NexFlex has been acquired by MBK Partners

NexFlex has been acquired by MBK Partners, gaining a strong financial partner with deep expertise in scaling market-leading industrial businesses. With extensive experience in the electronics and advanced materials sectors, as well as a track record of value creation across Korea and the broader region, MBK Partners is well positioned to support NexFlex’s continued growth and long-term strategic development.

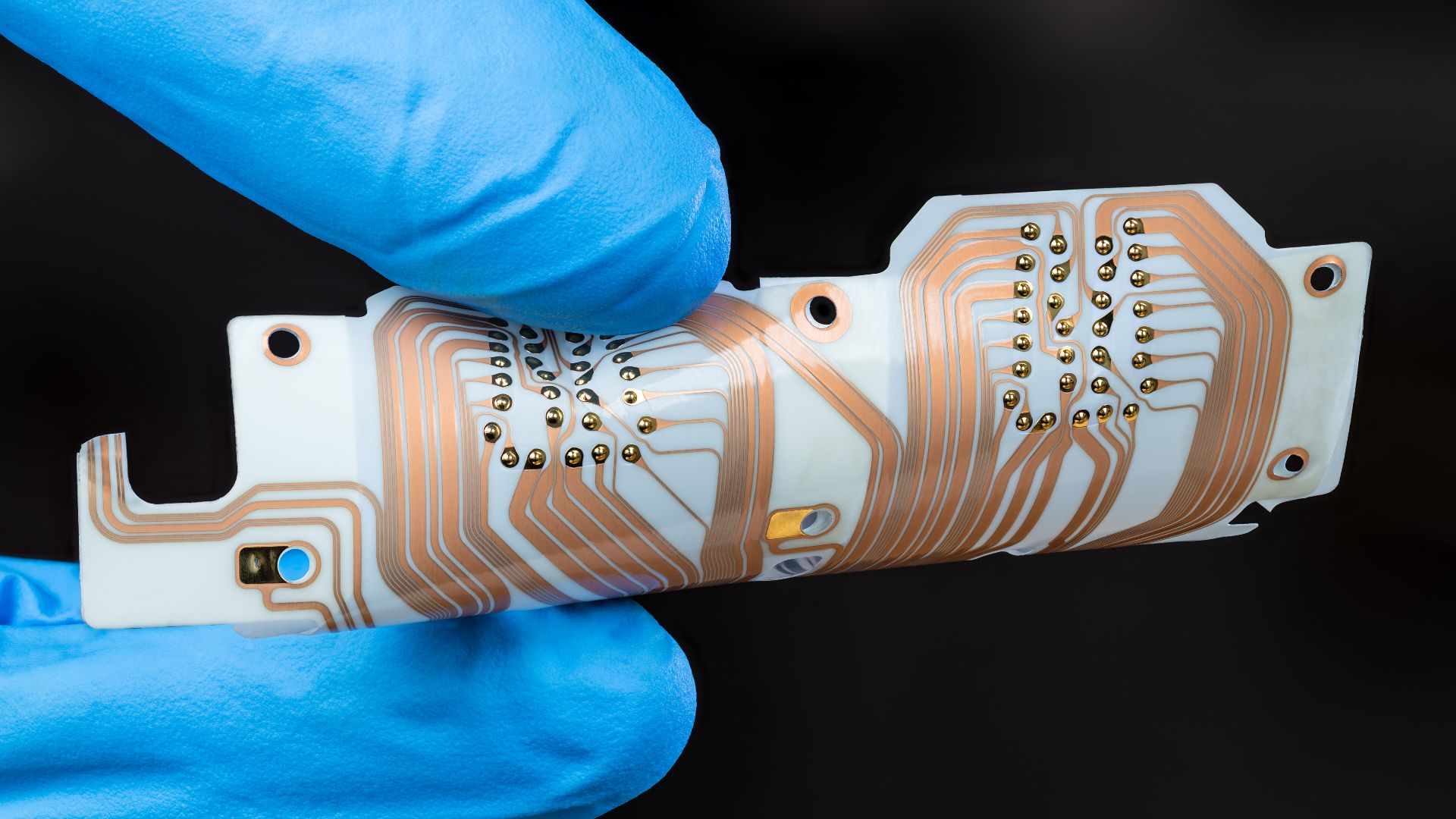

NexFlex is a leading Korean manufacturer of flexible copper-clad laminates (FCCLs), a critical base material used in the production of flexible printed circuit boards (FPCBs) for smartphones, displays and other advanced electronic devices. Backed by strong R&D capabilities and long-standing relationships with top-tier electronics customers, NexFlex has established a reputation for high product quality, technological innovation and reliable supply. The company operates state-of-the-art manufacturing facilities and continues to expand its product portfolio to meet growing demand across the global electronics value chain.

Founded in 2005, MBK Partners is one of the largest and most established private equity firms in Asia, managing over US$25 billion in capital. The firm focuses on control investments in North Asia, with a strong presence in Korea, Japan, China and Taiwan. MBK Partners invests in a broad range of industries, including consumer, healthcare, industrial and financial services, and is known for its ability to drive transformation and create value in portfolio companies. Its deep regional networks and operational expertise have enabled the firm to execute complex transactions and support long-term, sustainable growth.

Founded in 2006, Skylake Equity Partners is a private equity firm based in Seoul, South Korea, with a focus on the technology and information and communication technology sectors. Known for its deep industry expertise and hands-on value creation strategies, Skylake has a strong track record of partnering with leading Korean companies to drive operational improvements, strategic expansion and long-term growth. The firm has successfully exited multiple investments through various strategies, reinforcing its reputation as a leading local sponsor in Korea’s private equity market.

Oaklins’ team in Korea acted as the exclusive sell-side advisor to Skylake Equity Partners in the sale of NexFlex. The team led the preparation of the sale process, coordinated financial and legal due diligence, engaged a broad range of financial investors and supported the client throughout the transaction until closing. As a domestic transaction involving two leading financial sponsors, the team played a central role in managing a competitive process and driving a successful outcome. The transaction resulted in the successful sale of NexFlex to MBK Partners.

Talk to the deal team

Related deals

Dolmans Landscaping Group has welcomed Foreman Capital as a new shareholder to support further growth

Dolmans Landscaping Group, a leading full-service provider of landscaping services, has welcomed Foreman Capital as a new shareholder. By partnering with Foreman Capital, which has extensive experience in building stronger companies in the maintenance of public spaces, Dolmans can accelerate its growth trajectory across core verticals and further professionalize the business.

Learn moreBackspin has completed a mandatory public tender offer for the shares of Spindox

Backspin S.p.A. has completed a mandatory public tender offer for Spindox S.p.A.

Learn moreValmiermuižas Alus has been acquired by Cēsu Alus

Valmiermuižas Alus has been acquired by Cēsu Alus AS through the purchase of 100% of its shares. The transaction enabled the founder’s exit and strengthened the company’s platform for continued growth within a consolidating Baltic beverage market.

Learn more