Mekorot Water Company has issued bonds worth US$277 million

Mekorot Water Company (Mekorot) has completed a fundraising to refinance and develop the company.

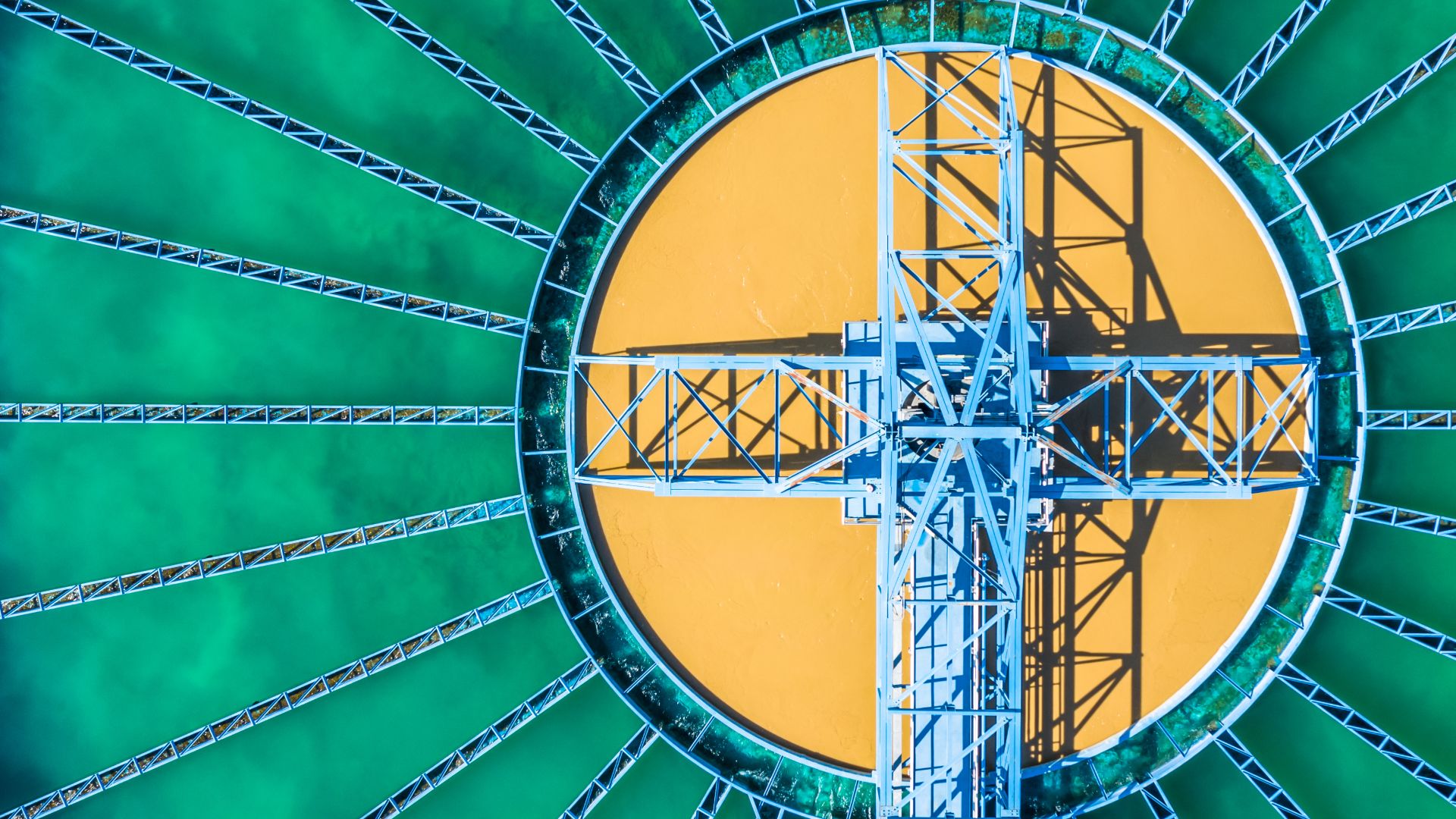

Mekorot is a wholly-owned government company under the purview of the Ministry of Energy and Water and the Ministry of Finance. Mekorot was defined in the Water Law as the national water company and it is accountable to the Water Authority – the regulator that supervises Mekorot’s activities on behalf of the state. The company was founded in 1937, before the establishment of the state. Since then, it has made a profound national contribution to realizing the Zionist vision and transforming it into a sustainable reality. The infrastructure and huge water plants founded by Mekorot have essentially facilitated life in Israel and provided solutions, at all times, to all sectors – households, fields, farmers and industrial plants.

Oaklins’ team in Israel advised Mekorot Water Company and acted as a member of the distributors’ consortium.

Talk to the deal team

Related deals

Top Systems teams up with Holland Capital to create the premier Dutch battery-based solutions provider

Holland Capital, a Netherlands-based private equity firm, has acquired a stake in Top Systems, a leading provider of complete battery-based power solutions, with a unique value-added services proposition.

Learn moreEVIO has raised funds from Lince Capital for its international expansion

EVIO has secured a second fundraising round lead by Lince Capital, a Portuguese private equity firm, in order to fund its international expansion and reinforce its commercial activity.

Learn moreAmot Investments Ltd. has issued bonds

Amot Investments Ltd. has raised funds to refinance the company for further development.

Learn more