SUHNER Group has acquired a minority stake in Jellypipe

As part of a start-up financing, SUHNER Group has acquired a minority stake in Jellypipe AG.

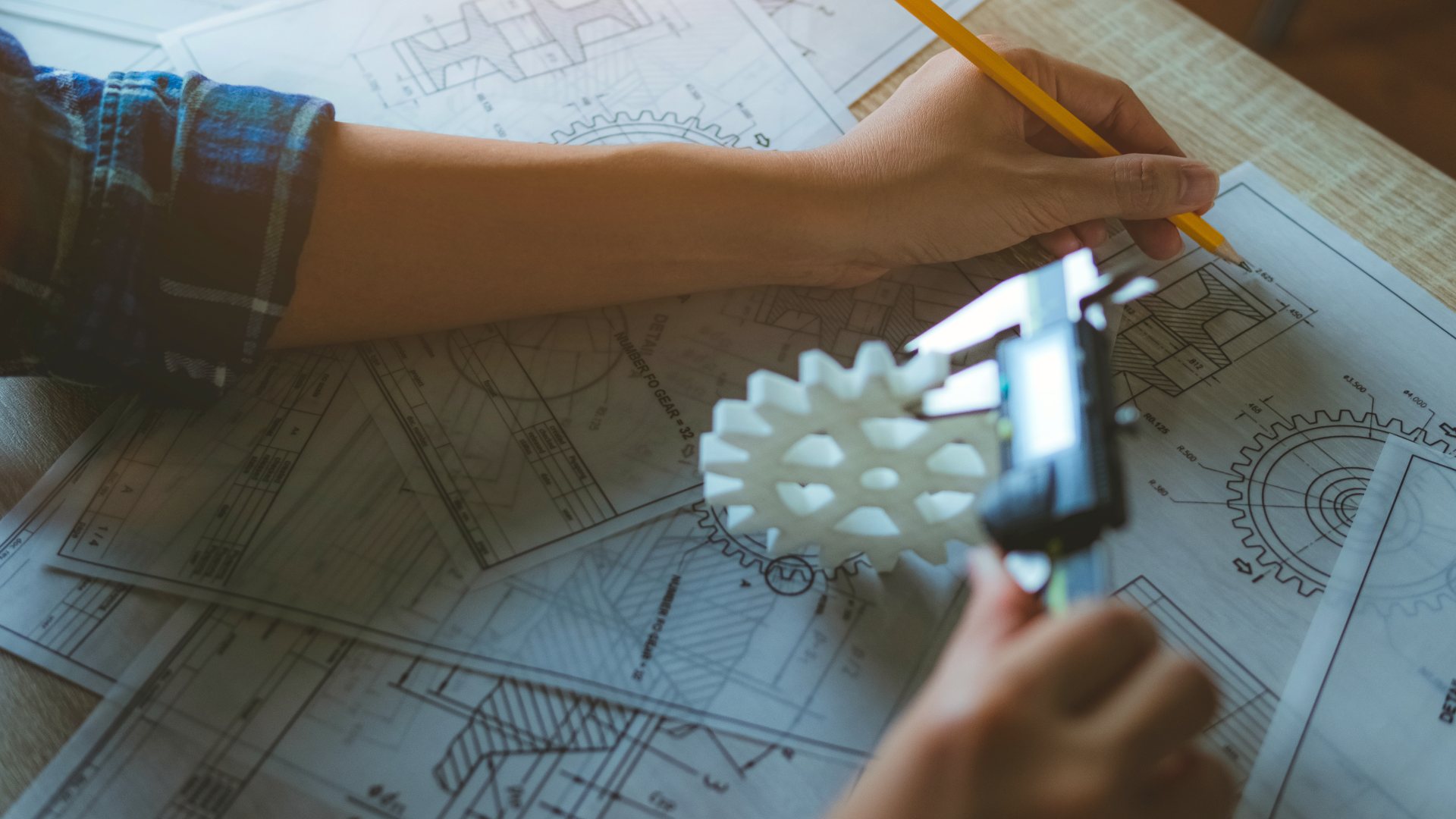

The globally active SUHNER offers its customers comprehensive solutions for mission-critical metal components and workpieces through its three divisions: abrasive, machining and components. With state-of-the-art technology, leading know-how and a comprehensive understanding of industrial manufacturing, SUHNER Group helps its customers to achieve better product performance and optimized manufacturing processes, from design to series production.

Jellypipe is a leading start-up in the B2B digital on-demand manufacturing marketplace platform for 3D-printed components and workpieces. Its in-house developed e-commerce platform brings customers, industry and 3D-print partners together and allows digitalized offer and order processes.

With the aim of participating in technological progress, Oaklins was mandated by the SUHNER Group’s shareholders to identify and examine acquisition opportunities. As a result, the group acquired a minority stake in Jellypipe AG. Oaklins’ team in Switzerland acted as the exclusive buy-side advisor to the shareholders of SUHNER Group in the transaction.

Jürg Suhner

Chairman of the Board, SUHNER Group

Talk to the deal team

Christoph Walker

Oaklins Switzerland

Related deals

Xeros Technology Group has completed a placing, subscription and retail offer

Xeros Technology Group plc has raised funds to drive forward its commercialization strategy.

Learn moreSuccesful integrated solution for strategic deadlock and tender offer by CMB on Euronav

Compagnie Maritime Belge (CMB) has successfully resolved the strategic and structural deadlock within Euronav through an agreement with Frontline, a world leader in the international seaborne transportation of crude oil and refined products, resulting in a mandatory takeover offer on Euronav.

Learn moreIndustrie Polieco - M.P.B. has sold a minority stake to RedFish Longterm Capital

T.P. Holding Srl, the company controlled by the Tonelli family, has sold Industrie Polieco - M.P.B. SpA to RedFish Longterm Capital SpA.

Learn more