Holland Capital has sold Quantib to RadNet

Quantib B.V., a portfolio company of Holland Capital, has been sold to RadNet, Inc.

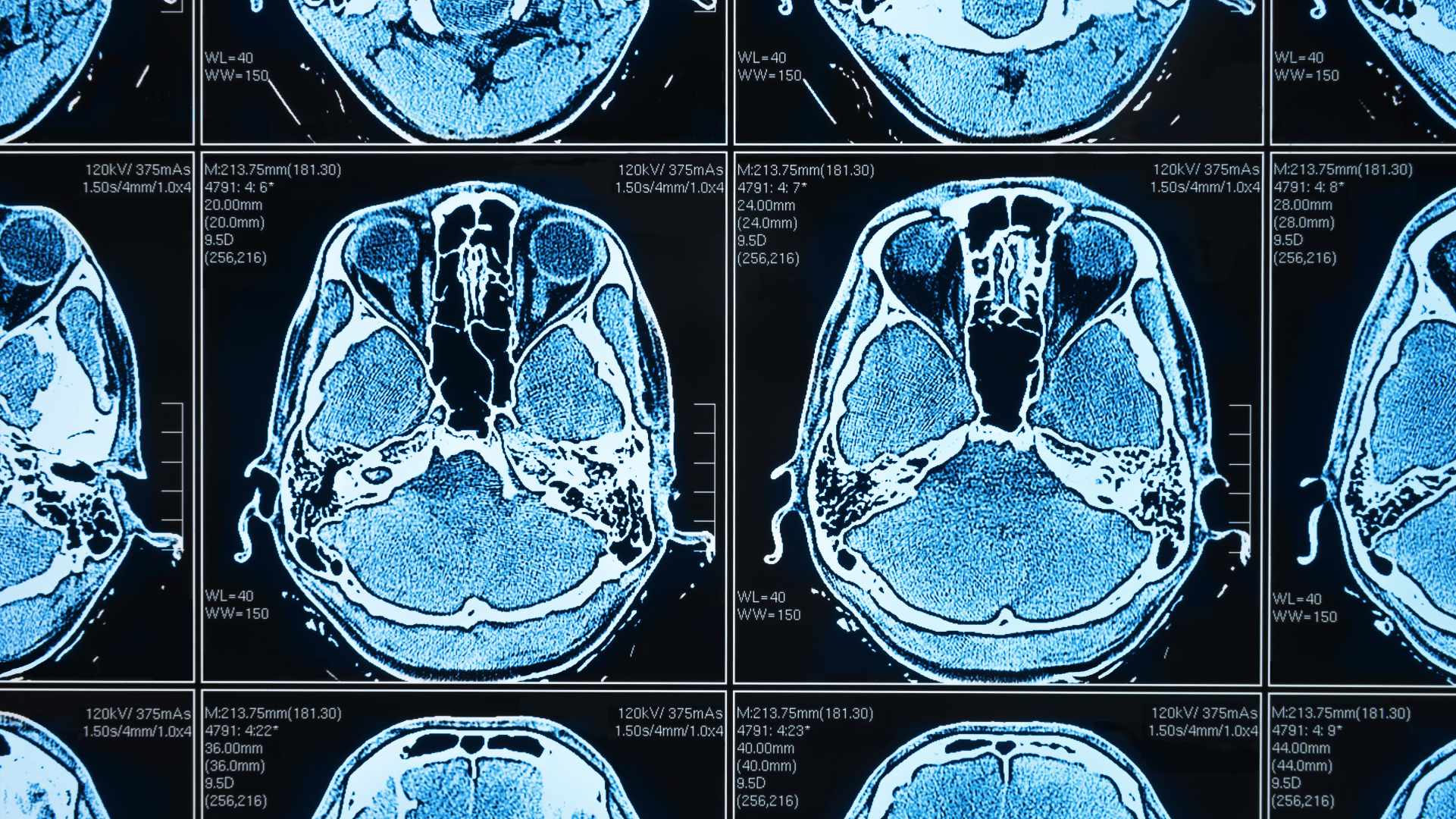

Founded in 2012 and headquartered in the Netherlands, Quantib is a leading radiology artificial intelligence and machine learning company focusing on clinical solutions for prostate cancer and neurodegeneration.

RadNet is a national leader in providing high-quality, cost-effective, fixed-site outpatient diagnostic imaging services through a network of 350 owned and operated outpatient imaging centers in the USA.

Holland Capital is one of the first independent private equity firms in the Netherlands. Since 1981, they have been successfully and responsibly investing in promising small and medium-sized Dutch businesses with growth ambitions. With a clear investment strategy, they anticipate long-term trends in attractive growth markets, focusing on the healthcare and technology sectors. Their experienced and dedicated investment team knows what entrepreneurship is.

One of Oaklins’ teams in the USA served as the exclusive financial advisor to Quantib B.V.

Talk to the deal team

James McLaren

Oaklins TM Capital

Michael Goldman

Oaklins TM Capital

Michael Bauman

Oaklins TM Capital

Related deals

Triscan has joined APA and Riverarch to accelerate growth in the European aftermarket

Triscan AS, a leading provider of OE-quality automotive spare parts for the professional aftermarket in Europe, has been acquired by APA Industries, LLC, a portfolio company of Riverarch Equity Partners.

Learn moreEuroHospital Varna has been acquired by Intermedica Group

EuroHospital Varna has been acquired by Intermedica Group, allowing the business to continue to grow and deliver high-quality healthcare services to its patients. Through the transaction, Intermedica Group expands its healthcare presence and intends to build a new model of integrated personalized care focused on preventive, holistic and digital medicine.

Learn moreTEAM Safety Services Limited has been acquired by Vadella Group

TEAM Safety Services Limited, a leading UK-based health, safety and fire safety consultancy, has been acquired by Vadella Group, a specialist provider of inspection-led compliance services for the built environment.

Learn more