SME has been acquired by Paprec

The family shareholders of Société Métallurgique d’Épernay (SME) have sold the company to Paprec Group.

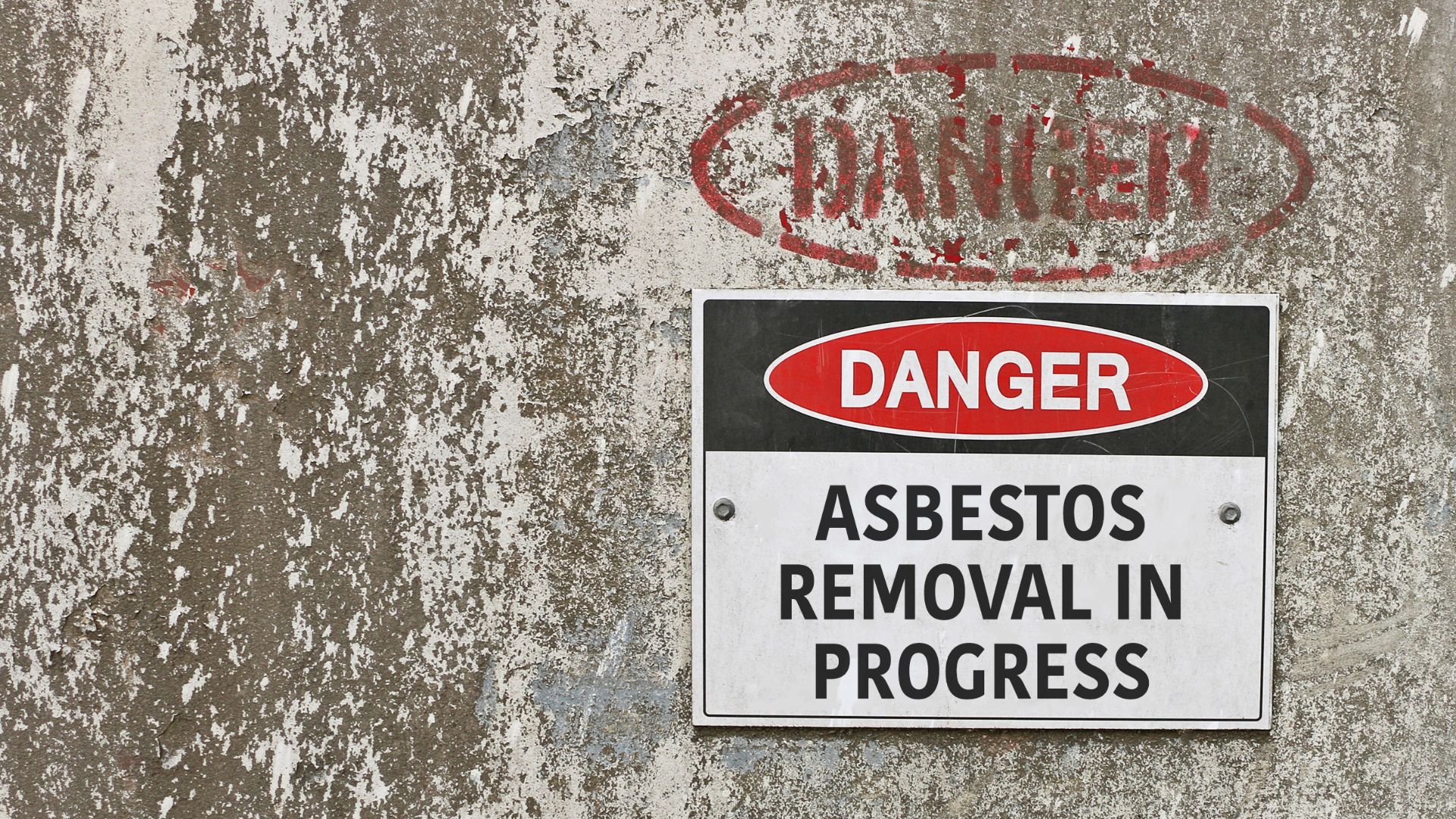

Founded in 1969, SME is a French company specialized in the dismantling, collection, asbestos removal and recycling of materials. The company operates three sites in France and recovers each year more than 30,000 tonnes of materials, mainly ferrous and non-ferrous metals, to a diversified industrial customer base. SME relies on three main supply channels: dismantling of railway and aeronautical equipment, vehicle recycling and retail purchases from private individuals and professionals.

Paprec Group is one of France’s leading waste treatment companies, processes 16 million tonnes of waste per year (plastics, scrap iron and non-ferrous metals, rubble, waste electrical and electronic equipment), with a workforce of 15,000 and revenues of approximately US$3.2bn in 2023. Paprec operates 300 centers in France and is present in 10 countries.

Oaklins’ team in France acted as M&A advisor to SME in this transaction.

Talk to the deal team

Related deals

Top Systems teams up with Holland Capital to create the premier Dutch battery-based solutions provider

Holland Capital, a Netherlands-based private equity firm, has acquired a stake in Top Systems, a leading provider of complete battery-based power solutions, with a unique value-added services proposition.

Learn moreSoler & Palau Ventilation has acquired subsidiaries of United Enertech Holdings

Soler & Palau Ventilation, Inc. (S&P) has acquired subsidiaries of United Enertech Holdings, LLC. (UEH). The subsidiaries included Air Conditioning Products, LLC; Air Performance, LLC; Metal Form Manufacturing, LLC; and United Enertech Corp.

Learn moreInfotreasury has been sold to Matera

Matera, a leading banking software company with world-class instant payments and core banking solutions, has acquired Infotreasury.

Learn more