Medis Medical Imaging and GE HealthCare announce collaboration focused on non-invasive coronary assessments

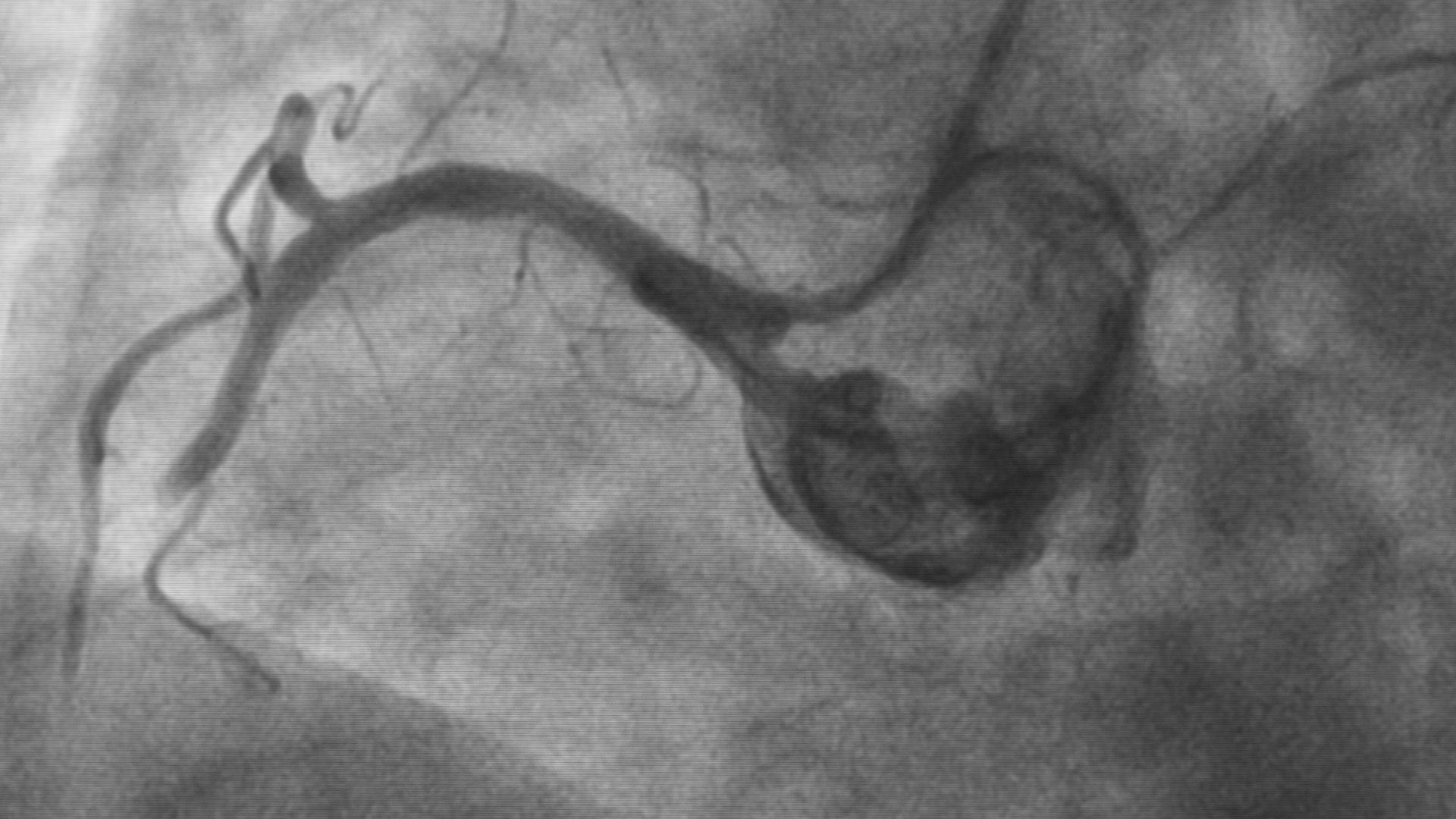

Medis Medical Imaging Systems B.V., a leading cardiac imaging software company, have completed a strategic investment to further develop its revolutionary non-invasive cardiovascular imaging solution. The company has announced its collaboration with GE HealthCare (Nasdaq: GEHC), a global leader in medical technology, pharmaceutical diagnostics and innovation in digital solutions, to contribute to the advancement of precision care in the diagnosis and treatment of coronary artery disease (CAD).

Founded in 1989, Medis Medical Imaging Systems B.V. provides high-quality quantitative analysis solutions for cardiovascular imaging to the medical community. Medis’ software is internationally appreciated due to its ease of use and clinical outcomes for patients. The company continuously focuses on creating, researching and innovating towards clinically relevant software solutions in the field of cardiovascular imaging.

Oaklins’ team in the Netherlands acted as the exclusive strategic advisor to the shareholders and management of Medis Medical Imaging Systems B.V.

Maya Barley

CEO, Medis Medical Imaging Systems B.V.

Talk to the deal team

Related deals

Middlecon has been acquired by Nion

Middlecon has been acquired by Nion, a digital consultancy backed by Stella Capital. The acquisition strengthens Nion’s capabilities in data management and advanced analytics, enabling it to undertake larger and more complex data-driven initiatives for its customers. The partnership with Nion provides Middlecon with a strong foundation for continued growth and expansion.

Learn morePresight Solutions has been acquired by Banyan Software

Banyan Software, a leading acquiror and operator of mission-critical software businesses, has entered Norway with the acquisition of Presight Solutions AS, a SaaS company delivering advanced software for safety, operational integrity and regulatory compliance in high-risk industries. The transaction marks a new chapter for Presight, strengthening its ability to scale while preserving the product focus, sector expertise and customer trust built since its founding in 2003.

Learn moreBackspin has completed a mandatory public tender offer for the shares of Spindox

Backspin S.p.A. has completed a mandatory public tender offer for Spindox S.p.A.

Learn more