IDP has been acquired by Nazca Capital

The founders of IDP have sold the company to Nazca Capital S.G.E.I.C., S.A.

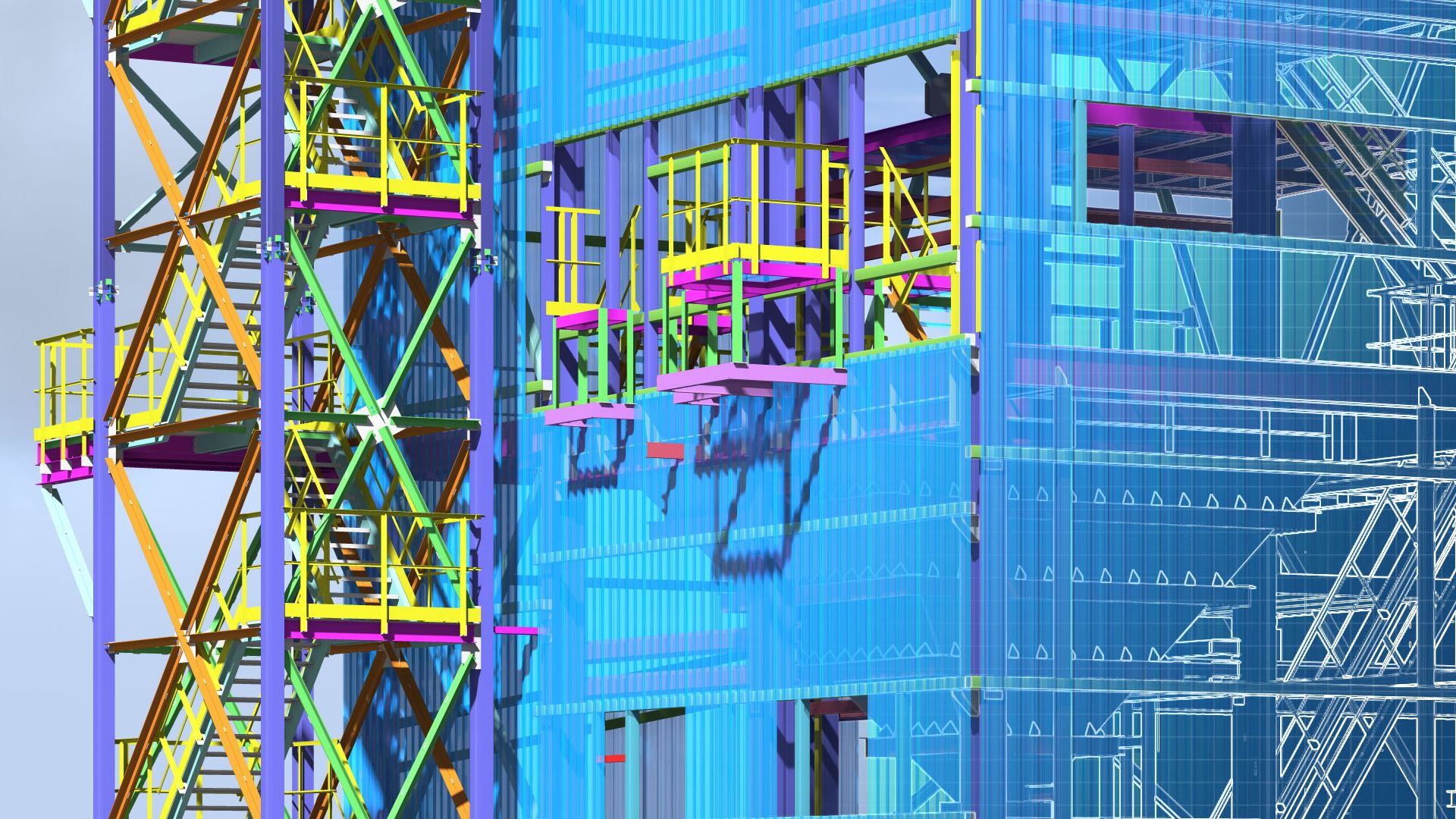

Established in 1998 and based in Barcelona, Spain, IDP specializes in providing engineering services based on building information modeling (BIM) methodology. This transaction allows IDP to incorporate a financial partner into its shareholding in order to accelerate the next phase of the company’s growth with a focus on national expansion.

Founded in 2001, Nazca Capital is a Spanish private equity fund, with approximately US$600 million under management. The firm focuses in the mid-market and has completed 70 transactions since its foundation.

Oaklins’ team in Spain acted as financial advisor to the founders of IDP in the structure and coordination of the sale process, negotiations and closing of the transaction.

Talk to the deal team

Related deals

Dolmans Landscaping Group has welcomed Foreman Capital as a new shareholder to support further growth

Dolmans Landscaping Group, a leading full-service provider of landscaping services, has welcomed Foreman Capital as a new shareholder. By partnering with Foreman Capital, which has extensive experience in building stronger companies in the maintenance of public spaces, Dolmans can accelerate its growth trajectory across core verticals and further professionalize the business.

Learn moreGuard has strengthened its Danish platform with the acquisition of Holtec

Guard Automation AS, a leading Nordic provider of automation services, insight and process optimization, has acquired Holtec AS, a Danish engineering and automation company. The acquisition strengthens Guard’s presence in Denmark and supports its strategy of combining strong local expertise with digital platforms. Together with X Automation, Holtec will form a strong Danish automation platform, enabling knowledge sharing, best-practice transfer and enhanced capabilities across the Nordics.

Learn moreBackspin has completed a mandatory public tender offer for the shares of Spindox

Backspin S.p.A. has completed a mandatory public tender offer for Spindox S.p.A.

Learn more