Infrastructure India plc has agreed and extension of an existing US$17 million working capital loan

Infrastructure India plc has completed a fairness opinion on a further extension of the US$17 million working capital loan facility provided to the company in April 2013 by GGIC, Ltd such that the maturity date of the loan has been extended by 30 days to 10 July 2017.

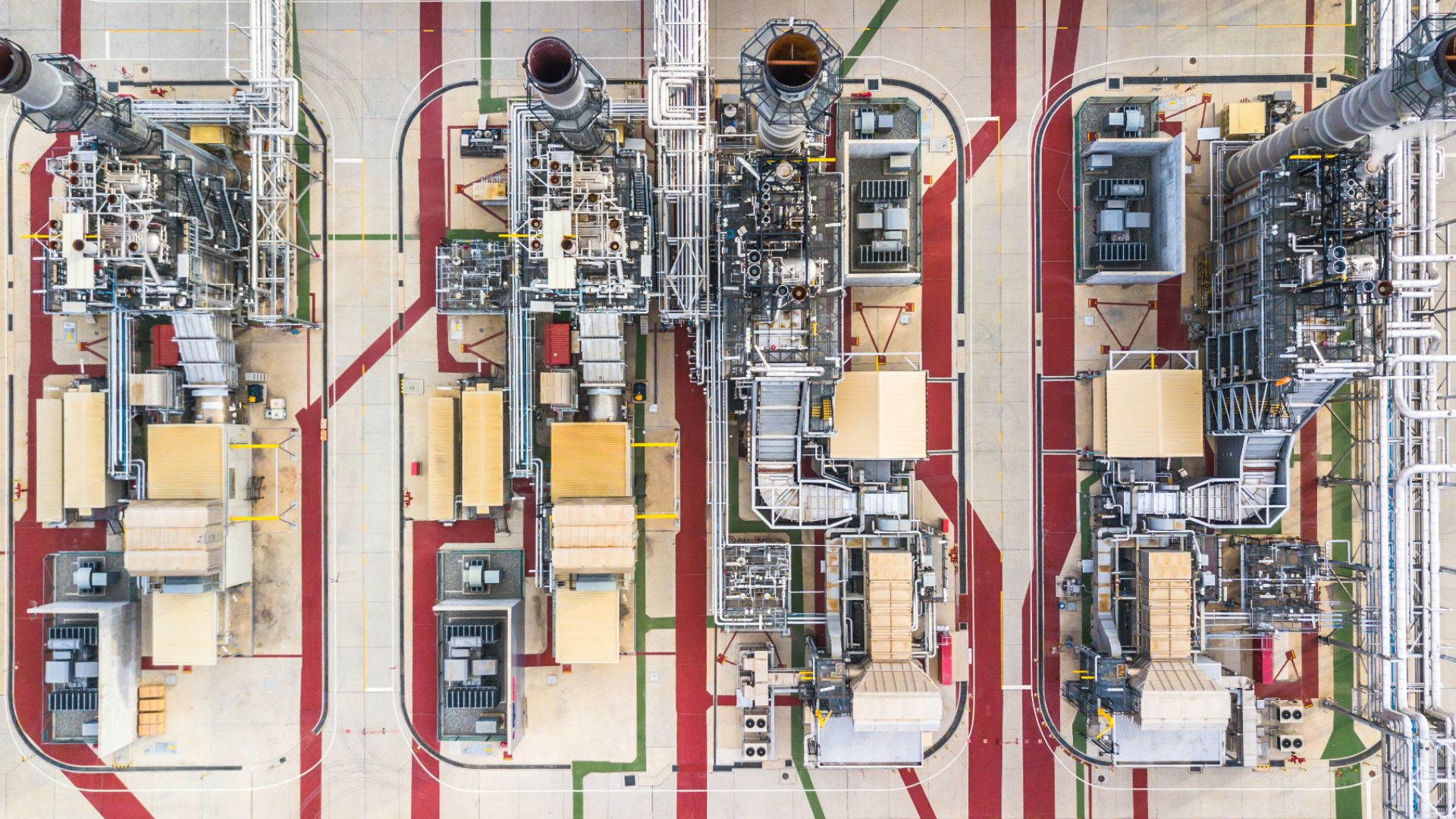

Infrastructure India is an AIM quoted fund investing in assets in the Indian infrastructure sector, with particular focus on assets and projects related to energy and transport.

Oaklins Smith & Williamson, based in the UK, acted as Nominated Advisor (Nomad) to Infrastructure India plc in this transaction and on an ongoing basis.

Talk to the deal team

Related deals

Presight Solutions has been acquired by Banyan Software

Banyan Software, a leading acquiror and operator of mission-critical software businesses, has entered Norway with the acquisition of Presight Solutions AS, a SaaS company delivering advanced software for safety, operational integrity and regulatory compliance in high-risk industries. The transaction marks a new chapter for Presight, strengthening its ability to scale while preserving the product focus, sector expertise and customer trust built since its founding in 2003.

Learn moreStrawberry Equities has sold Ecohz to Caely Renewables

Ecohz, a global renewable energy company, has been acquired by environmental commodity trading house Caely Renewables from Strawberry Equities. The transaction marks an important new chapter for Ecohz and brings together two organizations with complementary strengths, aligned in their commitment to accelerating the global energy transition.

Learn moreSwiss Solar Group has acquired OmniWatt and taken a significant minority stake in enshift

Swiss Solar Group AG has acquired OmniWatt AG and taken a significant minority stake in enshift AG. With these transactions, Swiss Solar Group advances its strategic growth initiative and pursues its objective of positioning itself as a leading integrated provider of sustainable energy transition solutions in Switzerland. The transactions support the group’s strategy to expand its presence across the entire energy value chain and to achieve profitable growth in the renewable energy sector.

Learn more