IPTE has acquired by a cash tender offer and delisting Connect Group

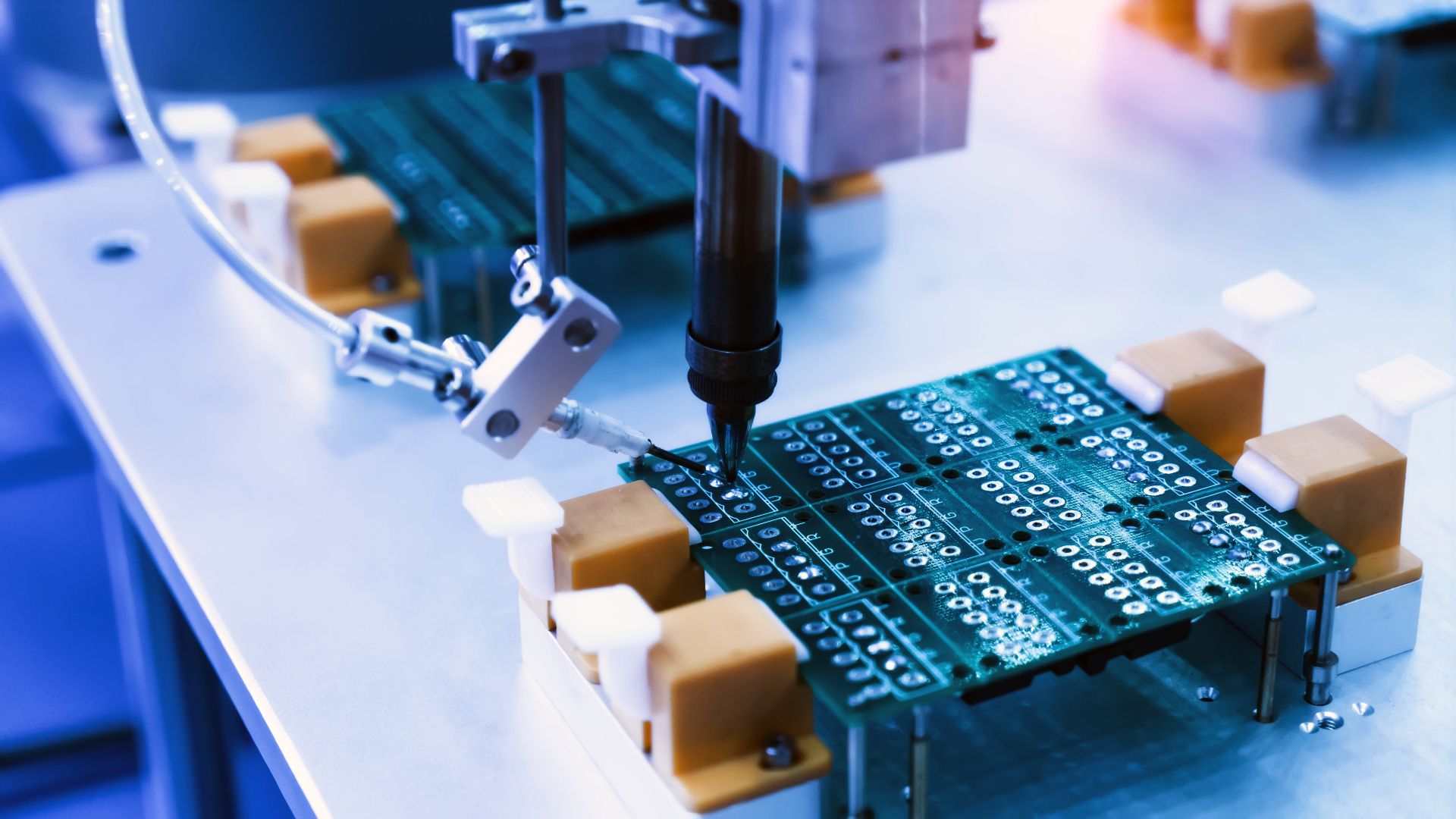

IPTE, a worldwide supplier of automated production equipment for the electronics and mechanics industry, has acquired Connect Group.

The IPTE Factory Automation division develops standard machinery and turnkey automation systems for the production, test and treatment of printed circuit boards and for final assembly work. The equipment is used in automotive, telecommunications, consumer electronics and other sectors within the electronics industry. IPTE is present in Belgium, France, Germany, Portugal, Spain, Romania, Estonia, Mexico, Brasil, USA and Asia.

Connect Group is a certified, leading subcontractor of technology, production systems, printed circuit boards and cable assembly services for the professional industry. The company was founded 30 years ago and has 200 employees.

Oaklins' team in Belgium acted as the exclusive advisor to the bidder in this public takeover bid.

Talk to the deal team

Related deals

Xeros Technology Group has completed a placing, subscription and retail offer

Xeros Technology Group plc has raised funds to drive forward its commercialization strategy.

Learn moreIndustrie Polieco - M.P.B. has sold a minority stake to RedFish Longterm Capital

T.P. Holding Srl, the company controlled by the Tonelli family, has sold Industrie Polieco - M.P.B. SpA to RedFish Longterm Capital SpA.

Learn moreEC Electronics has raised new debt facilities

EC Electronics Ltd. has raised funds from Shawbrook Bank to finance the acquisition of Liad Electronics Breda B.V. The debt facilities also include follow-on capital for future acquisitions as EC Electronics continues its search for complimentary electronics manufacturing businesses.

Learn more