Gilat Telecom Global has issued bonds

Gilat Telecom Global Ltd. has issued bonds for refinancing and business development purposes.

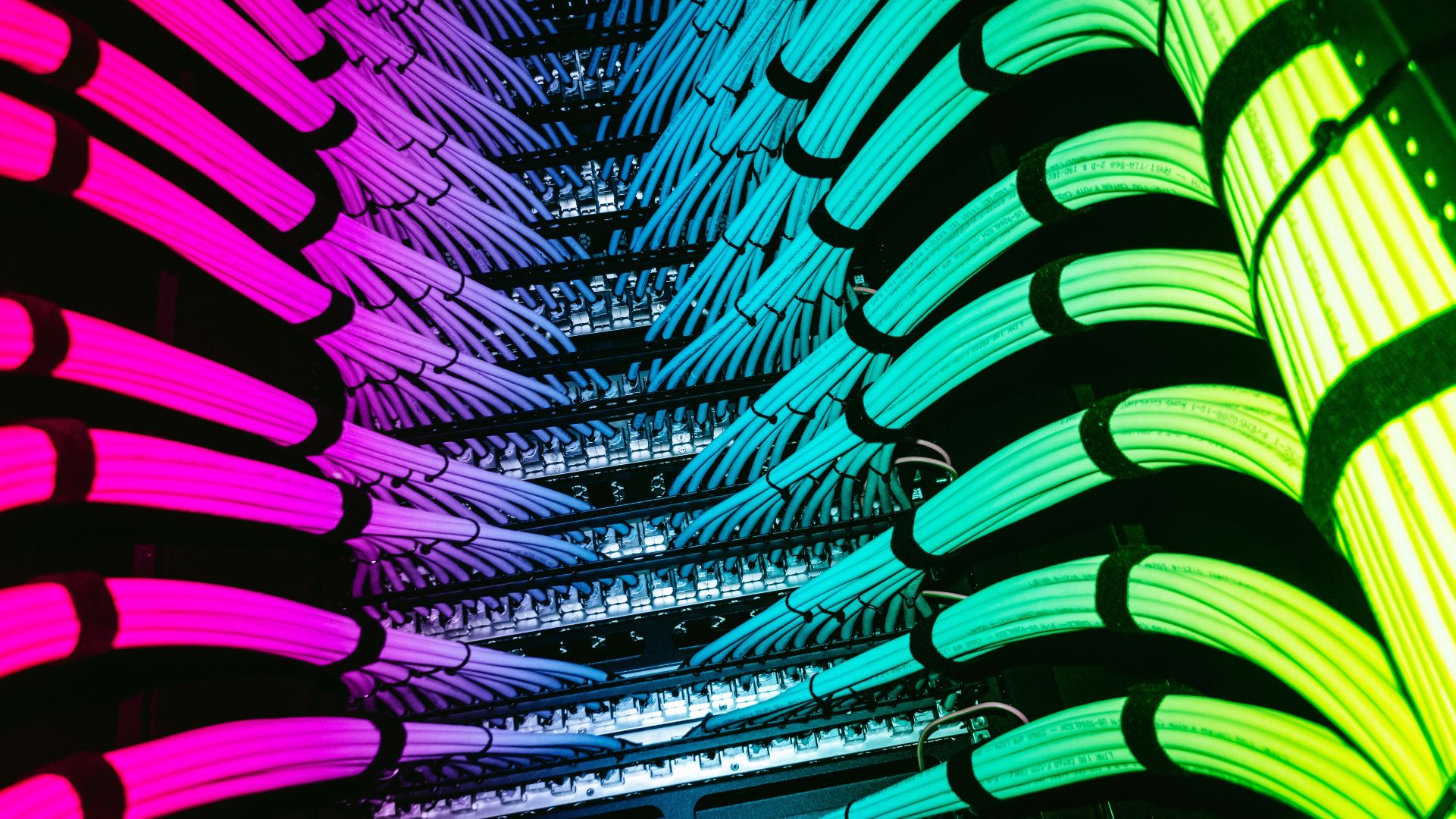

Gilat Telecom provides end-to-end communication solutions through satellite, fiber optic and radio systems, serving customers in Israel, Africa, the Middle East and beyond. The company delivers bandwidth, connectivity and managed services, including networks, infrastructure, cloud-based SaaS and security to a wide range of clients, including cellular operators, internet providers, enterprises, government organizations and emergency services. As a technology-driven company, Gilat Telecom integrates innovative infrastructures and technologies, adapting to the evolving communication landscape to enhance the customer experience with around-the-clock support and streamlined service onboarding.

Oaklins’ team in Israel advised Gilat Telecom and led the distributors’ consortium.

Talk to the deal team

Related deals

Middlecon has been acquired by Nion

Middlecon has been acquired by Nion, a digital consultancy backed by Stella Capital. The acquisition strengthens Nion’s capabilities in data management and advanced analytics, enabling it to undertake larger and more complex data-driven initiatives for its customers. The partnership with Nion provides Middlecon with a strong foundation for continued growth and expansion.

Learn morePresight Solutions has been acquired by Banyan Software

Banyan Software, a leading acquiror and operator of mission-critical software businesses, has entered Norway with the acquisition of Presight Solutions AS, a SaaS company delivering advanced software for safety, operational integrity and regulatory compliance in high-risk industries. The transaction marks a new chapter for Presight, strengthening its ability to scale while preserving the product focus, sector expertise and customer trust built since its founding in 2003.

Learn moreBackspin has completed a mandatory public tender offer for the shares of Spindox

Backspin S.p.A. has completed a mandatory public tender offer for Spindox S.p.A.

Learn more