Keystone Fund has issued bonds

Keystone Fund has raised funds to develop and refinance the company.

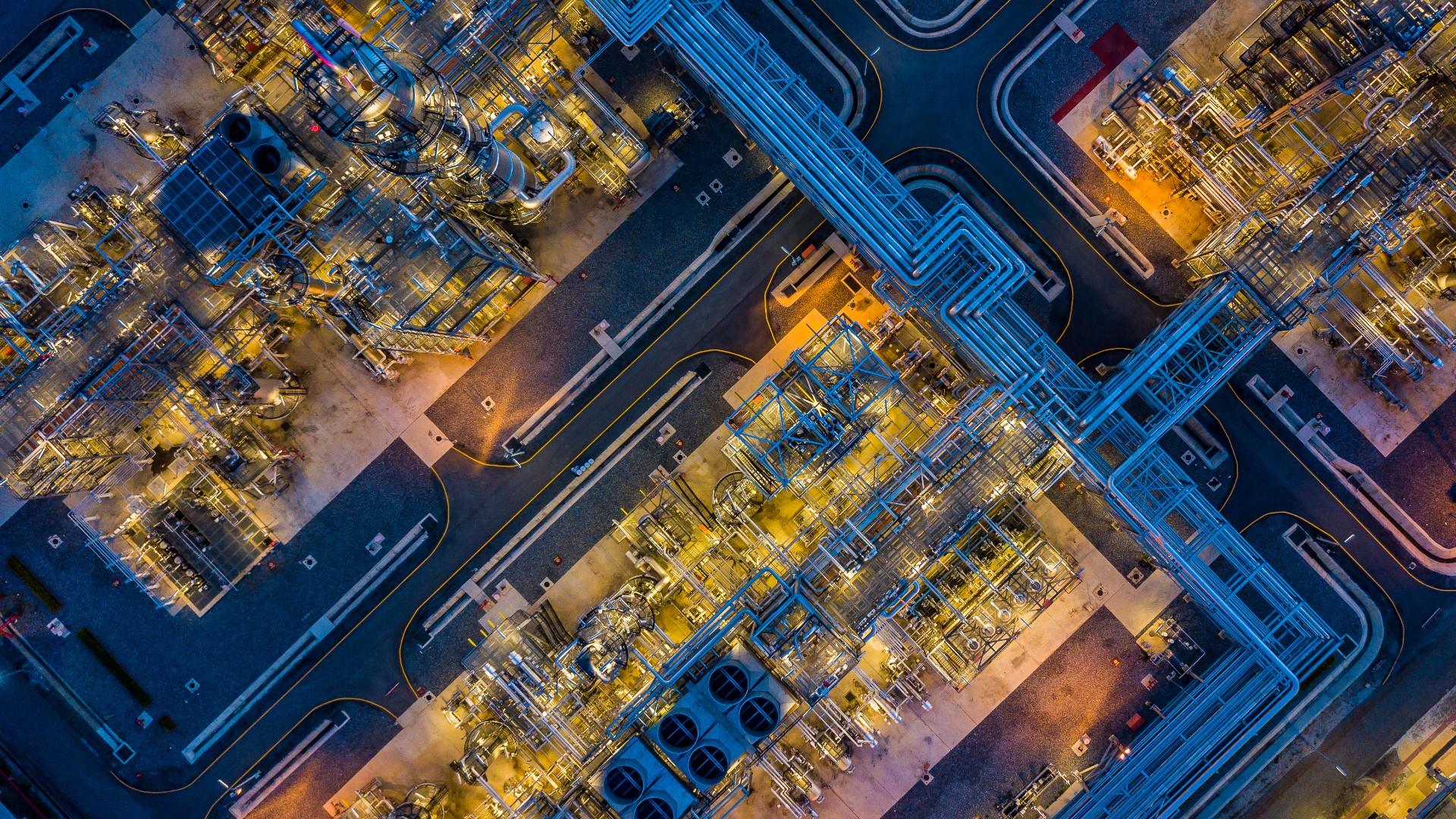

Keystone Fund is an Israeli infrastructure investment fund established in 2019 as part of the government’s policy to promote and encourage investments in infrastructure, including water desalination, wastewater and waste projects, energy infrastructure, transportation and communication projects. Keystone’s goal is to form and establish a balanced and diverse investment portfolio that will offer its investors a long-term return, with as little risk and fluctuation as possible.

Oaklins’ team in Israel advised the company and acted as a member of the distributors’ consortium.

Talk to the deal team

Related deals

Presight Solutions has been acquired by Banyan Software

Banyan Software, a leading acquiror and operator of mission-critical software businesses, has entered Norway with the acquisition of Presight Solutions AS, a SaaS company delivering advanced software for safety, operational integrity and regulatory compliance in high-risk industries. The transaction marks a new chapter for Presight, strengthening its ability to scale while preserving the product focus, sector expertise and customer trust built since its founding in 2003.

Learn moreGSP Group has secured an upsized growth refinancing package from HSBC

The GSP Group has refinanced its growth facilities through an upsized financing package provided by HSBC.

Learn moreStrawberry Equities has sold Ecohz to Caely Renewables

Ecohz, a global renewable energy company, has been acquired by environmental commodity trading house Caely Renewables from Strawberry Equities. The transaction marks an important new chapter for Ecohz and brings together two organizations with complementary strengths, aligned in their commitment to accelerating the global energy transition.

Learn more