3B Advanced Composites Privated Limited has raised debt financing

3B Advanced Composites Private Limited has successfully completed a fundraising.

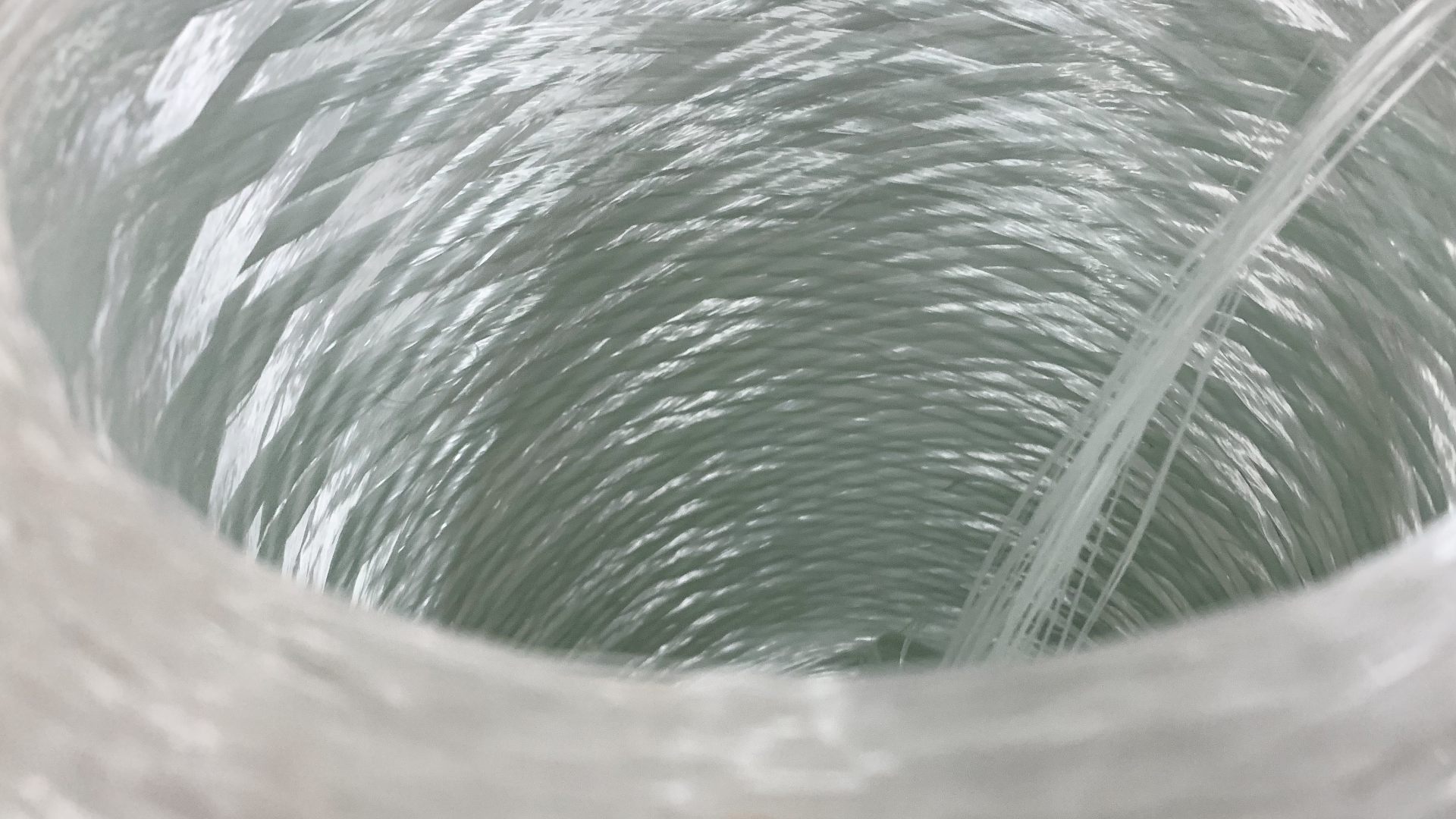

3B Advanced Composites, a wholly-owned subsidiary of Goa Glass Fibre Limited, has been constructing one of India's largest glass fiber facilities. The debt financing raised will be used to support this greenfield project. Goa Glass Fibre is primarily engaged in the manufacture and sale of glass fiber products.

Oaklins’ team in India provided advisory services to 3B Advanced Composites on this debt financing. Given the size of the project compared to the existing plant, the team structured the deal with an optimal security arrangement and interest rate.

Talk to the deal team

Related deals

GSP Group has secured an upsized growth refinancing package from HSBC

The GSP Group has refinanced its growth facilities through an upsized financing package provided by HSBC.

Learn moreGrowth Capital Partners has raised new debt facilities

Growth Capital Partners LLP has raised new debt facilities from NatWest Bank, supporting its minority investment in SecurityHQ.

Learn moreClinical Partners has raised new debt facilities

Clinical Partners Ltd. has successfully restructured and upsized its debt facilities to better reflect the scale of the business. The company increased its original US$9.4 million facility, comprising a US$3.4 million term loan and a US$6 million revolving credit facility (RCF), to a US$27 million RCF.

Learn more