Mekorot Water Company has issued bonds worth US$277 million

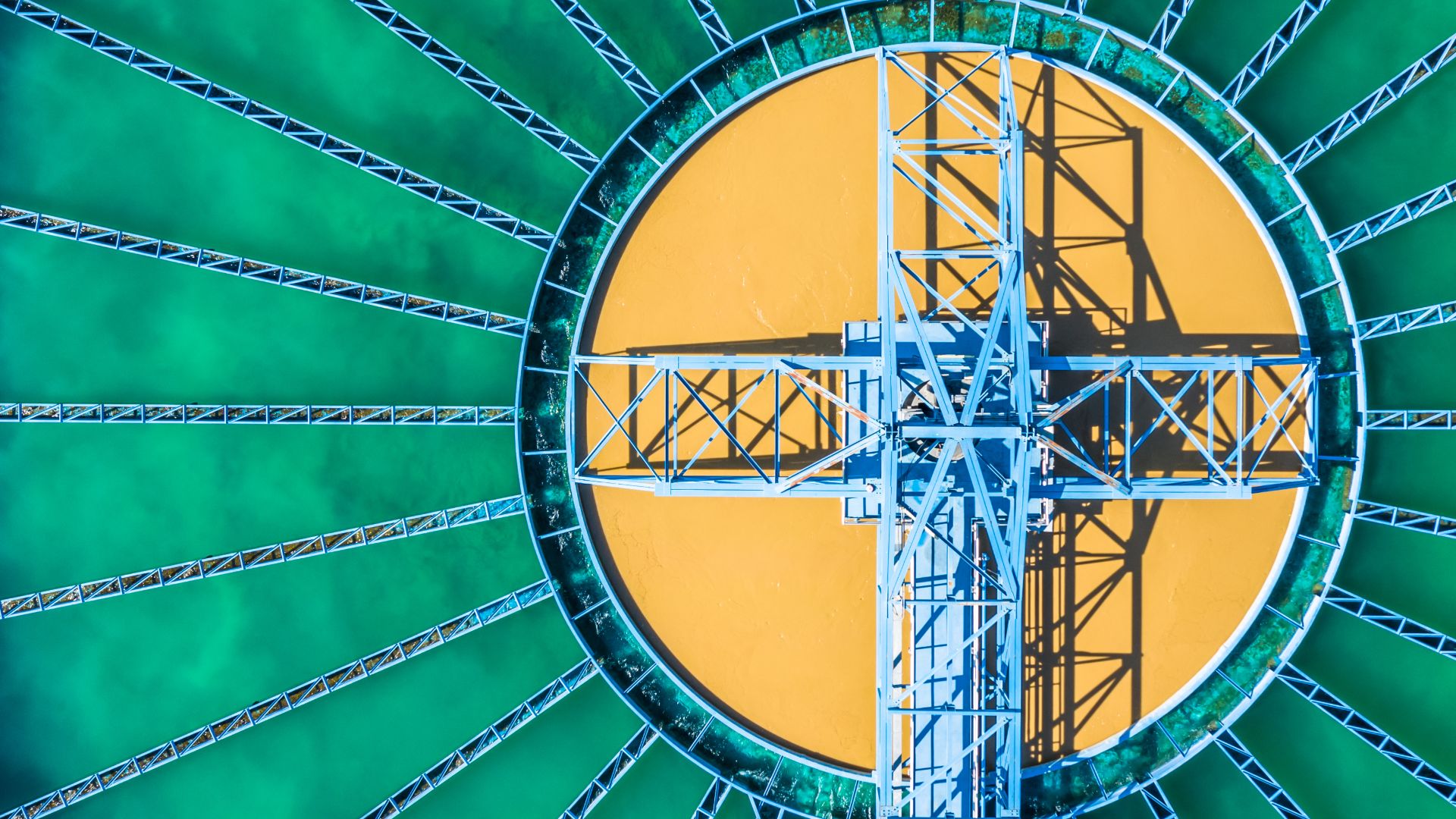

Mekorot Water Company (Mekorot) has completed a fundraising to refinance and develop the company.

Mekorot is a wholly-owned government company under the purview of the Ministry of Energy and Water and the Ministry of Finance. Mekorot was defined in the Water Law as the national water company and it is accountable to the Water Authority – the regulator that supervises Mekorot’s activities on behalf of the state. The company was founded in 1937, before the establishment of the state. Since then, it has made a profound national contribution to realizing the Zionist vision and transforming it into a sustainable reality. The infrastructure and huge water plants founded by Mekorot have essentially facilitated life in Israel and provided solutions, at all times, to all sectors – households, fields, farmers and industrial plants.

Oaklins’ team in Israel advised Mekorot Water Company and acted as a member of the distributors’ consortium.

Talk to the deal team

Related deals

Presight Solutions has been acquired by Banyan Software

Banyan Software, a leading acquiror and operator of mission-critical software businesses, has entered Norway with the acquisition of Presight Solutions AS, a SaaS company delivering advanced software for safety, operational integrity and regulatory compliance in high-risk industries. The transaction marks a new chapter for Presight, strengthening its ability to scale while preserving the product focus, sector expertise and customer trust built since its founding in 2003.

Learn moreGSP Group has secured an upsized growth refinancing package from HSBC

The GSP Group has refinanced its growth facilities through an upsized financing package provided by HSBC.

Learn moreStrawberry Equities has sold Ecohz to Caely Renewables

Ecohz, a global renewable energy company, has been acquired by environmental commodity trading house Caely Renewables from Strawberry Equities. The transaction marks an important new chapter for Ecohz and brings together two organizations with complementary strengths, aligned in their commitment to accelerating the global energy transition.

Learn more