CVA EOS Srl has completed a mandatory public tender offer on Renergetica SpA

CVA EOS Srl has acquired Renergetica SpA.

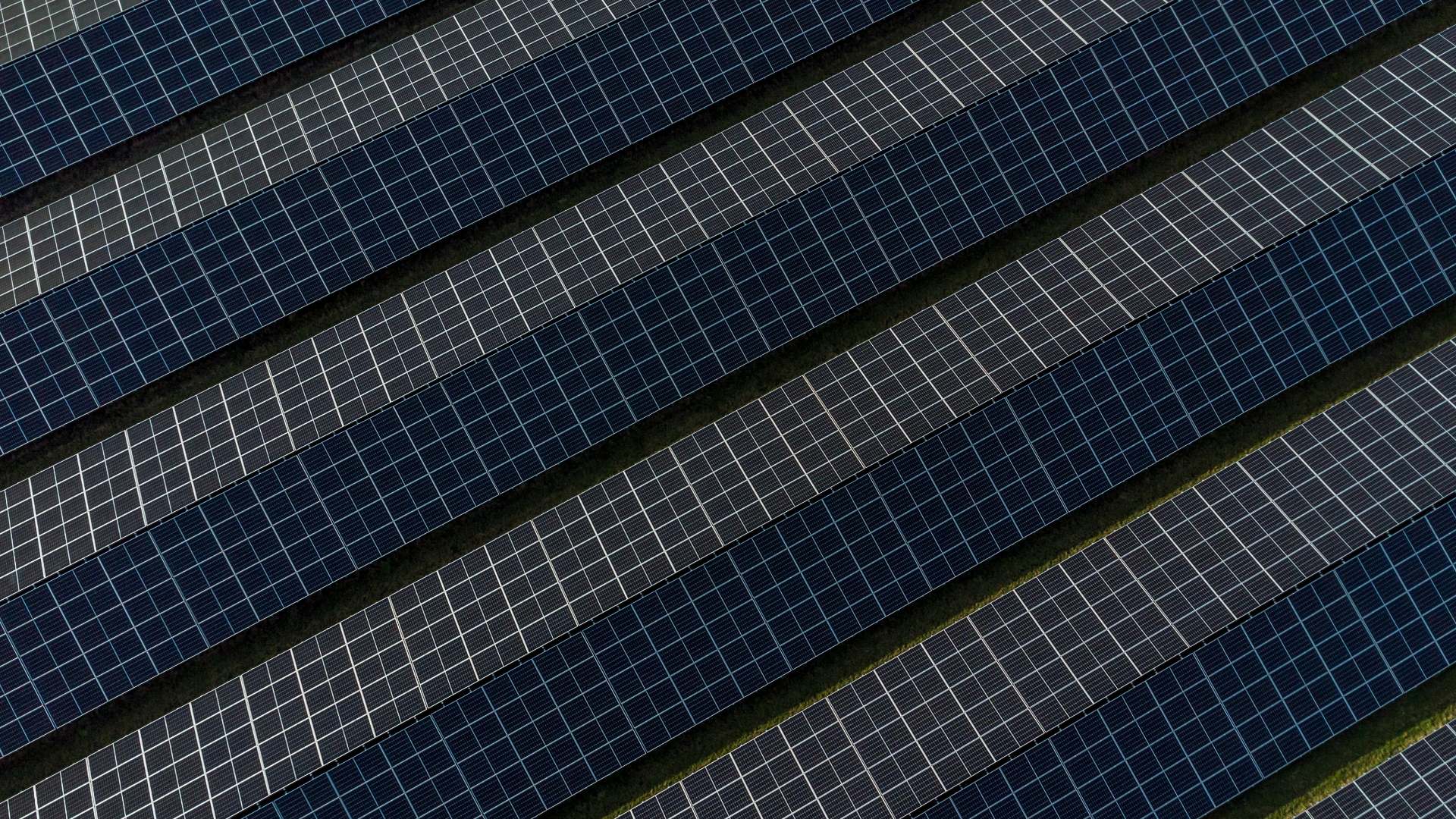

CVA EOS is a company operating in the wind and photovoltaic sector, wholly owned by CVA SpA (Compagnia Valdostana delle Acque).

Headquartered in Italy, Renergetica is a listed entity that designs engineering solutions for the renewable energy sector. The company specializes in the development of renewable energy plants, hybrid power generation systems and hybrid grids.

Oaklins Italy’s parent company Banca Akros acted as the financial advisor to CVA EOS and appointed broker in the collection of shares in the total mandatory public tender offer of 17.8% of Renergetica SpA by CVA EOS Srl.

Talk to the deal team

Related deals

Swiss Solar Group has acquired OmniWatt and taken a significant minority stake in enshift

Swiss Solar Group AG has acquired OmniWatt AG and taken a significant minority stake in enshift AG. With these transactions, Swiss Solar Group advances its strategic growth initiative and pursues its objective of positioning itself as a leading integrated provider of sustainable energy transition solutions in Switzerland. The transactions support the group’s strategy to expand its presence across the entire energy value chain and to achieve profitable growth in the renewable energy sector.

Learn moreOmer Engineering has completed an IPO

Omer Engineering Ltd. has successfully launched its IPO on the Tel Aviv Stock Exchange, pricing shares as part of a plan to raise approximately US$94 million at an implied pre-money valuation of around US$313 million. The offering included both newly issued shares and a secondary sale by existing shareholders, who retained a significant majority stake post-IPO. This transaction underscores strong investor interest in scaling the company’s operations and enhancing its capital.

Learn moreSmart Capital has finalized a rights issue

Smart Capital S.p.A. has finalized a rights issue to continue executing its growth plan and increase its investment capacity. The fundraising supports the expansion of its investment portfolio and the strengthening of its positions in higher-quality investee companies with stronger growth prospects.

Learn more