IDP has been acquired by Nazca Capital

The founders of IDP have sold the company to Nazca Capital S.G.E.I.C., S.A.

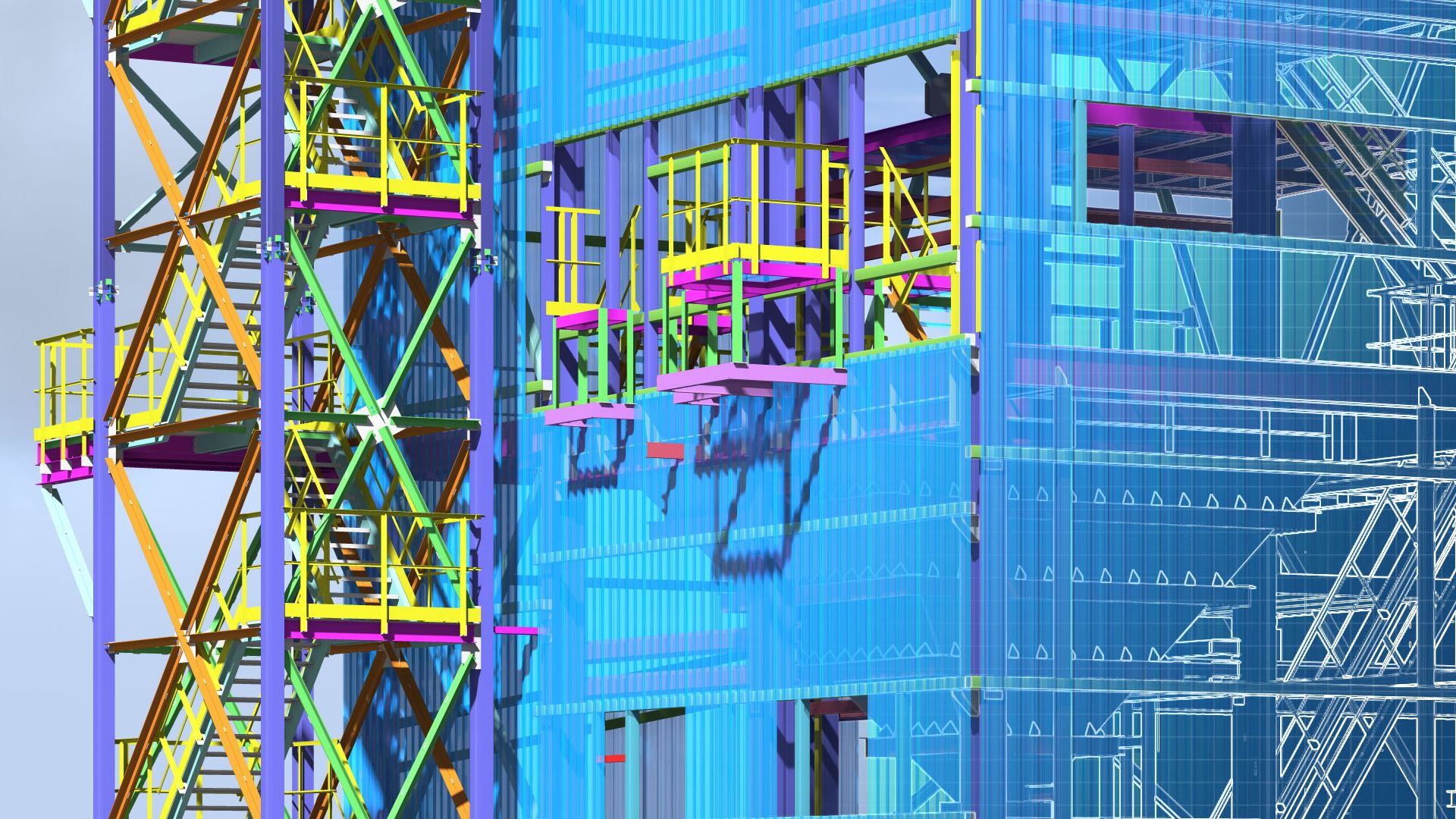

Established in 1998 and based in Barcelona, Spain, IDP specializes in providing engineering services based on building information modeling (BIM) methodology. This transaction allows IDP to incorporate a financial partner into its shareholding in order to accelerate the next phase of the company’s growth with a focus on national expansion.

Founded in 2001, Nazca Capital is a Spanish private equity fund, with approximately US$600 million under management. The firm focuses in the mid-market and has completed 70 transactions since its foundation.

Oaklins’ team in Spain acted as financial advisor to the founders of IDP in the structure and coordination of the sale process, negotiations and closing of the transaction.

Talk to the deal team

Related deals

Top Systems teams up with Holland Capital to create the premier Dutch battery-based solutions provider

Holland Capital, a Netherlands-based private equity firm, has acquired a stake in Top Systems, a leading provider of complete battery-based power solutions, with a unique value-added services proposition.

Learn moreSoler & Palau Ventilation has acquired subsidiaries of United Enertech Holdings

Soler & Palau Ventilation, Inc. (S&P) has acquired subsidiaries of United Enertech Holdings, LLC. (UEH). The subsidiaries included Air Conditioning Products, LLC; Air Performance, LLC; Metal Form Manufacturing, LLC; and United Enertech Corp.

Learn moreInfotreasury has been sold to Matera

Matera, a leading banking software company with world-class instant payments and core banking solutions, has acquired Infotreasury.

Learn more