New chapters, global ambitions: mid-market M&A in Q4

Deal activity I Q4 2025

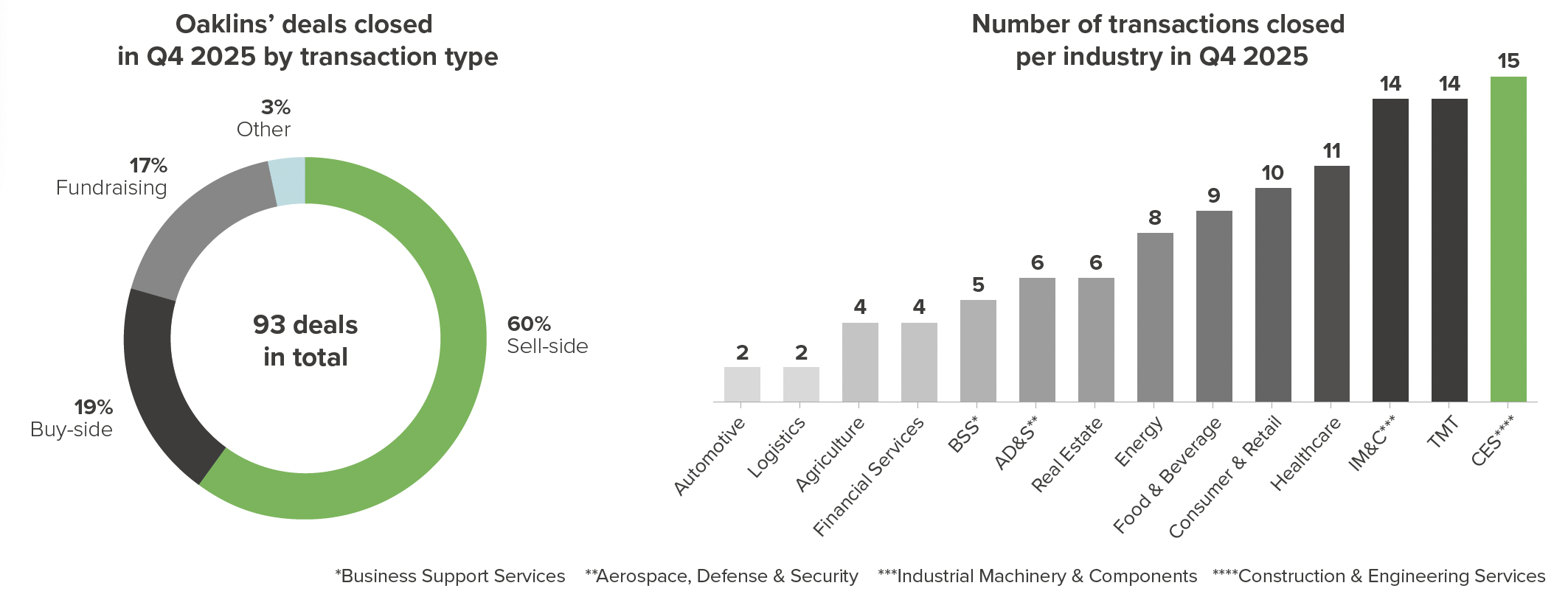

In the final quarter of 2025, our clients completed 93 transactions across a wide range of industries and regions, illustrating how business owners continue to use M&A as a strategic tool for growth, transition and repositioning — even as global deal patterns evolve.

The quarter included 56 sell-side mandates, 18 buy-side acquisitions, 16 fundraising assignments and three other advisory transactions. The variety reflects the different ways companies are acting on long-term goals: securing capital, enabling succession, or gaining access to new markets or capabilities.

Cross-border activity featured prominently, with around half of all M&A deals involving international buyers or sellers. This highlights how companies are increasingly looking beyond domestic markets to expand their reach and customer access — a trend that stood out across mid-market M&A throughout 2025, as cross-border deals continued to attract keen interest from both strategic and financial buyers.

The industry mix this quarter also shows where strategic ambition is strongest. Construction & Engineering Services and Technology, Media & Telecommunications (TMT) led in volume, with solid activity in Industrial Machinery & Components, Healthcare and Consumer & Retail. Many of these deals reflect an ongoing focus on innovation, digital transformation and operational scale as companies respond to structural and competitive shifts.

Wider market commentary confirms that strategic M&A remains a key lever for growth, even in uncertain conditions. Buyers and investors continue to seek companies with technological strength, predictable revenue and solid market positions.

In the following section, we share a selection of transactions and client testimonials that highlight how business leaders are putting their ambitions into action — whether planning generational transitions, accelerating growth or expanding internationally.

A selection of deals closed in Q4

A big thank you to the Oaklins team for their professional support throughout the transaction. Their hands-on approach and guidance were key to achieving a smooth and successful outcome.MICHAEL JUUL HANSEN, CEO AND CO-OWNER, TRISCAN

We are very pleased with the outcome of this process and the new partnership with Eurowind Energy. The support and guidance we received from Oaklins throughout the transaction have helped us team up with the right long-term partner.KRISTIAN LUNDGAARD-KARLSHØJ, FOUNDER AND CEO, AUSUMGAARD BIOGEN

My experience working with Oaklins has been nothing short of exceptional. From the very beginning, Oaklins demonstrated an outstanding depth of knowledge in selling businesses, and their expertise was evident at every stage of the process. What was initially a daunting and unfamiliar journey for me quickly became manageable with their guidance, support and clear communication. They took the time to explain every step, ensured I fully understood the implications of each decision and provided advice that was both practical and strategically insightful. I genuinely believe that without their involvement, support and leadership, this deal would not have been completed. Overall, I could not recommend their services more highly. Oaklins played the single most important role in securing our deal, and I would not hesitate to work with them again or recommend them to any prospective vendor looking for trusted, knowledgeable and dedicated advisors.MICK DOYLE, DIRECTOR, TEAM SAFETY SERVICES LIMITED

Special thanks to our advisors, Oaklins’ team in Germany. Their support for our project was outstanding.THOMAS LÜTKE-KAPPENBERG, CO-FOUNDER AND SELLER, MEDIK HOSPITAL DESIGN GROUP

Having worked with Oaklins’ team in Canada on previous transactions, choosing them again for advising on the sale of Niscon was an easy decision. From the outset, they understood and worked in function of my priorities: identifying a strategic buyer who could support Niscon’s continued growth; ensuring our employees would have opportunities to work on cutting-edge technological projects; and completing a fair and balanced transaction for all parties involved. The team guided me with clarity, professionalism and unwavering dedication from start to finish. I am delighted with the outcome for all parties involved and for the bright future that awaits the company under the SGPS ShowRig banner.DENIS LEFRANÇOIS, OWNER, NISCON AND SHOWSDT

This partnership with Terma represents a pivotal moment for OSL and those we serve. By combining Terma’s proven defense systems with our hands-on expertise, we’re delivering unprecedented capability across the entire operational chain. The result is enhanced threat identification, superior intelligence analysis and seamless execution — all compressed into moments rather than minutes. We’re grateful to Oaklins Cavendish for their invaluable guidance throughout the sale process.MARK LEGH-SMITH, CEO, OSL GROUP LIMITED

We are grateful to Oaklins Janes Capital, who operated as an extension of our management team and embodied our core values throughout the process. They would be my first and only call for representation in any future aerospace business sale.CHRISTOPHER ST. JOHN, CEO, AMERICAN CASTING COMPANY

Oaklins’ efforts enabled us to join Banook and significantly enhance our impact on respiratory drug development. Together with an outstanding transaction team, we were able to efficiently integrate into the Banook platform, backed by Motion Equity Partners.JAN DE BACKER, CEO, FLUIDDA NV

The Oaklins team was not only the professional local resource we needed, but was also creative in their approach. They were a trusted partner throughout the process.CHERI BERANEK, CEO, CLEARFIELD, INC.

As a founder, choosing the right partner for such an important milestone was crucial. The team were fantastic to work with from start to finish, combining hard work, unwavering support, clear advice and good humor. Oaklins Cavendish were a real extension of our team, and together we achieved a great result for the business.LUKE FISHER, FOUNDER AND CEO, MO

We are delighted to have found a successor that will secure the company’s long-term future in Bern. The Oaklins team played a decisive role in successfully completing the transaction. I would particularly like to highlight their extraordinary commitment, discretion, availability and professionalism throughout the entire process.ANDREA DÄHLER-HOFWEBER, CHAIR OF THE BOARD OF J. HOFWEBER & CIE. AG, FORMER OWNER OF RUGENBRÄU AG

We chose Oaklins’ team in Finland as our advisor due to their impressive track record in M&A processes especially on the international business side. They proved to be professional, helpful and especially nice to work with. We are happy with the result, finding a good home for Navitec at Hawk Infinity AS.JOUNI SIEVILÄ, CEO, NAVITEC SYSTEMS OY

Working with Oaklins was a key factor in the success of our transaction. Their expert and practical advice throughout the M&A process and during commercial negotiations accelerated the transaction in many respects and took the pressure off our management team. They always kept our strategic objectives in mind.HANS-JÖRG MIHM, OWNER, EXTRAMET AG

Working with Oaklins’ team in Germany was a real gain for us. The dedicated team guided us through the entire process with speed, expertise and clear communication – from identifying potential buyers through due diligence to final negotiations. Oaklins was a true partner at eye level and made a significant contribution to the excellent outcome.CHRISTIAN HEIT, FOUNDER AND CEO, QUALITYHOSTING AG

We were delighted with our choice of advisors for this very significant transaction. Oaklins Cavendish guided us through the process, and we felt very well taken care of throughout. I personally could not imagine a better partner and would not hesitate to choose this team again.JOHN HARKIN, FOUNDER AND CEO, ALCHEMY TECHNOLOGY SERVICES

The sale of P&S Paving marked a defining moment in our company’s history, and Oaklins TM Capital was instrumental in making it a success. Their integrity, leadership and strategic guidance were evident from the onset of the engagement. The team approached every stage of the process with professionalism, transparency and a deep understanding of both our business and our goals. Their disciplined execution, clear communication and commitment to achieving the best outcome for all stakeholders set them apart. The team’s ability to navigate complex negotiations while maintaining respect and balance among all parties exemplified the highest standards of advisory excellence. Thanks to Oaklins TM Capital’s expertise and steadfast dedication, P&S Paving achieved an exceptional transaction result that reflects the strength of our company’s legacy and positions us for continued success in the industry.TIM PHILLIPS, CO-FOUNDER, P&S PAVING

Oaklins helped us position WATT Infra as a scalable platform in a fast-moving market. Their understanding of the investor landscape and of what drives value in energy infrastructure was key to getting this deal across the line. They brought structure, momentum and clear advice at every step of the process. We are excited to enter this next phase with a strong partner by our side.ROBBERT VAN GOMPEL, FOUNDER AND CEO, WATT INFRA

For something we will only do once or twice in our lifetimes, having the right advisor was really important to us. The primary reasons we chose Oaklins’ team in Ireland were their expertise in the critical infrastructure sector and their partner-led approach. They guided us through every step of the process and delivered the right outcome for us. We really enjoyed working with the entire team. Their ability to foresee and negate potential obstacles throughout the process was second to none. We could not recommend them highly enough.ANTHONY MCDERMOTT AND PAUL MITCHELL, CO-FOUNDERS AND EXECUTIVE DIRECTORS, MITCHELL MCDERMOTT

When we were exploring a partial exit of our equipment platform by selling Grand Equipment, we chose Oaklins TM Capital for their expertise in the equipment dealer and rental sector. Their industry insight, understanding of Grand’s business and strong buyer relationships helped secure Grand’s new partner in Strength Capital. Oaklins TM Capital delivered on their commitment to senior-level attention and exceptional management support throughout the process.RON YOKUBISON, PARTNER, COGNITIVE CAPITAL PARTNERS

Selecting the right advisor was a critical decision as I considered the sale of my business. I ultimately selected Oaklins TM Capital due to their deep experience working with equipment dealers, unique knowledge of the Bobcat dealer network and strength of buyer relationships. Having never sold a business before, Oaklins TM guided me through the sale process with the utmost care and professionalism, anticipating challenges before they arose and ensuring that I achieved the best possible outcome at every step. Through Oaklins TM’s nuanced positioning of the opportunity and deep buyer relationships, we found the perfect partner in Brenton Point, who will provide my employees meaningful growth opportunities and expanded resources to deliver greater value to our customersSTU GRAHAM, PRESIDENT, BOBCAT OF CONNECTICUT, INC.