Holland Capital has sold Quantib to RadNet

Quantib B.V., a portfolio company of Holland Capital, has been sold to RadNet, Inc.

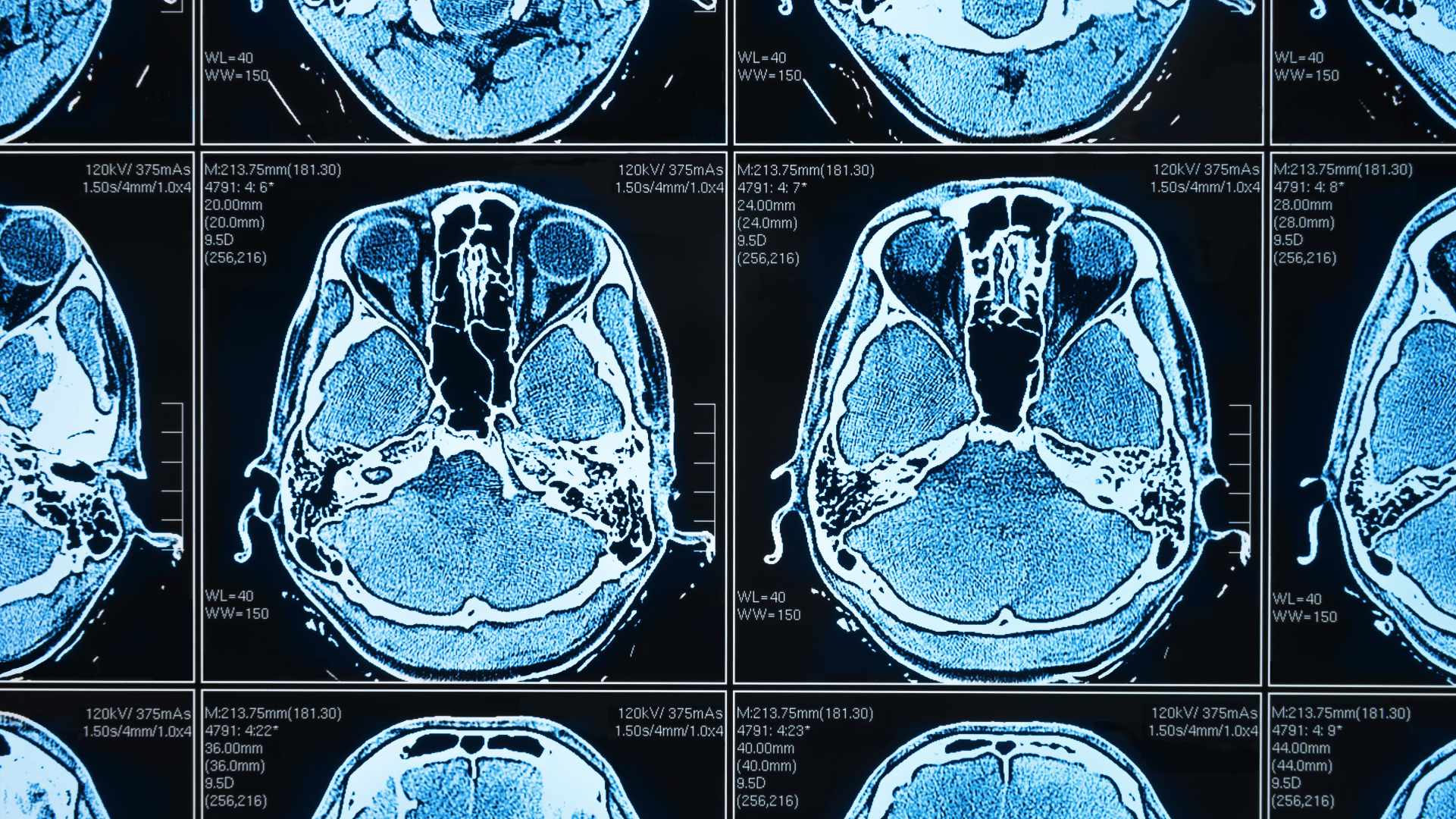

Founded in 2012 and headquartered in the Netherlands, Quantib is a leading radiology artificial intelligence and machine learning company focusing on clinical solutions for prostate cancer and neurodegeneration.

RadNet is a national leader in providing high-quality, cost-effective, fixed-site outpatient diagnostic imaging services through a network of 350 owned and operated outpatient imaging centers in the USA.

Holland Capital is one of the first independent private equity firms in the Netherlands. Since 1981, they have been successfully and responsibly investing in promising small and medium-sized Dutch businesses with growth ambitions. With a clear investment strategy, they anticipate long-term trends in attractive growth markets, focusing on the healthcare and technology sectors. Their experienced and dedicated investment team knows what entrepreneurship is.

One of Oaklins’ teams in the USA served as the exclusive financial advisor to Quantib B.V.

Talk to the deal team

James McLaren

Oaklins TM Capital

Michael S. Goldman

Oaklins TM Capital

Michael L. Bauman

Oaklins TM Capital

Harrison P. Boeschenstein

Oaklins TM Capital

Related deals

TEAM Safety Services Limited has been acquired by Vadella Group

TEAM Safety Services Limited, a leading UK-based health, safety and fire safety consultancy, has been acquired by Vadella Group, a specialist provider of inspection-led compliance services for the built environment.

Learn moreMEDIK Hospital Design Group has been acquired by STERIS

The private shareholders of MEDIK Hospital Design Group have sold their shares to STERIS plc. Together, MEDIK and STERIS will expand their offerings for hospitals and ambulatory surgery centers worldwide. MEDIK’s solutions ideally complement STERIS’ existing portfolio, enabling the combined group to strengthen its position as a leading provider of turnkey room solutions in surgical and IPT environments. The MEDIK management team will actively support the next phase of growth.

Learn moreNiscon Inc. has been acquired by SGPS ShowRig

Niscon Inc. has been successfully acquired by SGPS ShowRig, a global provider of staging, rigging and automation for live entertainment. The acquisition reinforces SGPS Showrig’s commitment to pushing the boundaries of innovation in the entertainment industry. By adding Niscon’s unique motion-control technology to its portfolio, SGPS Showrig strengthens its ability to deliver cutting-edge, precision-driven solutions.

Learn more