American Casting Company has been acquired by Arcline Investment Management

Arcline Investment Management has completed a strategic investment in American Casting Company (ACC), a leading provider of highly engineered investment castings for aerospace, defense, medical and specialty industrial applications.

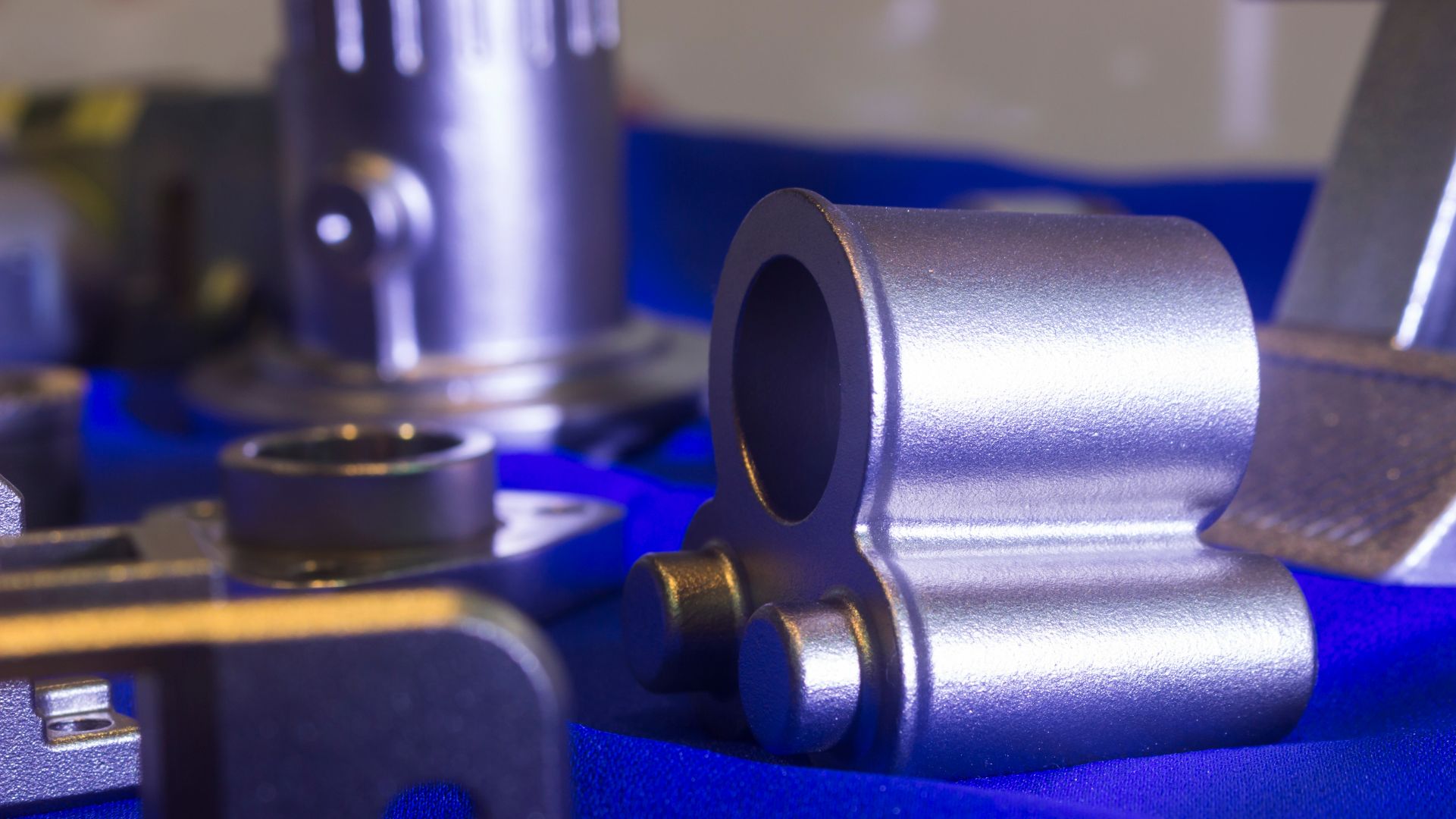

Founded in 1974, American Casting Company specializes in casting complex, tight-tolerance geometries from superalloys and other difficult-to-pour materials. Its capabilities enable customers to achieve lighter-weight designs, higher operating temperatures and improved performance. With rapid prototyping expertise and end-to-end process control, the company is a trusted supplier of demanding aerospace and defense programs, including marquee aircraft engines and next-generation unmanned systems.

Arcline Investment Management is a growth-oriented private equity firm with over US$20 billion in assets under management. The firm invests in businesses with persistent demand, limited disruption risk and fragmented industry structures.

Oaklins Janes Capital, based in Irvine, USA, served as the exclusive financial advisor to American Casting Company on its sale to Arcline Investment Management.

Christopher St. John

CEO, American Casting Company

Talk to the deal team

Stephen Perry

Oaklins Janes Capital

Related deals

Dolmans Landscaping Group has welcomed Foreman Capital as a new shareholder to support further growth

Dolmans Landscaping Group, a leading full-service provider of landscaping services, has welcomed Foreman Capital as a new shareholder. By partnering with Foreman Capital, which has extensive experience in building stronger companies in the maintenance of public spaces, Dolmans can accelerate its growth trajectory across core verticals and further professionalize the business.

Learn moreBackspin has completed a mandatory public tender offer for the shares of Spindox

Backspin S.p.A. has completed a mandatory public tender offer for Spindox S.p.A.

Learn moreBridgepoint has partnered with Exile Group to support its next phase of growth

Bridgepoint Group has partnered with Exile Group, a leading provider of proprietary data and intelligence to the trade, project and development finance markets. The transaction sees Bridgepoint Growth become a significant minority shareholder in Exile. Exile’s founders and management team will retain majority ownership and continue to lead the business.

Learn more