iXO Private Equity will support LBA in the achievement of its development plan in France and internationally

La Barrière Automatique (LBA Group) has completed an LBO alongside iXO Private Equity.

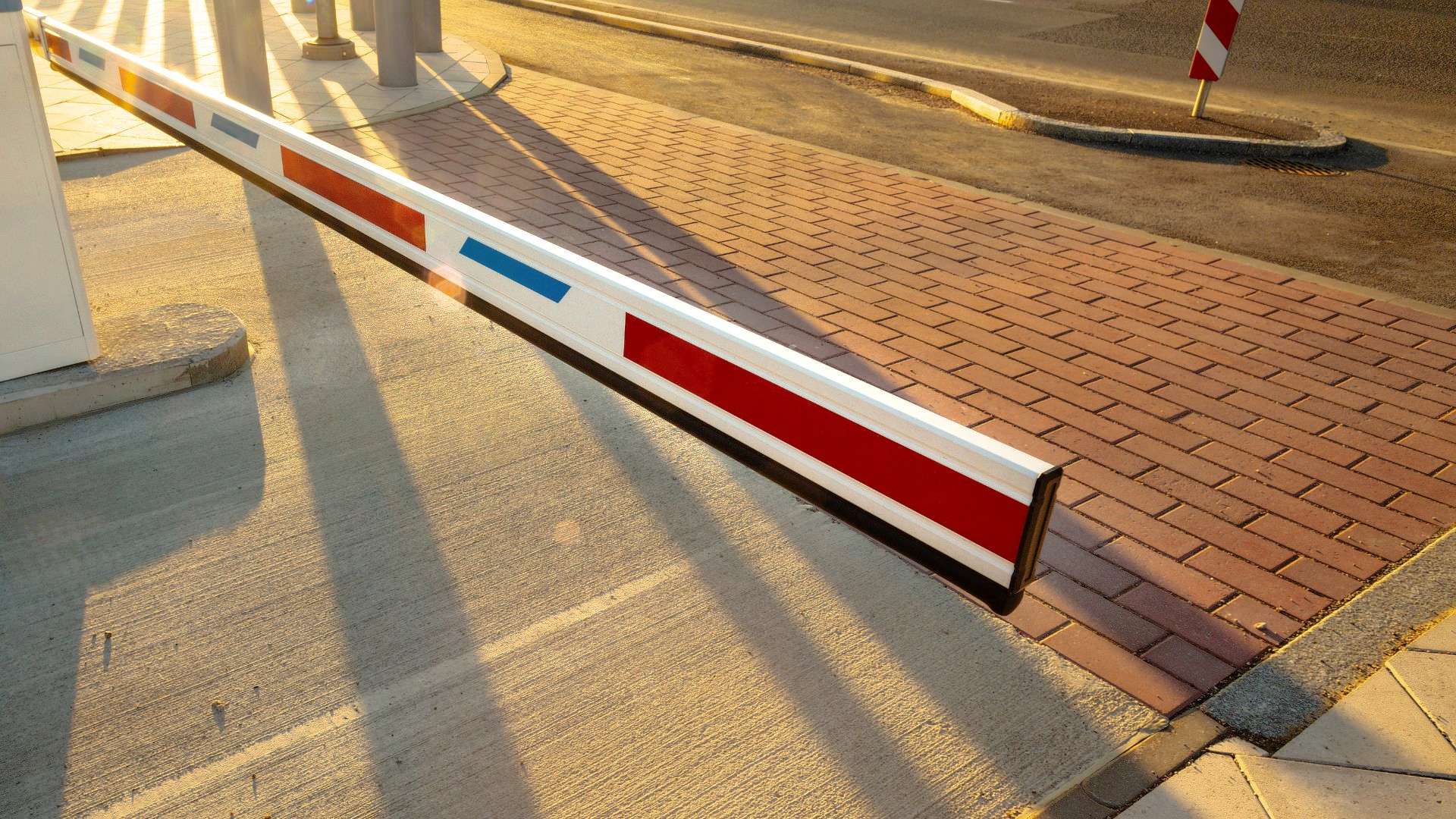

LBA Group is a security and access control specialist enabling the management of flows and the cohabitation of different mobilities. It designs, manufactures and distributes robust, high quality and reliable products, including automatic lifting barriers, pedestrian access turnstiles, retractable and security bollards, and anti-intrusion obstacles. In the last two years, the group has launched two new product ranges: hydroalcoholic gel dispenser terminals and design bollards. In 2019, LBA Group acquired AMCO Les Escamotables, specializing in retractable bollards and anti-intrusion obstacles. LBA Group operates in a market with significant growth dynamics: increasing demand for security measures deployment, and the revolution of urban land use planning, including massive pedestrianization programs. The group has generated strong organic growth (12% of CAGR 2011–2021).

Based in Toulouse, Marseille and Lyon, iXO Private Equity meets the equity needs for the best companies in southwest and southeast of France and the Rhône-Alpes region. It focuses on venture capital for high potential startup firms and small businesses, growth capital for restructuring or expanding further for ambitious small and medium-sized enterprises, and LBO/OBO/MBOs.

Oaklins’ team in France assisted LBA Group and its shareholders throughout this four-month sale process to structure the most attractive transaction.

Talk to the deal team

Related deals

Thrive Freeze Dry has successfully sealed the acquisition deal with Paradiesfrucht GmbH

Paradiesfrucht GmbH, a gobal freeze dryer of fruits, fruit preparations, drops, powders and granulates, has been acquired by Thrive Freeze Dry (Thrive), a portfolio company of Entrepreneurial Equity Partners (e2p) and Mubadala Capital. The transaction is expected to close in 2024, subject to customary closing conditions, including antitrust approval.

Learn moreVarsteel, Ltd. has acquired Pacific Steel, Inc.

Pacific Steel, Inc. has been acquired by Varsteel, Ltd.

Learn moreAmot Investments Ltd. has issued bonds

Amot Investments Ltd. has raised funds to refinance the company for further development.

Learn more