Infrastructure India plc has arranged a further extension of a working capital loan & a bridging loan

Infrastructure India plc has completed a fairness opinion on a further extension of, and increase in, the US$17 million working capital loan facility provided to the company in April 2013 by GGIC, Ltd, and has agreed a US$8 million unsecured bridging loan facility with Cedar Valley Financial, an affiliate of GGIC. Both the existing loan and the bridging loan have been extended from 30 September 2017 to 31 December 2017.

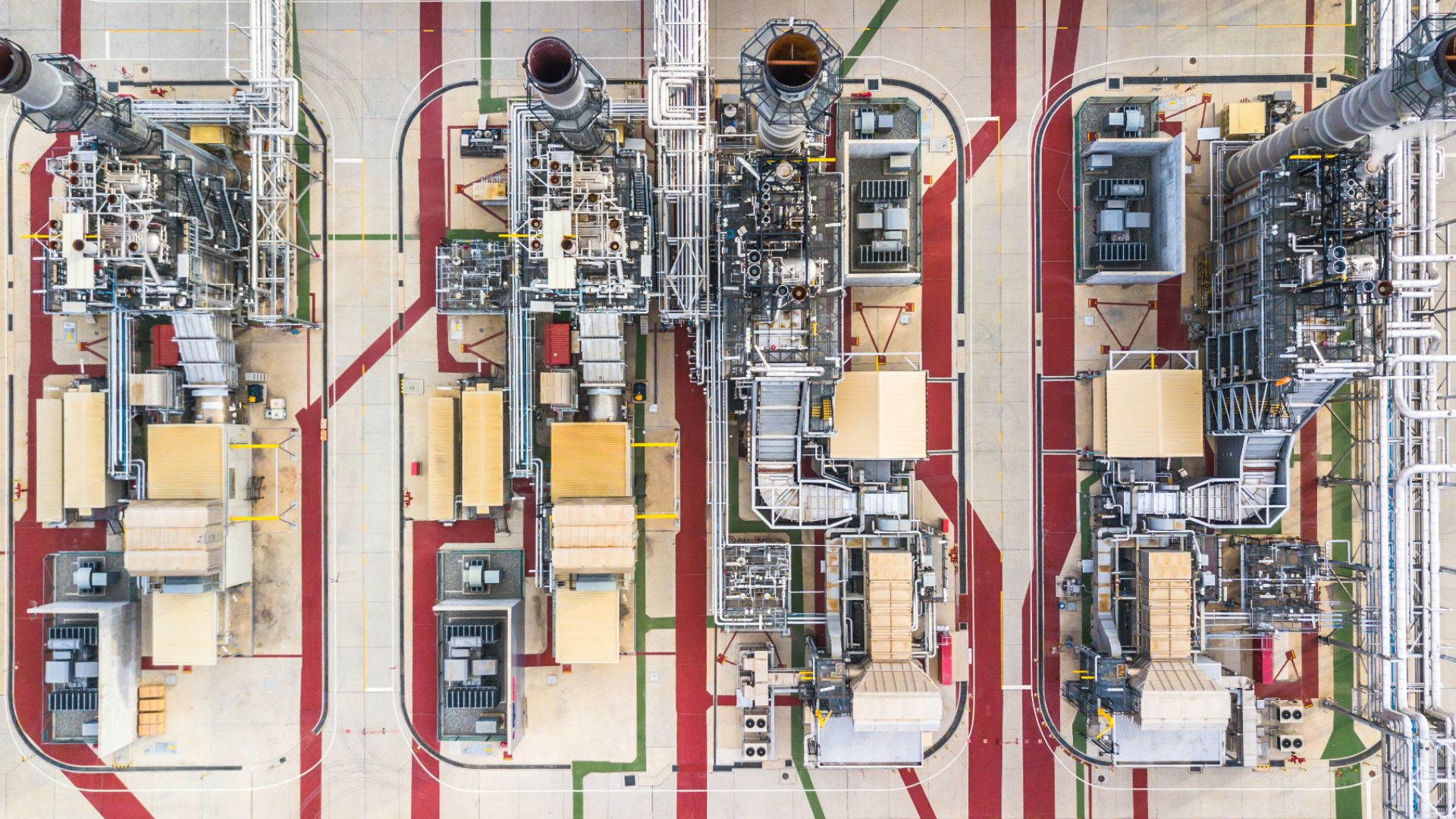

Infrastructure India is an AIM quoted fund investing in assets in the Indian infrastructure sector, with particular focus on assets and projects related to energy and transport.

Oaklins Smith & Williamson, based in the UK, acted as Nominated Advisor (Nomad) to Infrastructure India plc in this transaction and on an ongoing basis.

Talk to the deal team

Brian Livingston

Oaklins Evelyn Partners

Related deals

Varsteel, Ltd. has acquired Pacific Steel, Inc.

Pacific Steel, Inc. has been acquired by Varsteel, Ltd.

Learn moreTotalEnergies and SHV Energy have sold PitPoint.LNG to ViGo Bioenergy

TotalEnergies and SHV Energy have agreed to sell PitPoint.LNG, a Netherlands-based operator of state-of-the-art LNG refueling stations, to ViGo Bioenergy, a Germany-based developer and operator of refueling stations for alternative fuels. With this strategic acquisition, ViGo Bioenergy expands its international station network for alternative fuels and strengthens its European bio-LNG position.

Learn moreJL&P has received a minority investment from Arkéa Capital and Swen Capital Partners

JL&P Group has completed a primary minority LBO with Arkéa Capital and Swen Capital Partners.

Learn more