Strategic Horizons

Global perspectives from Oaklins, bringing insight into the trends shaping markets across boarders.

Author: Roger Lee, Head of Equity Strategy

To start 2026, we are very excited to introduce our first Strategic Horizons report, where we share our insights into the key themes driving global markets and the investment landscape ahead.

In the thirty years I have been in the market, I doubt there has been a time when there has been a greater confluence between market performance, politics, and central bank policy, all overlayed with the potential epochal technology shift of AI.

On a fortnightly basis we will try and shed light on these market developments in an engaging and approachable way and so add macro context to what you may be seeing domestically. In addition, we will try and identify the specific macro themes driving M&A from mega-cap to the private market and in this edition a review of M&A in 2025.

I firmly believe to even try and anticipate how markets will behave in the future we need to understand what has driven markets in the recent past. So, in this inaugural Strategic Horizons we will look back into 2025 and explore the themes behind a remarkable year across a range of asset classes and examine whether these themes will continue into 2026.

2025 – The year when Diversification mattered again

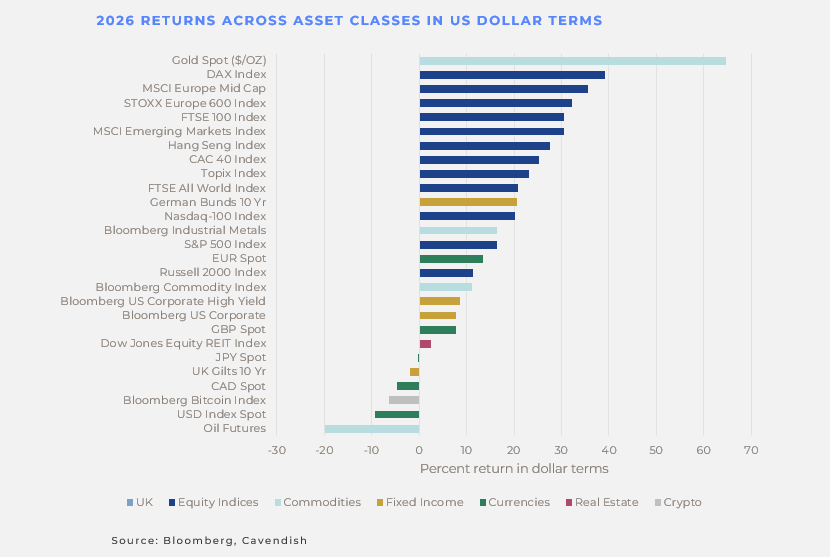

The overwhelming narrative for 2025 was diversification out of US assets. This can be seen very clearly in the table below showing the performance across major asset classes in USD terms.

Non-US assets dominated performance in 2025, with European equities claiming four of the top five best performing asset classes. There is also a strong argument that gold is the ultimate diversification hedge, but we will discuss gold’s particular drivers in more detail below.

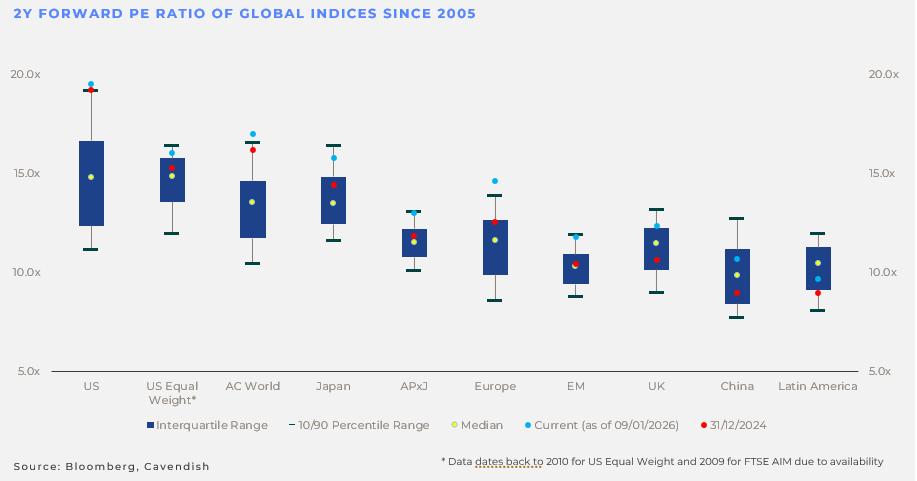

There were some very specific local issues driving European equities, removing the debt brake in Germany for instance and increased defence spending. There was also a concentration of performance particularly around financials and defence stocks. But the overarching theme was one of diversification out of the US into non-US assets. That can clearly be seen on the chart below where almost every equity asset class re-rated over 2025. With the notable exception of US equities which could only maintain their, albeit elevated, valuation.

The other tell-tale sign that diversification away from US assets was the principal driver to equity performance was the strength of non-US currencies. The Euro, GBP and many EM currencies were notably stronger against the USD. This relative weakness of the USD implies that there were asset outflows out of the US.

And the catalyst for this renaissance in the benefits of diversification… undoubtedly the policies of President Donald J Trump and the return of what is generally known as ‘policy volatility’.

It’s probably fair to say that this ‘policy volatility’ is to a greater extent intentional, specifically the re-set of global trade through tariffs and a more expansionist US foreign policy. Both as it happens key policies of President Trump’s inspiration, President McKinley, to whom I am sure we will return.

Whether one agrees or not with President Trump, he is clearly a ‘disruptor’ prepared to take short term pain (up to a point) in pursuit of a perceived long term strategic US advantage. That is in essence the ‘policy volatility’ that has emerged since his inauguration. Combined with the relative attractive valuation of non-US assets, the diversification trade became the dominant theme for global equities in 2025.

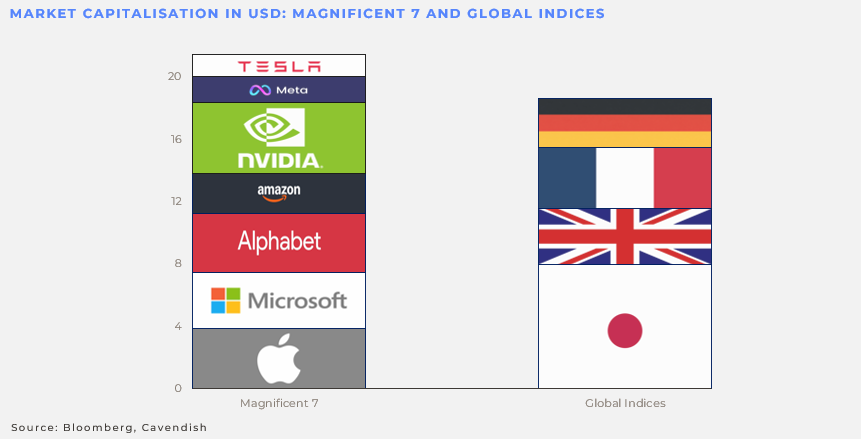

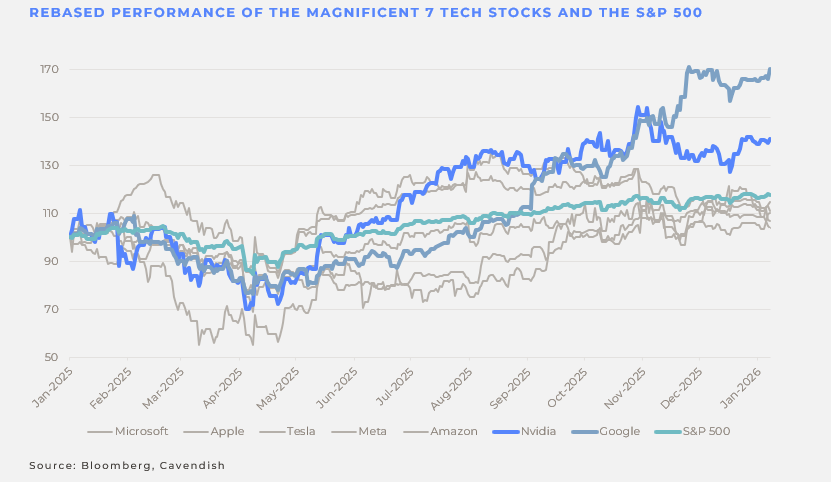

Diversification and the performance of non-US assets accelerated in the final quarter of last year as the second major risk within US equities started to become apparent: AI valuations. Even the smallest asset allocation shifts out of the US, or perhaps more pertinently out of the Mag-7, could have a profound impact on international indices that in many cases are fractions of those largest stocks. And that is exactly what we have also seen…

So, the next question... will this diversification theme continue?

Well unless President Trump is going to have a complete policy reversal, then policy volatility is likely to continue. This has been even more apparent in the first couple of weeks of 2026.

If ‘policy volatility’ last year was focused on tariffs and a reset of global trade, so far this year we have seen a challenge to the independence of the Federal Reserve, US expansionism and direct intervention in US corporate policy. The disruptive nature of this presidency is unlikely to diminish especially as the mid-terms approach.

And the concerns around AI only seem to be gathering pace as the market perceives some sort of AI winners and losers emerging amongst the tech giants (again see below), and the Mag-7 becomes the Mag-3 or Mag-whatever...

Valuation in many non-US asset classes is less supportive than a year ago, as also shown on the chart above, but compared to the valuation of the S&P there still seems road to run, again what we have broadly seen in the first couple of weeks of 2026.

So, all the drivers of 2025 are still very much intact, and in some cases could even accelerate, for instance if Trump’s expansionist foreign policy gains momentum or the market seriously questions the economics of the AI capex investment.

The US is still exceptional in terms of growth and the breadth of its capital markets, it’s just not quite as exceptional as it once was. These small changes in sentiment, a small reappraisal of risk and the benefits of diversification can cause major shifts in global capital. That was what we saw in 2025, and there seems little to suggest the theme won’t continue into 2026.

Gold – the ultimate diversification trade?

Simplistically gold’s performance last year could be explained by the same diversification theme, gold might even be the purest expression of the diversification trade. And there is no doubt that the Trump presidency has turbo charged the performance of the yellow metal.

Although gold’s performance is perhaps more nuanced than it appears, because it provides a hedge against a deeper risk - the potential debasement of the U.S. dollar.

‘Debasement risk’ is one of those terms that is often bandied around in a highfaluting way, but it is essentially very simple. It’s the risk that the value of the US Dollar loses purchasing power over time because the supply of US dollars grows faster than the real economy. The risk that as more US dollars are issued, they are worth less…

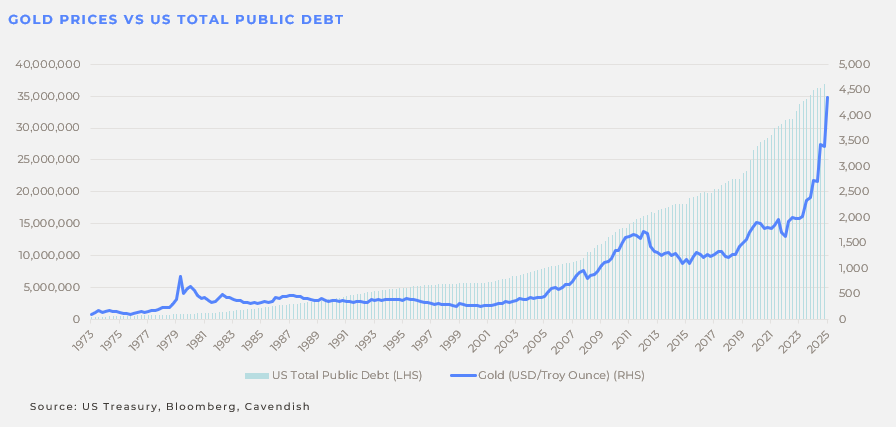

So gold is a hedge against specific monetary policies that the Trump administration and previous administrations have allowed, the ever-increasing US deficit which is expected to reach $40 trillion this year. And there is a pretty good correlation between the gold price and US total debt, as can be seen on the chart below.

We can already see this theme continuing this year, as President Trump proposes increasing defence spending by half a trillion dollars which would be funded by the deficit. Or just this last weekend with subpoenas for the Federal Reserve. The market implication is this threatens the Fed’s independence risking inflation and further debasement of the USD, and so gold goes up almost $100 / oz.

Again, the question is whether this specific monetary policy volatility is likely to continue, and the answer is probably yes.

There are broader risks associated with monetary debasement, especially to the US Treasury market but so far that has been relatively stable, (although perhaps that is the ‘black swan’ event, but let’s hope not.)

For as long as the US government continues to print US Dollars to fund its spending, the gold price looks reasonably underpinned. As Mr J. P. Morgan famously said, “gold is money, everything else is credit”. The largest economy in the world is living on credit.

Mag-7 diverges

Another major theme that started towards the end of last year that has every chance of carrying through into 2026 is the divergent performance of the Mag-7, as the market starts to discern the winners and losers from AI. I suspect the IPO of Anthropic and other AI stocks will only heighten the market’s discrimination as well as provide some hard numbers around the monetisation of AI.

There are estimates that AI related stocks have generated some 70% of the S&P’s returns since ChatGPT was launched in November 2022. Inevitably there are associated risks to the broader market if there are questions about the future monetisation of AI.

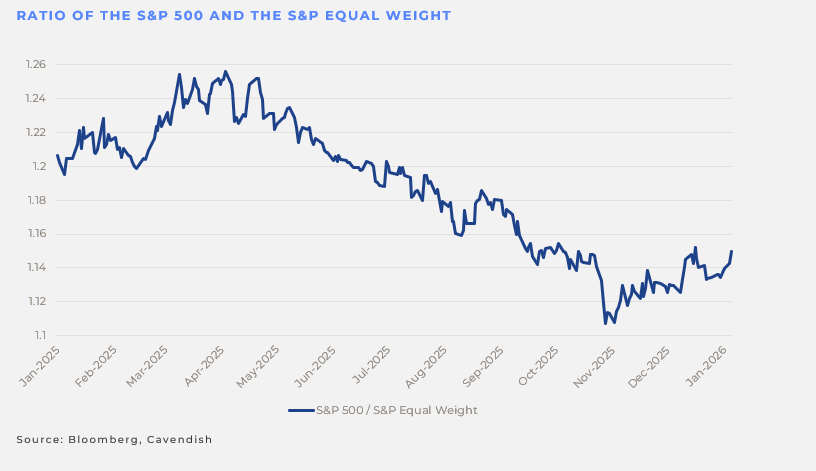

The evidence since October last year in a domestic US context is very similar to what we have seen globally. Investors have started to diversify away from the Mag-7 not only into global equities but into the S&P 493. This is best illustrated by the recent outperformance of the S&P Equal Weight as shown below.

This all seems very rational, perhaps a bit too perfect to be true, but so far so good. If there was an AI bubble in the US, some air is coming out of it and, so far, without a loud bang.

Review of M&A in 2025

After years of predicting it, waiting for it, and frankly beginning to wonder if it would ever actually arrive, 2025 turned out to be quite the year for M&A. Not that anyone would have guessed it from the first few months, when we were all still cautiously tiptoeing around. But wake up it did. And when it did, it came roaring back with a vengeance that caught even the optimists off guard.

THE US MARKET: SECOND BEST YEAR EVER

US M&A is on track to hit approximately $2.3 trillion in deal value for 2025 - up 49% from 2024. This makes 2025 the second-best year on record, beaten only by 2021's $2.6 trillion during the perfect storm of cheap money, soaring valuations, and SPAC mania. What's remarkable is we've achieved this without near-zero interest rates and whilst navigating tariff uncertainty, geopolitical tensions, and the usual regulatory headwinds that make dealmakers' lives so wonderfully complicated.

The market is being driven by megadeals – we've seen four deals worth more than $40 billion announced year-to-date, compared to precisely zero in 2024. Union Pacific's $85 billion combination with Norfolk Southern, Netflix's $82.7 billion proposed acquisition of Warner Bros., and Teck Resources' $69 billion merger with Anglo American represent companies making bold, transformational bets.

What's particularly striking is that many of these acquirers traditionally haven't engaged in significant M&A activity – the fact that they're now making these moves speaks volumes about the current environment.

Mid-market deals are also resilient, at or close to the five-year average in the US and Europe - this dependable segment of the M&A looks remarkably stable.

Private equity has been central to the broader resurgence. Deal value jumped 54% to $536 billion through November - more than double what we saw just a few years ago. Interest rates have finally started moving in the right direction, valuations have become more sensible, and limited partners have been insistent that PE firms actually deploy capital.

THE EUROPEAN STORY: RESILIENCE AMIDST UNCERTAINTY

European M&A has been a tale of fewer deals but bigger bets. Deal volumes declined 6-9%, but values actually rose - reaching $547 billion by Q3. The market is increasingly bifurcated: high-quality assets with strong cash flows attract aggressive bidding, whilst lower-quality assets struggle to find buyers at any price.

Germany continues to face structural challenges, with its industrial base under pressure from Chinese overcapacity, the energy transition, and negative growth in 2024. The automotive sector is being disrupted by Chinese EV manufacturers benefiting from state subsidies. Meanwhile, France saw deal values tumble 86% in Q3 amid political uncertainty, whilst Italy had a strong year with both values and volumes up significantly.

THE SWITZERLAND PHENOMENON

Amidst European uncertainty, Switzerland emerged as a genuine bright spot. Overall Swiss M&A value increased from $72 billion in 2024 to $115 billion in 2025 – a remarkable 60% rise. The energy and infrastructure sector led the charge, with deal value growing by more than 25%. Major transactions included Helvetia's €9.4 billion acquisition of Baloise, PAI Partners' €3.5 billion acquisition of Viridium, and Bain Capital and Mubadala's €3.8 billion acquisition of Apleona Group. Inbound transactions accounted for approximately 60% of all deals, underscoring Switzerland's safe-haven reputation. When the rest of Europe looks uncertain, money flows to Switzerland – it's been true for centuries, and 2025 proved it's still true today.

MEGADEALS AND AI: DEFINING FEATURES OF 2025

Globally, we've seen 63 megadeals deals worth $10 billion or more through late November – exceeding the prior annual high set a decade earlier and nearly doubling 2024's 30 such transactions. These represent a fundamental shift in corporate strategy: after years of incrementalism and bolt-on acquisitions, CEOs have rediscovered their appetite for transformational deals. The new US administration's different approach to antitrust enforcement – reinstating early termination notices and showing greater openness to large transactions – has created an environment where previously risky deals are now getting done.

More than 20% of deals valued at $5 billion or more have an AI theme. Software deal value rose 38% despite volumes falling 33%, driven by AI-related transactions. The infrastructure supporting this revolution has seen massive investment: Microsoft's partnership to restart a nuclear plant, Google's $20 billion renewable energy investment, Blackstone's $16 billion AirTrunk acquisition, and the announced $500 billion 'Stargate' joint venture by OpenAI, SoftBank, and Oracle.

WHERE DOES M&A GO FROM HERE?

The pipeline remains robust. Corporate balance sheets are strong. Private equity has an estimated $2.1 trillion in dry powder globally. Interest rates are moving in the right direction, and AI transformation continues to drive deal activity.

However, headwinds persist: tariff uncertainty, regulatory scrutiny, stretched valuations, and geopolitical tensions. The middle market remains challenging – whilst megadeals have surged, smaller deal volumes have been underwhelming.

In Europe, much will depend on whether we see stabilisation of the political and economic environment. Germany needs to find a way forward, France needs to resolve its political uncertainty, and the UK needs to figure out what it wants to be. Switzerland will probably continue being Switzerland – a safe haven that attracts capital when everywhere else looks risky. For the M&A market to truly fire on all cylinders, we need strength across deal sizes.

CONCLUSION

M&A in 2025 was remarkable. The US posted its second-best year ever. Europe showed resilience despite challenges. Switzerland emerged with 60% growth.

But beyond the headline numbers, what strikes us most is the resurgence of confidence – the return of ambition. CEOs willing to make bold, transformational bets on their companies' futures rather than playing it safe. Those megadeals are sending a powerful signal that should inspire broader confidence and encourage mid-market entrepreneurs to take the plunge too.

2025 was quite the ride, and the ride is unlikely to be over.

Things to watch

Perhaps not surprisingly the things to watch over the next couple of weeks will be similar to the themes to look out for all year. I have little doubt the policy volatility will continue, especially around US expansionism.

However, the direct involvement in compensation and distribution policies of defence contractors and limiting interest charged on credit cards is a new and concerning intervention from this US administration. Together with the judicial action against the Federal Reserve, the risk of owning US assets has increased even over this last weekend. Diversification away from this ‘policy volatility’ is set to continue.

US earnings season is also about to start with a focus on the monetisation of AI and perhaps more prosaically how the broader economy is performing given the lack of government data due to the recent shutdown.

Japan is also an economy we will be discussing, because it’s hard to imagine that the market has fully priced in the implications of an economy that has battled deflation over the last quarter of a century to now have to normalise monetary policy to control inflation.

We will be covering all these themes and a lot more over the coming weeks. The next Strategic Horizons will be published on 26 January.

Your contact persons

If you have any questions and would like to discuss the topics mentioned in the context of your company, please contact us. We would be pleased to discuss these matters with you, both in Switzerland and internationally, including broader economic topics and global market developments.

Partner

Kurzprofil

Partner

View profile

Partner

Kurzprofil