Betronic has raised growth financing

Betronic has raised debt provided by Rabobank to support its future growth plans.

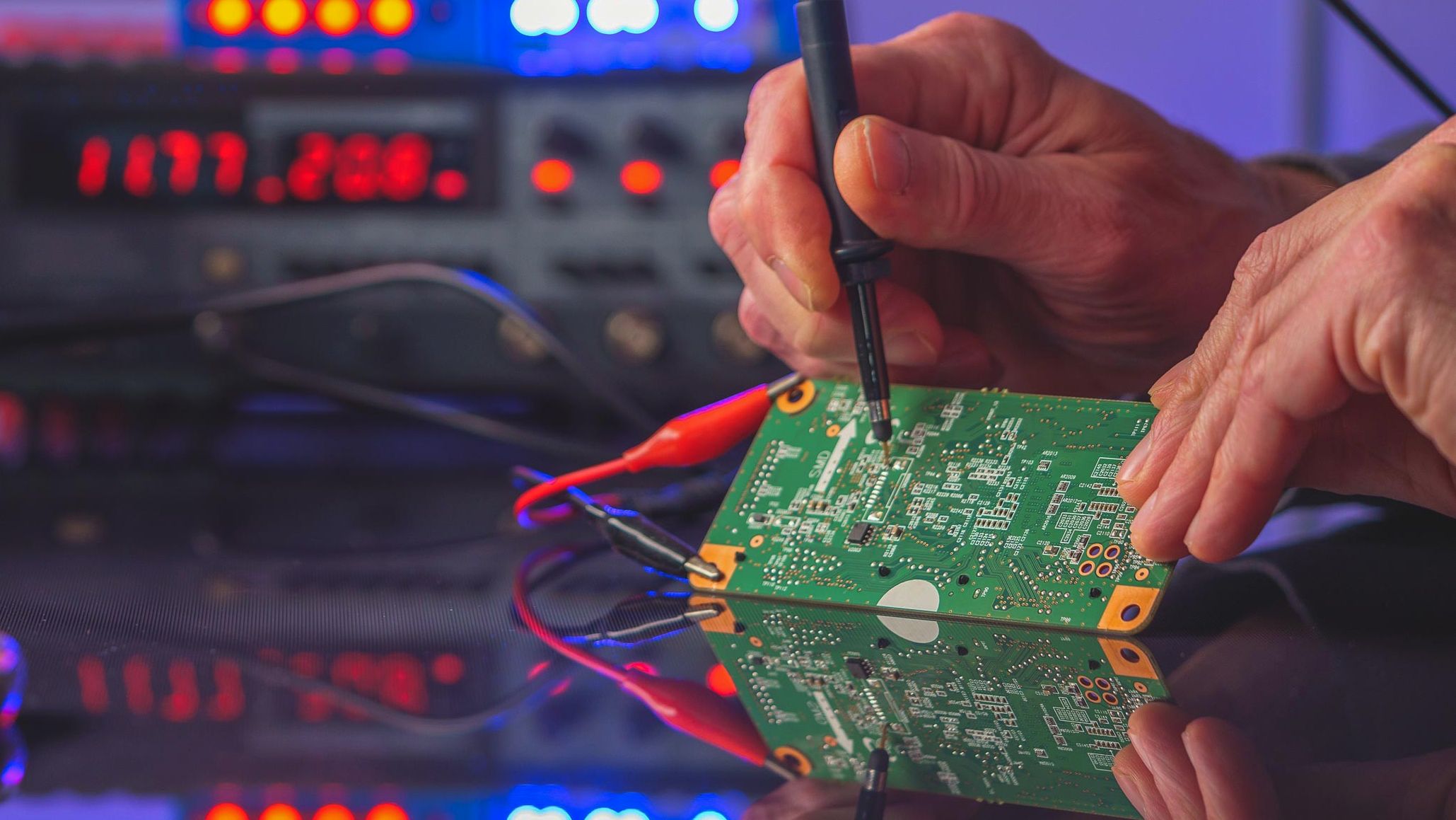

Founded in 1977, Betronic is a Dutch electronic development manufacturing solutions provider of innovative electronics across Europe. The company’s offering focuses on developing and producing technology-driven electronics, both software and hardware. Its main services include the development and production of printed circuit boards and semi-finished products. Furthermore, Betronic develops and produces its own test equipment and provides these services also to third parties.

Oaklins’ debt advisory team in the Netherlands advised Betronic in this transaction by establishing a financing package aligned with the current business profile and future growth ambitions. This transaction emphasizes Oaklins’ strong track record in the industrial sector.

Porozmawiaj z zespołem obsługi transakcji

Powiązane transakcje

Amot Investments Ltd. has issued bonds

Amot Investments Ltd. has raised funds to refinance the company for further development.

Więcej informacjiOmnetic, member of EAG Group, has raised growth capital from Kartesia and CVI

EAG Group has completed a first investment round for its Omnetic platform. The company was seeking growth capital of up to US$110 million in order to consolidate the CEE markets and finance its expansion to new geographies. The transaction was closed with Kartesia, the European specialist provider of capital solutions for small- and mid-sized companies, in partnership with CVI, a private debt investor based in Warsaw, Poland.

Więcej informacjiJL&P has received a minority investment from Arkéa Capital and Swen Capital Partners

JL&P Group has completed a primary minority LBO with Arkéa Capital and Swen Capital Partners.

Więcej informacji