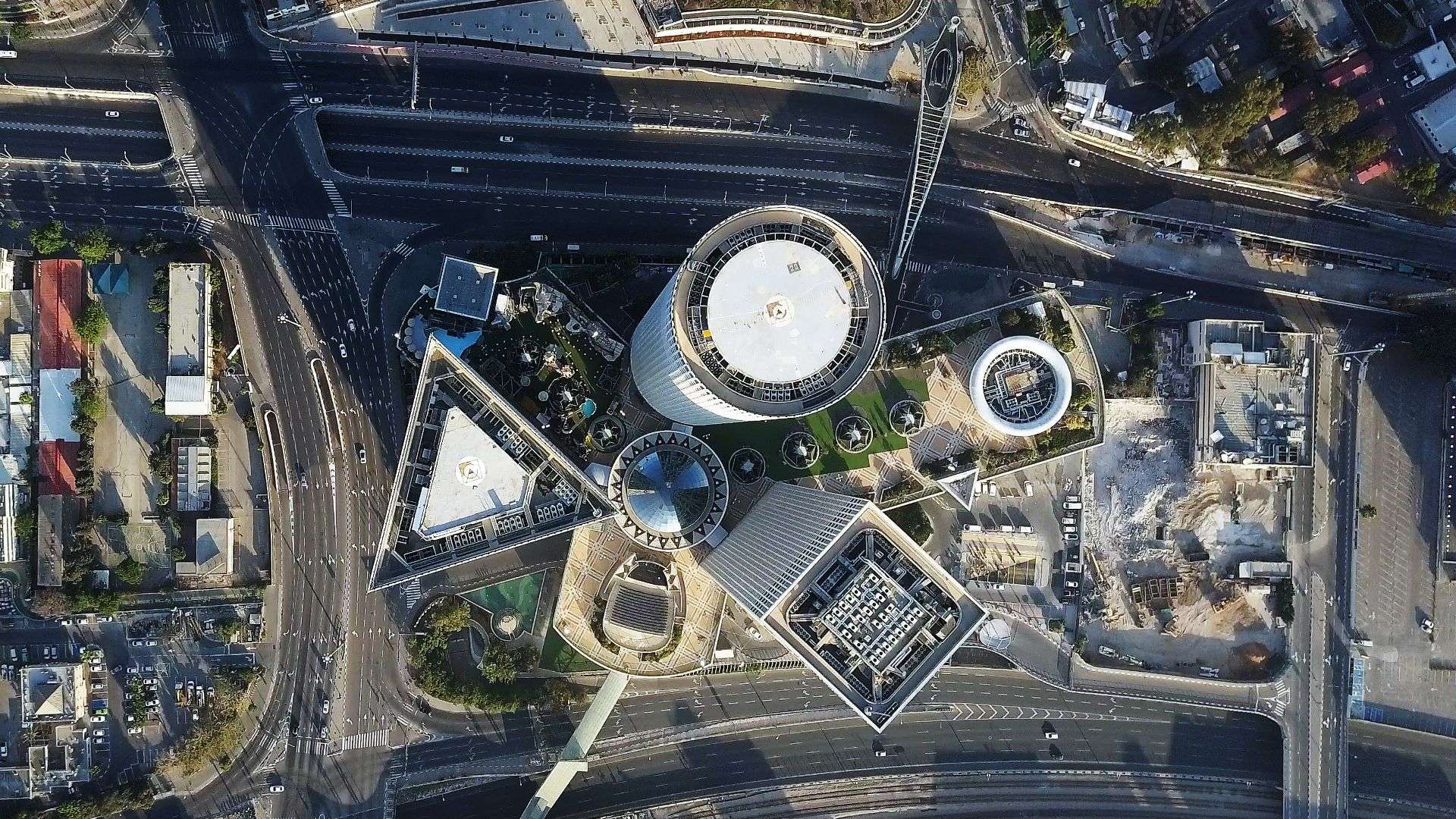

Altshuler Shaham Investment House has issued stocks worth US$80 million

Altshuler Shaham Investment House has raised funds through an IPO.

Altshuler Shaham Investment House, one of Israel’s leading investment firms, was founded in 1990 by Gilad Altshuler and Kalman Shaham and includes several companies within the finance sector. It manages investment portfolios, provident funds, study funds, pension funds and mutual funds, with over US$37 billion under management, offering additional services such as pension plans, alternative investments, as well as trust and currency services.

Oaklins’ team in Israel advised Altshuler Shaham Investment House and acted as a member in the distributors’ consortium.

Talk to the deal team

Related deals

Backspin has completed a mandatory public tender offer for the shares of Spindox

Backspin S.p.A. has completed a mandatory public tender offer for Spindox S.p.A.

Learn moreOmer Engineering has completed an IPO

Omer Engineering Ltd. has successfully launched its IPO on the Tel Aviv Stock Exchange, pricing shares as part of a plan to raise approximately US$94 million at an implied pre-money valuation of around US$313 million. The offering included both newly issued shares and a secondary sale by existing shareholders, who retained a significant majority stake post-IPO. This transaction underscores strong investor interest in scaling the company’s operations and enhancing its capital.

Learn moreQuantum Base has completed a fundraise

Quantum Base Holdings plc (AIM: QUBE) has successfully completed a US$5.7 million fundraise.

Learn more