FAI Automotive has been acquired by Motus Holdings

FAI Automotive plc (FAI), one of the UK’s leading distributors of replacement automotive parts, has been sold to Motus Holdings, a South Africa-headquartered automotive group.

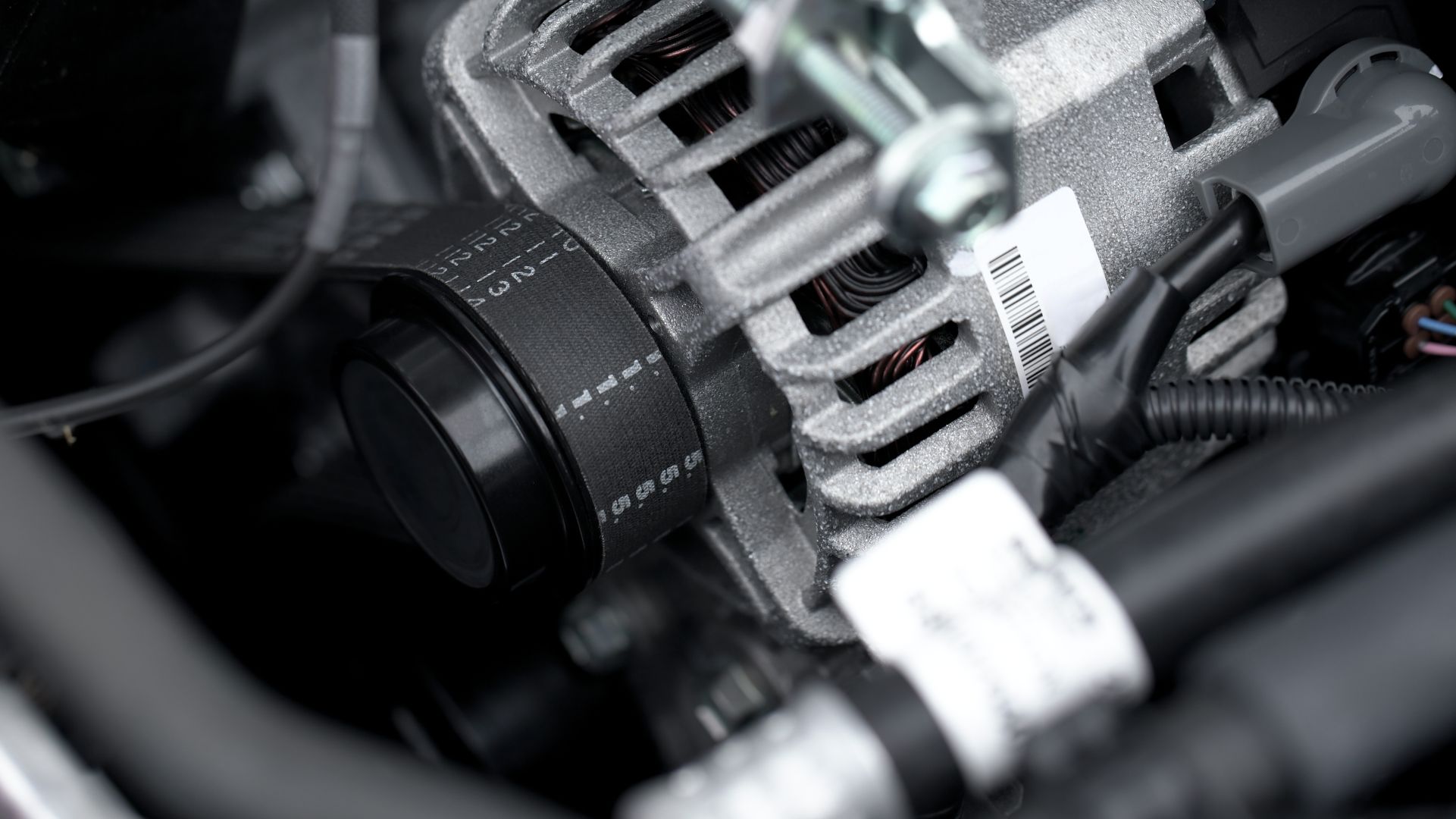

FAI is an “all makes” spare parts provider, with a range of over 25 product lines and 30,000 parts numbers, covering 64 vehicle manufacturers, including some of the world’s leading European, Japanese and Korean brands. FAI’s ever-growing export division serves over 60 countries around the world, and 50% of the company’s sales are generated from outside of the UK.

Listed on the Johannesburg Stock Exchange, Motus is South Africa’s leading automotive group, employing over 16,700 people globally. It is a diversified (non-manufacturing) business in the automotive sector, with unrivalled scale and scope in the country and a selected international presence primarily in the UK and Australia. Motus offers a differentiated value proposition to OEMs, customers and business partners with a fully integrated business model across the automotive value chain.

With FAI’s access to the key European aftermarket and ability to trade internationally, the acquisition will enable Motus to further its international growth strategy of increasing its presence in Europe and Southeast Asia. This includes establishing a distribution center in China to better serve its international client base with more products now sourced from the Far East.

Oaklins Cavendish, based in the UK, advised on the sale of FAI Automotive to Motus Holdings. Oaklins’ team in South Africa supported the transaction.

Jonathan Alexander

CEO, FAI Automotive plc

Talk to the deal team

Related deals

Triscan has joined APA and Riverarch to accelerate growth in the European aftermarket

Triscan AS, a leading provider of OE-quality automotive spare parts for the professional aftermarket in Europe, has been acquired by APA Industries, LLC, a portfolio company of Riverarch Equity Partners.

Learn moreSubaru of Jacksonville has been acquired by Shottenkirk Automotive Group

Subaru of Jacksonville (SOJAX) has been successfully acquired by Shottenkirk Automotive Group. The acquisition marks the group’s entry into both the Subaru brand and the Jacksonville market, establishing a presence in Florida while honoring the Porter family’s long-standing legacy and retaining the existing team at SOJAX.

Learn morePlain Vanilla Investments has sold its portfolio company Euphoria Mobility to Sofindev

Sofindev has reached an agreement with the shareholders of Euphoria Mobility, including private equity firm Plain Vanilla Investments, to acquire a majority stake in the company. This strategic partnership will enable Euphoria to accelerate its European expansion, reinforce its presence in the Benelux region and further enhance its product offering.

Learn more