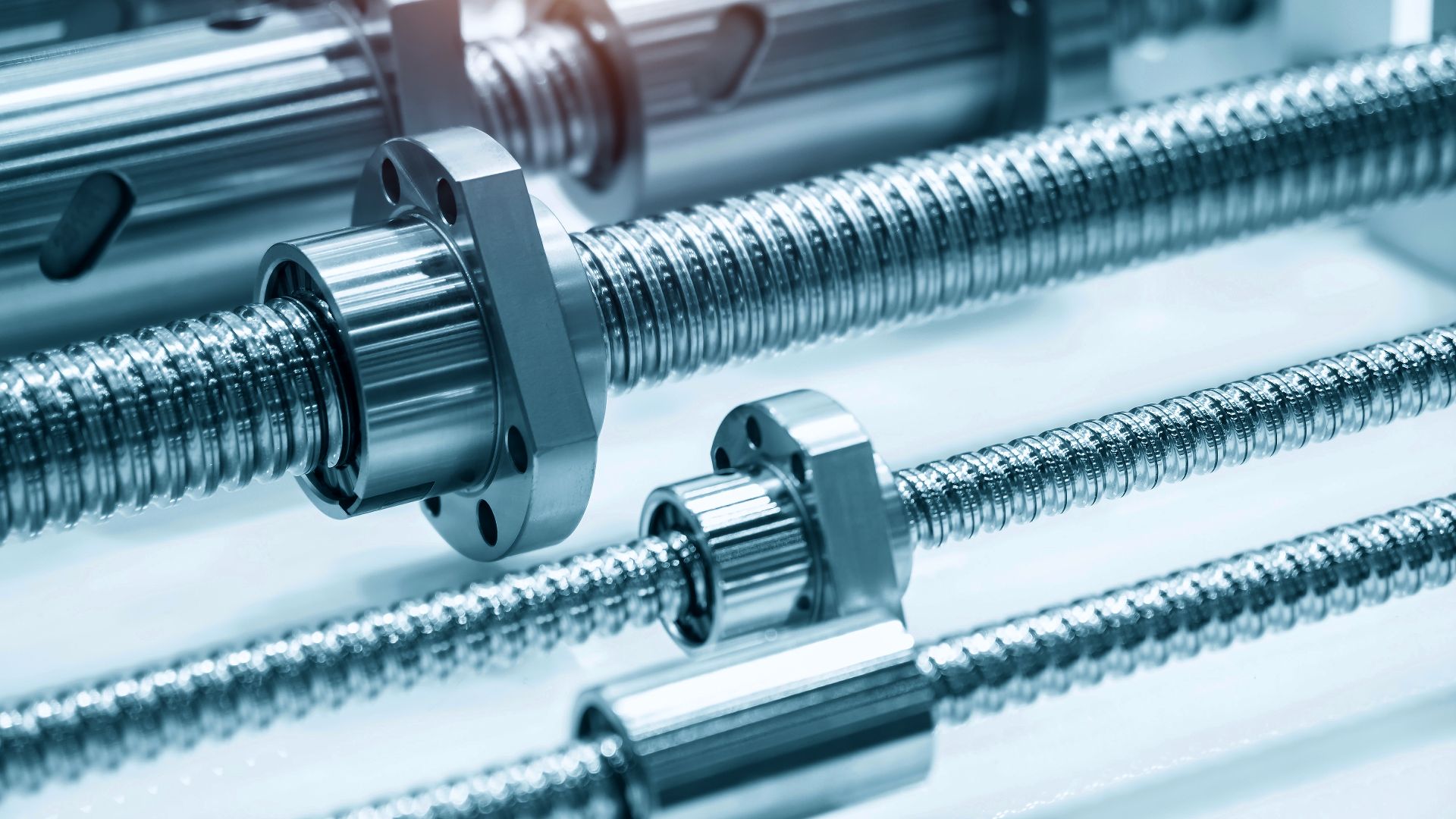

Fameco Group manufactures a wide range of small parts, new materials and new assembly methods, as well as specific services designed to industrial assembly. Headquartered in Gothenburg, Sweden, Fameco is a one-stop-shop offering its customers everything they need for the efficient assembly of high-quality products.

Keller & Kalmbach is a family business with more than 140 years of history. K&K is a specialist in fasteners and fastening technology, as well as the expert of choice for intelligent C-parts management. The company supplies customers in the automotive, machinery and plant engineering industries, as well as the railway technology and aerospace sectors worldwide. K&K has a strong focus on technical progress and is constantly improving its services. The firm generated annual sales revenue of US$375 million and has 900 employees.

Oaklins’ team in Sweden acted as advisor to the seller in this transaction.

Talk to the deal team

Related deals

Xeros Technology Group has completed a placing, subscription and retail offer

Xeros Technology Group plc has raised funds to drive forward its commercialization strategy.

Learn moreIndustrie Polieco - M.P.B. has sold a minority stake to RedFish Longterm Capital

T.P. Holding Srl, the company controlled by the Tonelli family, has sold Industrie Polieco - M.P.B. SpA to RedFish Longterm Capital SpA.

Learn moreEC Electronics has raised new debt facilities

EC Electronics Ltd. has raised funds from Shawbrook Bank to finance the acquisition of Liad Electronics Breda B.V. The debt facilities also include follow-on capital for future acquisitions as EC Electronics continues its search for complimentary electronics manufacturing businesses.

Learn more