Snorkel has sold a 49% stake to Xtreme Manufacturing LLC

The Tanfield Group plc (Tanfield) has sold a 49% stake in Snorkel, a manufacturer of self-propelled aerial work platforms, to a new company controlled by Xtreme Manufacturing LLC (Xtreme) for US$80 million.

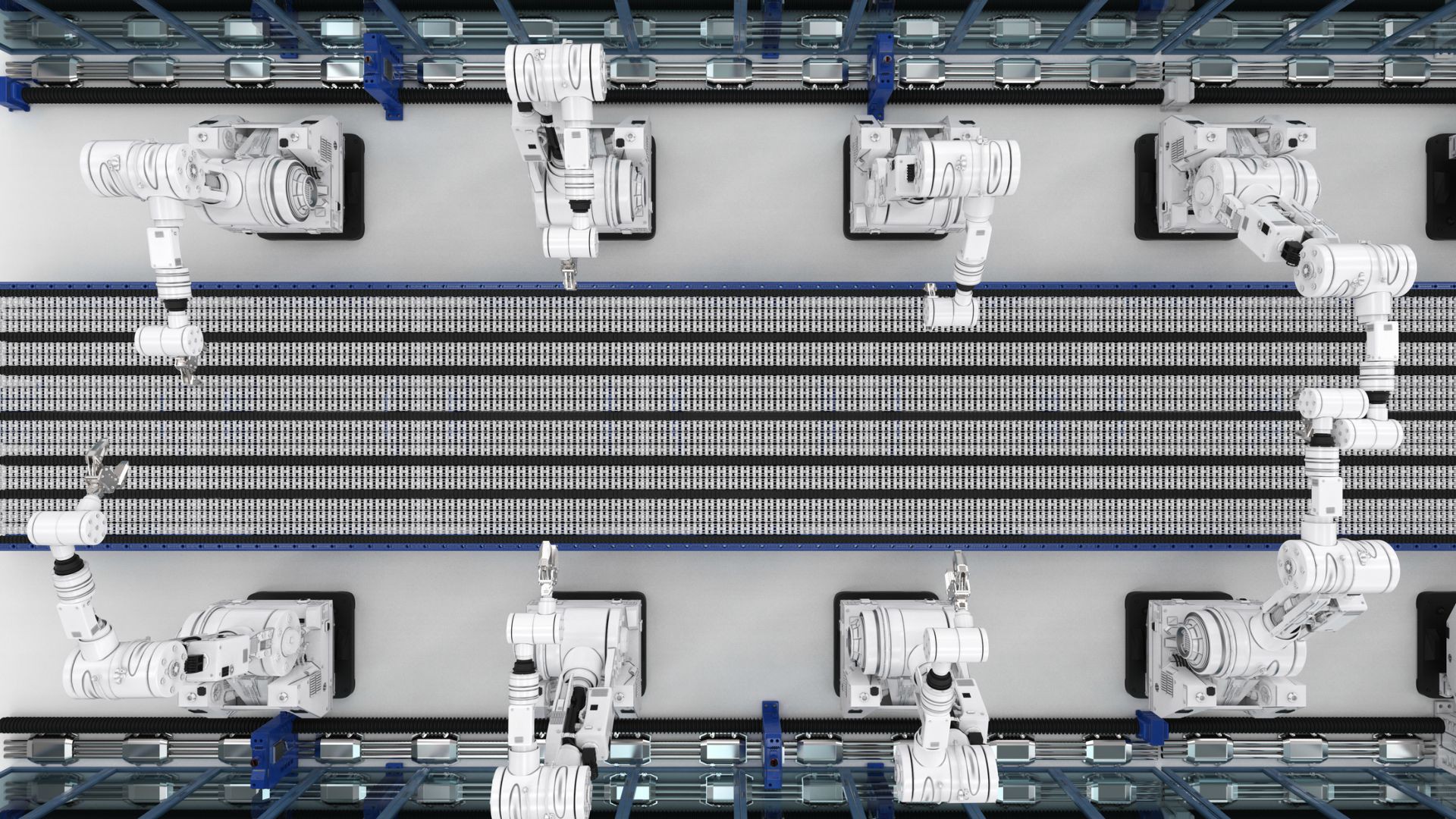

Snorkel has manufacturing facilities across the globe and supplies a range of cherry-pickers used in building, construction and infrastructure projects.

Xtreme is a manufacturer of telescopic material handlers, under the control of Don Ahern. Mr Ahern owns Ahern Rentals, Inc., one of the largest privately held equipment rental companies in the world and a long-standing customer of Snorkel. Xtreme has committed working capital facilities of up to US$50 million to support Snorkel’s growth plans and Tanfield will retain a 49% interest in Snorkel along with a preferred interest position of US$50 million.

In early 2013, the Board of Tanfield took the decision to appoint Cavendish to help find a purchaser for Snorkel. Following the global economic downturn in 2008, Snorkel suffered a catastrophic collapse in its market. In the four years ended 31 December 2012, the cumulative losses of Snorkel were circa US$80 million. For the first six months of 2013 Snorkel suffered further losses of over US$13 million. Market demand has now improved but Snorkel has continued to struggle due to working capital constraints.

Oaklins Cavendish, based in the UK, advised the seller in this transaction.

Talk to the deal team

Related deals

Xeros Technology Group has completed a placing, subscription and retail offer

Xeros Technology Group plc has raised funds to drive forward its commercialization strategy.

Learn moreVarsteel, Ltd. has acquired Pacific Steel, Inc.

Pacific Steel, Inc. has been acquired by Varsteel, Ltd.

Learn moreSibelco has received strategic advisory related to the exit of a minority shareholder

SCR Sibelco has received strategic advisory related to the exit of a minority shareholder. Different options were considered. On 8 December 2023, Sibelco announced its intention to launch a share buyback program, via a tender offer, to acquire up to 18.94% of outstanding shares for a price of €6,850 per share and a total deal consideration of €609 million. The program offered liquidity optionality to the exiting shareholder, as well as other minority shareholders looking forward to crystallizing some value. Sibelco is delighted to pursue with its ambitious mid-term growth plan thanks to a refocused shareholder register and the support of the founding families. Further information on the transaction can be found in the prospectus of the tender offer.

Learn more